A number of occasions throughout varied ecosystems made it to the checklist of high crypto information this week. Key highlights embody Ethereum’s much-anticipated Pectra Improve and the FOMC (Federal Open Market Committee) assembly.

This week, merchants and traders seeking to capitalize on event-specific volatility ought to watch the next headlines.

Ethereum’s Pectra Improve

On Could 7, the Ethereum community will activate its much-anticipated Pectra Improve, with 11 Ethereum Enchancment Proposals (EIPs) slated for implementation.

Key options embody EIP-7251, which is predicted to lift the staking cap from 32 ETH to 2048 ETH. The Pectra improve additionally brings enhancements for user-friendly wallets, together with improved UX, simpler restoration, and no ETH for transactions.

“Ethereum is having its biggest upgrade this month,” DeFi researcher hodl shared on X (Twitter).

These adjustments intention to spice up staking participation and dApp adoption, doubtlessly growing ETH demand and, successfully, the Ethereum worth.

Nevertheless, exchanges might briefly halt ETH transactions throughout deployment, which may spark short-term volatility.

Whereas a easy rollout may drive bullish sentiment and reinforce Ethereum’s dominance, technical hiccups may erode confidence and stress ETH costs.

In the meantime, it’s price mentioning that Ethereum’s Pectra Improve has confronted a number of delays already. Causes vary from due diligence checks, such because the Hoodi and Sepolia testnets, to make sure easy working earlier than mainnet launch.

Sonic Summit

The Sonic Summit, pivotal for the Fantom ecosystem, will begin on Could 6 earlier than the Pectra Improve. It will likely be held in Vienna for 3 days.

The occasion will see the community show developments in its high-throughput, EVM-compatible blockchain. Reportedly, discussions will middle on Fantom’s sub-second transaction finality, dApp scalability, and potential partnerships.

“Got your ticket for Summit yet? You’ll meet these pioneering teams leading the DeFi scene on Sonic,” Sonic Labs wrote.

Bulletins of recent initiatives or integrations may ignite curiosity in Sonic’s (previously Fantom) S token, driving speculative buying and selling and worth spikes.

The summit’s deal with developer instruments and enterprise use circumstances might appeal to institutional consideration, boosting long-term adoption. Nevertheless, markets may see muted reactions or profit-taking if the occasion lacks main reveals.

Polkadot App Launch

Including to the checklist of high crypto information this week, Polkadot is planning an app launch that can allow staking, buying, and saving on a single platform.

The potential Polkadot app goals to simplify person interplay with its interoperable blockchain ecosystem. The all-in-one strategy may appeal to retail customers, boosting adoption and growing demand for DOT tokens.

Staking incentives might lock up provide, doubtlessly supporting worth appreciation. In the meantime, buying and saving options may draw real-world use circumstances, enhancing Polkadot’s utility.

The app’s success hinges on person expertise and safety, as any vulnerabilities may erode belief. If Polkadot positive factors traction, rivals like Cosmos might face stress.

Hyperliquid’s New Price System And Staking Tiers

Extra intently, the Hyperliquid ecosystem unveiled a brand new price system and staking tiers on Monday, Could 5. With these product launches, stakers of the decentralized derivatives platform’s powering token, HYPE, obtain buying and selling price reductions.

“…the new Hyperliquid fee system is now live. This means perps and spot fees are now different (spot fees count as double volume) and trading fee discounts for staked HYPE are officially active,” Steven.hl highlighted.

The transfer is meant to incentivize staking whereas on the identical time decreasing the circulating provide. These measures may assist worth HYPE stability, doubtlessly inspiring a surge.

In the meantime, it will likely be attention-grabbing to see income tendencies over the following few weeks. The tiered construction might appeal to high-volume merchants, boosting platform exercise and income.

Regardless of the launch, the influence on the HYPE token was underwhelming, dropping by 1.42% within the final 24 hours. As of this writing, HYPE was buying and selling for $20.58.

FOMC Assembly and Powell Convention

That includes among the many US financial indicators with crypto implications this week, the FOMC assembly and subsequent Federal Reserve chair Jerome Powell convention additionally rank among the many high crypto information this week.

On Could 8, the Fed will announce its subsequent rate of interest choice, a important occasion for crypto markets. Increased charges sometimes scale back danger urge for food, doubtlessly triggering sell-offs in Bitcoin, as traders shift to safer belongings. Conversely, a pause or charge minimize may spark a rally, as seen in previous dovish alerts.

“Fed Press Conference FOMC this Wednesday, May 7th Rate cuts are NOT expected … but will they end quantitative tightening?” dealer Ozzy posed.

BitMEX co-founder and former CEO Arthur Hayes just lately predicted that the Fed’s shift to quantitative easing (or ending quantitative tightening) may propel Bitcoin’s worth to $250,000. Different analysts additionally favor this pivot, citing the MOVE Index and international market instability as triggers.

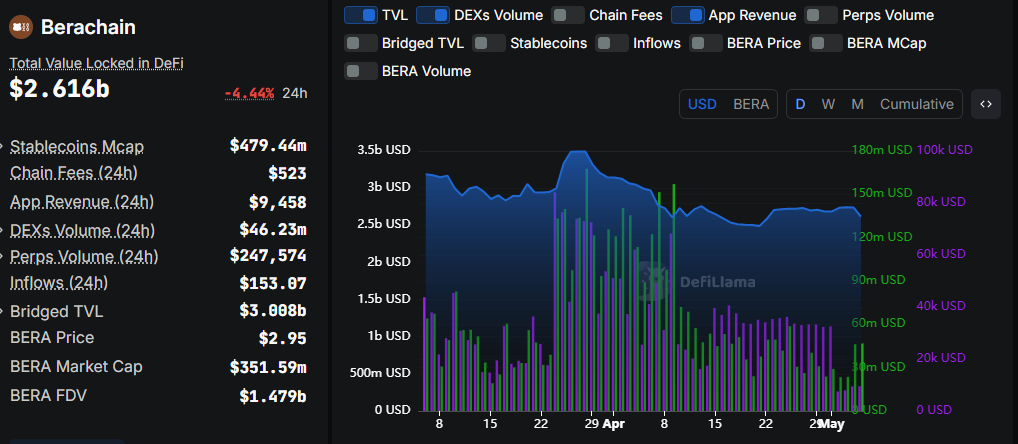

Berachain’s Boyco Unlock

Berachain’s Boyco funds are set to unlock on Could 6, releasing a major token provide. Particularly, roughly $2.7 billion in TVL (whole worth locked) will unlock from Boyco Vaults on Berachain on Tuesday.

As one of many largest unlocks, this occasion may set off sharp liquidity shifts and heightened volatility.

Langerius, founding father of HuntersofWeb3, defined that over $2 billion in whole is awaiting launch, ascribing the continuing BERA sell-off to the expectation of this occasion.

“There’s over $2 billion in total waiting. And because of that, BERA is dumping fast. Looks like whales are about to farm this one and move on to the next,” Langerius said.

Unlocking occasions usually set off sell-offs, as early traders or insiders money out. Markets ought to brace for volatility, with merchants possible front-running the unlock.

Nevertheless, Berachain was the worst-performing blockchain of the previous month, and a few analysts say the BERA token worth might have already bottomed out.

“I strongly believe BERA has hit the bottom right now…and with that ton of liquidity unlocking, I do hope we see the price of at least $5 in the upcoming days,” one person expressed.

Coinbase Earnings

Additionally on the watchlist amongst high crypto information this week is the Coinbase trade’s earnings name. The decision will present insights into the US-based trade’s Q1 2025 efficiency, a bellwether for the crypto trade.

Sturdy income from buying and selling charges or development in institutional companies may sign robust market well being, boosting sentiment for crypto. Conversely, weak outcomes or regulatory considerations may spark bearish reactions, as Coinbase’s inventory usually correlates with crypto costs.

Markets will scrutinize steerage on buying and selling volumes, person development, and Web3 initiatives like Base blockchain. Constructive surprises may drive speculative shopping for, whereas disappointing metrics may set off sell-offs.

Coinbase’s efficiency usually units the tone for trade tokens like BNB. Merchants might place forward of the decision, with volatility anticipated post-announcement. Historic earnings beats recommend an upside, however macro headwinds may mood optimism.

“FOMC and Coinbase earnings. Volatile week in the crypto market,” analyst CrypNuevo remarked.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.