Ethereum (ETH) had one in all its worst days of the yr on Monday, August 5, as the value skilled a steep 23% correction. The results of this notorious decline was a drop to $2,120 — a degree it final reached in 2023.

Nonetheless, whereas ETH has rapidly recovered, the preliminary plunge possible marked the underside, and right here’s why.

Ethereum On-Chain Indicators Factors to Main Upswing

From an on-chain perspective, Ethereum’s Market Worth to Realized Worth (MVRV) Z—Z-Rating is right down to 0.52. This entry-adjusted metric tells whether or not a cryptocurrency’s value is undervalued or overvalued relative to its truthful worth.

In different phrases, the MVRV Z-Rating also can assist spot market tops and bottoms. Traditionally, as soon as the rating is above 2.20, the value is near the highest of the cycle. For instance, in 2021, when ETH’s value reached $4,819, this metric was 3.35.

Two months later, the value dropped to $2,440. In March, the metric reached 2.34 when ETH traded round $4,067. Since then, the altcoin has not examined the $4,000 mark.

Learn extra: Put money into Ethereum ETFs?

Nonetheless, the chart above exhibits that ETH could have reached the underside once more, because the MVRV Z-Rating is close to the identical studying as November 2023. Throughout this era, ETH moved from $1,959 to over $4,000 in lower than 4 months.

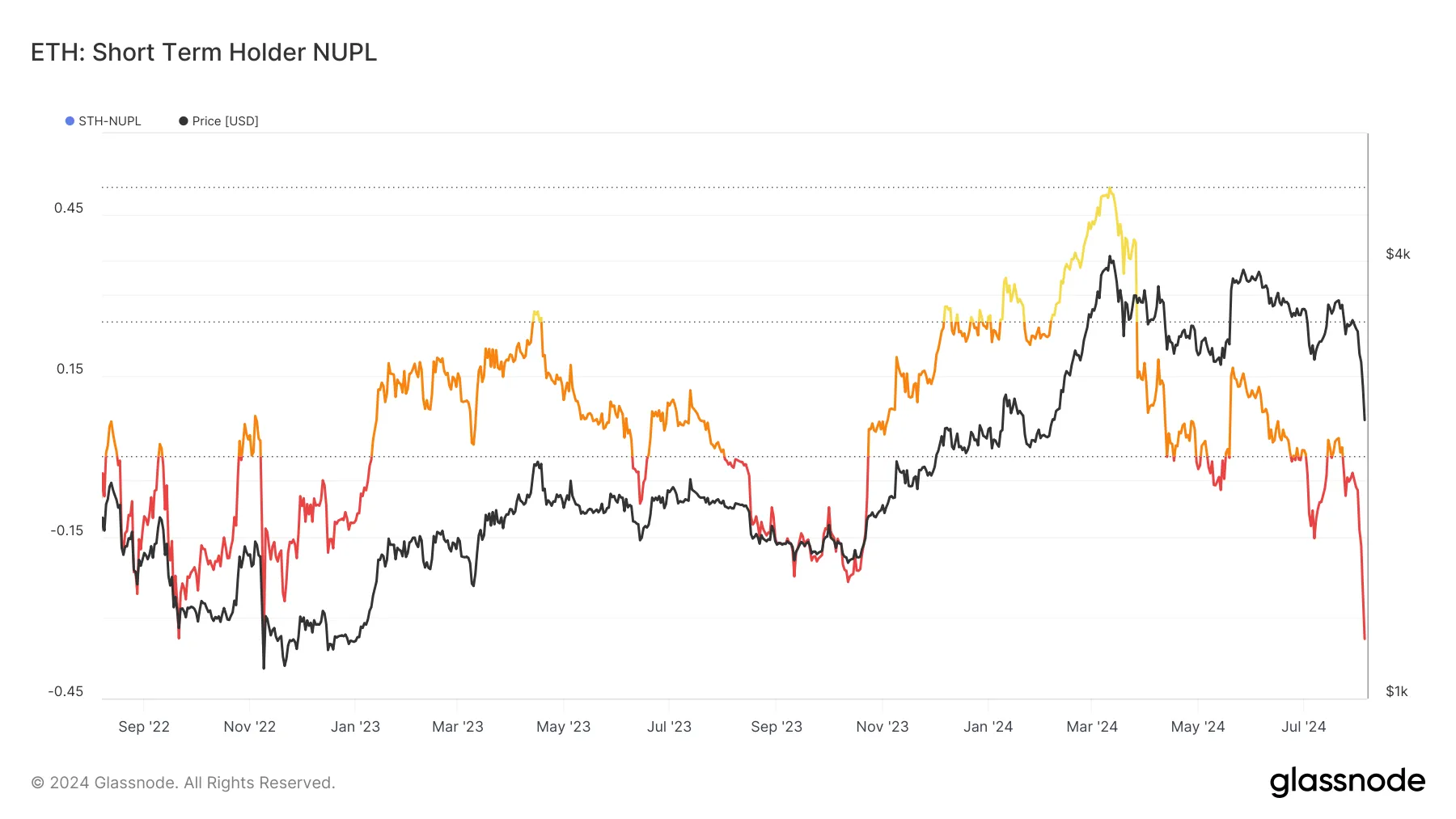

If this sample performs out once more, Ethereum’s value could surge greater than 100% earlier than the yr ends. One other indicator reinforcing this thesis is the STH-NUPL, which stands for Quick-Time period Holder-Internet Unrealized Revenue/Loss.

Just like the MVRV, this metric is essential to figuring out market tops and bottoms. Sometimes, the STH-NUPL’s euphoric (inexperienced) state alerts the start of the market high.

Nonetheless, in ETH’s case, the metric is right down to the capitulation area (pink), indicating that the market is rife with worry. If earlier patterns rhyme, then ETH has hit the underside.

ETH Value Prediction: 100% Improve Earlier than the Yr Ends?

Just like the on-chain state, technical indicators recommend that the ETH may observe a sample much like the efficiency within the first quarter of 2024.

Contemplate this — ETH’s value confronted a notable correction between January 12 and 26. On January 27, the altcoin skilled a pointy restoration just like the 7% hike ETH produced within the final 24 hours.

A number of days later, the help noticed round $2,220, which was one motive the altcoin produced its finest efficiency yr thus far. A have a look at the Relative Power Index (RSI) additionally provides credence to the bias.

As seen beneath, the RSI, which measures momentum, was near being oversold earlier than the rally in January. For context, RSI readings at 30 or beneath point out oversold positions, whereas these at 70 or beneath recommend overbought.

Learn extra: Ethereum (ETH) Value Prediction 2024/2025/2030

In the meantime, the cryptocurrency has hit the oversold level, indicating a better likelihood of a notable bounce. This situation may result in ETH starting with a retest of $2,871.

Additional, sustained shopping for strain may see the value hit $4,094 in just a few months. Nonetheless, this prediction could also be invalidated if bulls fail to take care of the current momentum.

Disclaimer

In keeping with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.