Bitcoin has posted seven consecutive weeks of good points, pushing its worth above $100,000. Nonetheless, new indicators recommend this bullish streak would possibly quickly finish.

Figuring out the exact second of a worth reversal is difficult. Nonetheless, sure indicators might point out rising dangers, significantly for buyers who haven’t established robust positions but.

Two Indicators Point out Revenue-Taking Might Finish the 7-Week Rally

The primary notable signal is that wallets with massive balances have stopped accumulating and have began distributing their cash.

Glassnode knowledge confirms this pattern. In Might, the buildup rating for wallets holding over 10,000 BTC dropped from round 0.8 to beneath 0.5. This shift is visually represented by a change in coloration from blue to orange.

“The group of wallets holding the most BTC has started distributing,” Thuan Capital said.

Moreover, wallets between 1 BTC and 10,000 BTC present weaker accumulation conduct, as seen by way of regularly fading blue tones. Solely wallets with lower than 1 BTC are displaying a transparent shift from distribution to robust accumulation, triggered by Bitcoin reaching a brand new all-time excessive.

These knowledge factors mirror a profit-taking tendency amongst massive buyers. On the similar time, smaller retail buyers seem pushed by FOMO (concern of lacking out) as they chase short-term alternatives.

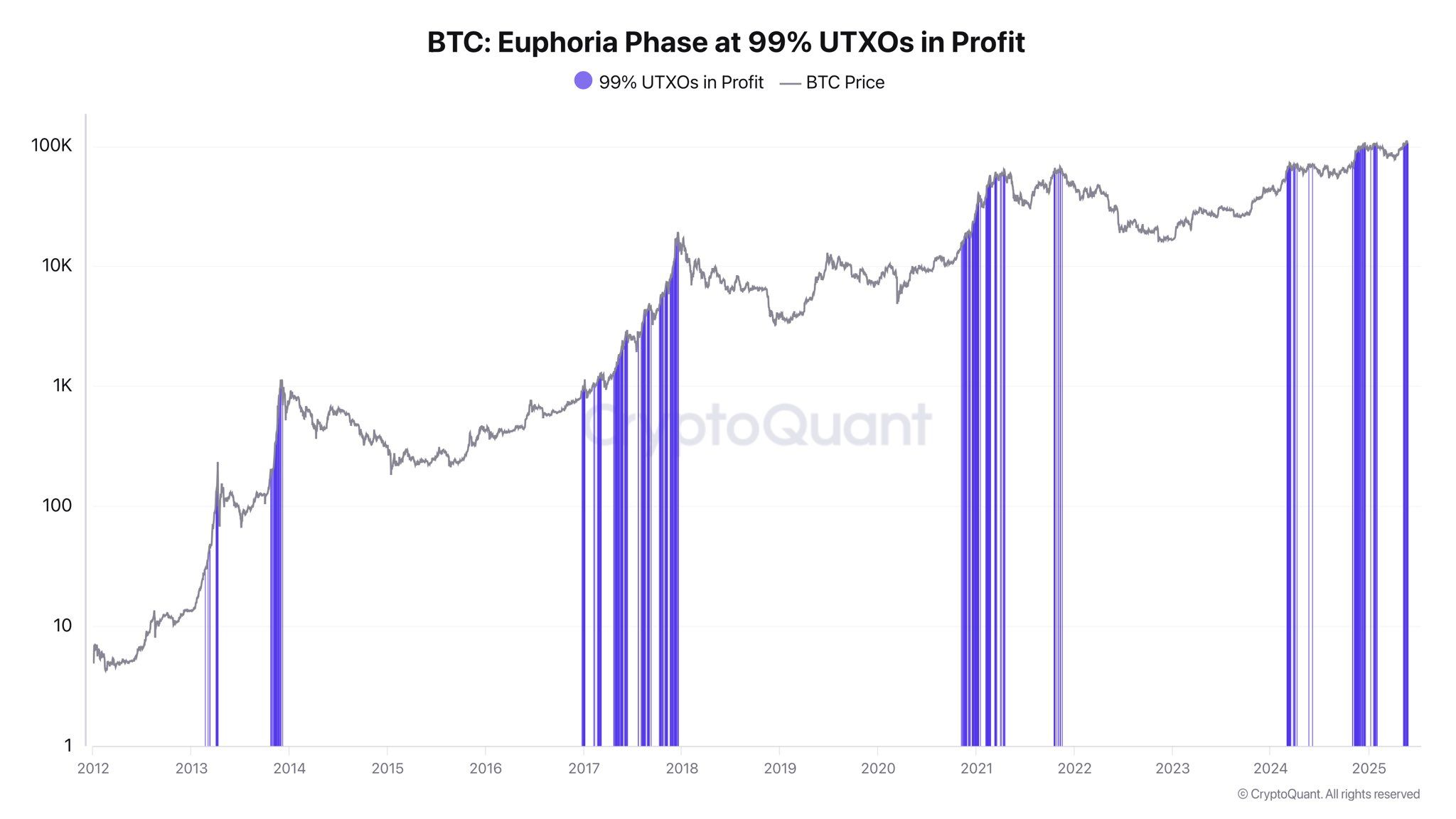

One other warning signal comes from Unspent Transaction Outputs (UTXOs). UTXOs are a technical mechanism that ensures every particular person BTC can solely be spent as soon as on the blockchain. In addition they present a approach to consider unrealized revenue throughout all unspent BTC.

CryptoQuant knowledge exhibits that when 99% of UTXOs are in revenue, it normally indicators a market overheating part. Traditionally, such phases usually precede worth corrections. Whether or not the correction is short- or long-term, this sign nonetheless highlights a rising threat for patrons.

“Right now, it’s hard to say we’re in a euphoric phase. The broader macroeconomic context and the uncertainty surrounding the Trump administration’s policy direction make it difficult for investors to flip fully risk-on. When this 99% signal drops, unrealized profits shrink and can trigger more profit-taking and push latecomers to capitulate and sell at a loss,” analyst Darkfost mentioned.

As of now, Bitcoin’s rally has paused round $108,000. There aren’t any clear indicators of a correction but. BeInCrypto experiences a powerful wave of Bitcoin accumulation amongst companies worldwide. Many specialists stay optimistic about Bitcoin’s future worth.

“A tidal wave of institutional demand is reshaping bitcoin’s market dynamics: Wealth‐management platforms poised to roll out access to bitcoin ETFs, corporate treasuries adding bitcoin to boost shareholder returns, and sovereigns diversifying reserves into bitcoin to hedge geopolitical risk. Together, these forces are creating a structural supply/demand imbalance—and over the next 18 months, bitcoin is set to cement its role as a global store of value,” Juan Leon, Senior Funding Strategist at Bitwise Asset Administration, instructed BeInCrypto.

Subsequently, whereas these short-term indicators might trace at a pullback from present highs, they don’t appear to have an effect on analysts’ broader expectations for this 12 months and subsequent.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.