Polkadot’s DOT has witnessed a surge in buying and selling exercise over the previous few days. Since final weekend, the altcoin has posted modest however constant beneficial properties.

This transfer has been largely pushed by renewed optimism surrounding pending regulatory selections on DOT-backed exchange-traded funds (ETFs) in america. With a kind of selections anticipated to come back on June 11, DOT is seeing a notable rise in demand amongst market members.

Polkadot Gathers Steam as ETF Choice Looms

Investor sentiment round DOT has grown more and more bullish because the US Securities and Trade Fee (SEC) prepares to challenge its remaining rulings on two main ETF functions this month.

In response to a SEC submitting dated April 24, the primary choice, concerning Grayscale’s Polkadot ETF proposal, is predicted on June 11, whereas a ruling on 21Shares’ Polkadot ETF is scheduled for June 24.

DOT is gaining steam forward of the June 11 choice, with merchants betting on a positive end result.

This rising optimism is mirrored in DOT’s worth motion, because it edges nearer to its 20-day exponential shifting common (EMA), a key indicator that alerts a shift in momentum. At press time, DOT trades just under this key stage, with mounting bullish strain suggesting a possible breakout to the upside.

The 20-day EMA measures an asset’s common buying and selling worth over the previous 20 days, putting larger weight on latest worth actions. When an asset’s worth breaks above the EMA, it’s a bullish sign indicating that consumers are gaining management and a near-term uptrend could also be forming.

For DOT, a sustained transfer above this stage might verify the rising bullish sentiment and set off additional upward momentum.

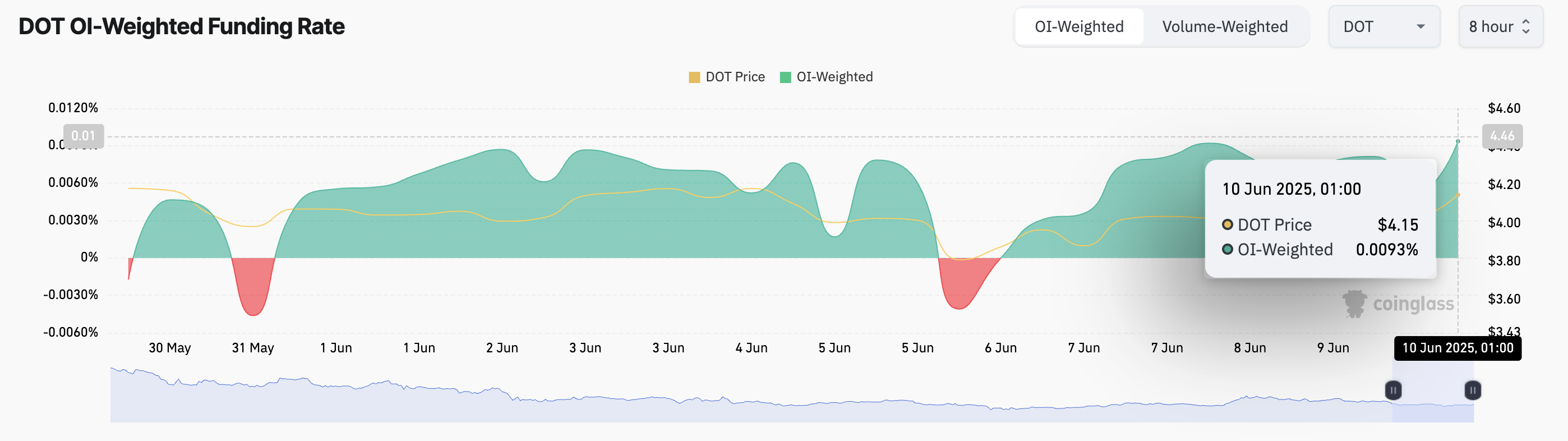

Moreover, the coin’s funding charge throughout derivatives exchanges stays constructive, suggesting that long-position holders are keen to pay a premium, one other signal of rising confidence forward of tomorrow’s choice. At press time, the metric sits at 0.0093%, per Coinglass.

The funding charge is a periodic payment between lengthy and brief merchants in perpetual futures markets. It retains contract costs aligned with the spot market. A constructive funding charge signifies that lengthy merchants are paying shorts. This implies bullish market sentiment and the next demand for lengthy positions.

DOT Rally Gathers Steam, However SEC Ruling Might Be a Sport-Changer

DOT trades at $4.11 at press time, recording a 3% worth achieve over the previous day. Throughout that interval, its day by day buying and selling quantity has soared 76% to $230 million, highlighting robust investor demand behind the rally.

When an asset’s worth and buying and selling quantity rise concurrently, it reveals robust market curiosity. It additionally confirms the energy of the worth transfer. This mixture means that DOT’s uptrend is backed by demand and will have additional momentum.

On this situation, DOT might break the resistance at $4.13 and climb to $4.37.

Nevertheless, an unfavorable SEC choice tomorrow might shake investor confidence and spark sell-offs. This might drive DOT’s worth down towards the $3.96 stage.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.