Welcome to the US Morning Crypto Information Briefing—your important rundown of an important developments in crypto for the day forward.

Seize a espresso for an intriguing dive into what specialists say about rising stablecoin adoption. With dollar-pegged digital belongings demonstrating important progress, the risk is actual, sufficient for the US Treasury to take discover.

Stablecoin Market To Attain $2 Trillion by 2028, US Treasury Initiatives

In its Q1 2025 report, the US Treasury Borrowing Advisory Committee (TBAC) projected that stablecoins may attain a market capitalization of $2 trillion by 2028.

“Evolving market dynamics, structures, and incentives have the potential to accelerate stablecoins’ trajectory to reach ~$2 trillion in market cap by 2028,” learn an excerpt within the report.

As BeInCrypto reported, this is able to represent a eightfold improve from its present degree of roughly $234 billion, with USD-pegged stablecoins dominating (99%) the market.

MEXC change COO Tracy Jin agrees, including that the milestone could also be achieved as quickly as 2026.

The US Treasury acknowledged that stablecoin issuers can be required to carry [short-dated] T-bills beneath new laws. They stated this is able to strengthen the correlation between US Treasury invoice demand and stablecoin adoption.

Nonetheless, the US Treasury additionally identified that stablecoin progress may compel retail banks to pay increased rates of interest to depositors.

In opposition to this backdrop, BeInCrypto contacted Max Keiser, who warned in regards to the rising stablecoin market. The Bitcoin pioneer urged it may exacerbate US debt ranges and undermine the greenback’s worth.

“Stablecoins are a financial hospice where fiat money like the US dollar goes to die,” Keiser instructed BeInCrypto.

Keiser argued that elevated stablecoin utilization dilutes the greenback’s worth. In his opinion, the enlargement and progress of stablecoin utilization will finally “work the US dollar to death.”

Can Stablecoins Supplant the US Greenback’s Reign? Commonplace Chartered Weighs In

Keiser linked the rise of stablecoins to rising nationwide debt, countering political guarantees of debt discount.

“It also means that US indebtedness goes up, not down, as Trump has promised,” he added.

BeInCrypto additionally contacted Commonplace Chartered Head of Digital Belongings Analysis Geoff Kendrick, who famous the Treasury’s adoption of their $2 trillion stablecoin forecast.

“US Treasury is using our $2 trillion stablecoin forecast for their own projection, as per this TBAC Presentation. The tail is really wagging the dog now,” Kendrick instructed BeInCrypto.

Kendrick anticipates a surge in stablecoin issuance following upcoming US laws. Whereas he agrees with the US Treasury’s forecast, there’s a caveat, with Kendrick citing implications for the US Treasury invoice (T-bill) market.

“Specifically, I think stablecoins will go from $230 billion to $2 trillion by the end of 2028. That growth will require an extra $1.6 trillion of US T-bills to be held as reserves, and that is all of the planned new T-bill issuance over that period,” he added.

In the meantime, amidst these tasks, Tether, the issuer of the world’s largest stablecoin USDT, is contemplating launching a US-only stablecoin by late 2025 or early 2026.

Tether CEO Paolo Ardoino revealed that discussions are ongoing because the Trump administration goals to place stablecoins as strategic monetary instruments and make the US a world crypto chief.

“We are just exporters of what we believe to be the best product the United States ever created — that is, the US dollar,” Ardoino stated in an interview.

With rising stablecoin adoption anticipated to present extra legitimacy to crypto, Bitcoin (BTC) may gain advantage from the resultant liquidity. Institutional traders are already pivoting to crypto over conventional belongings, as a current US Crypto Information publication signifies.

Chart of the Day

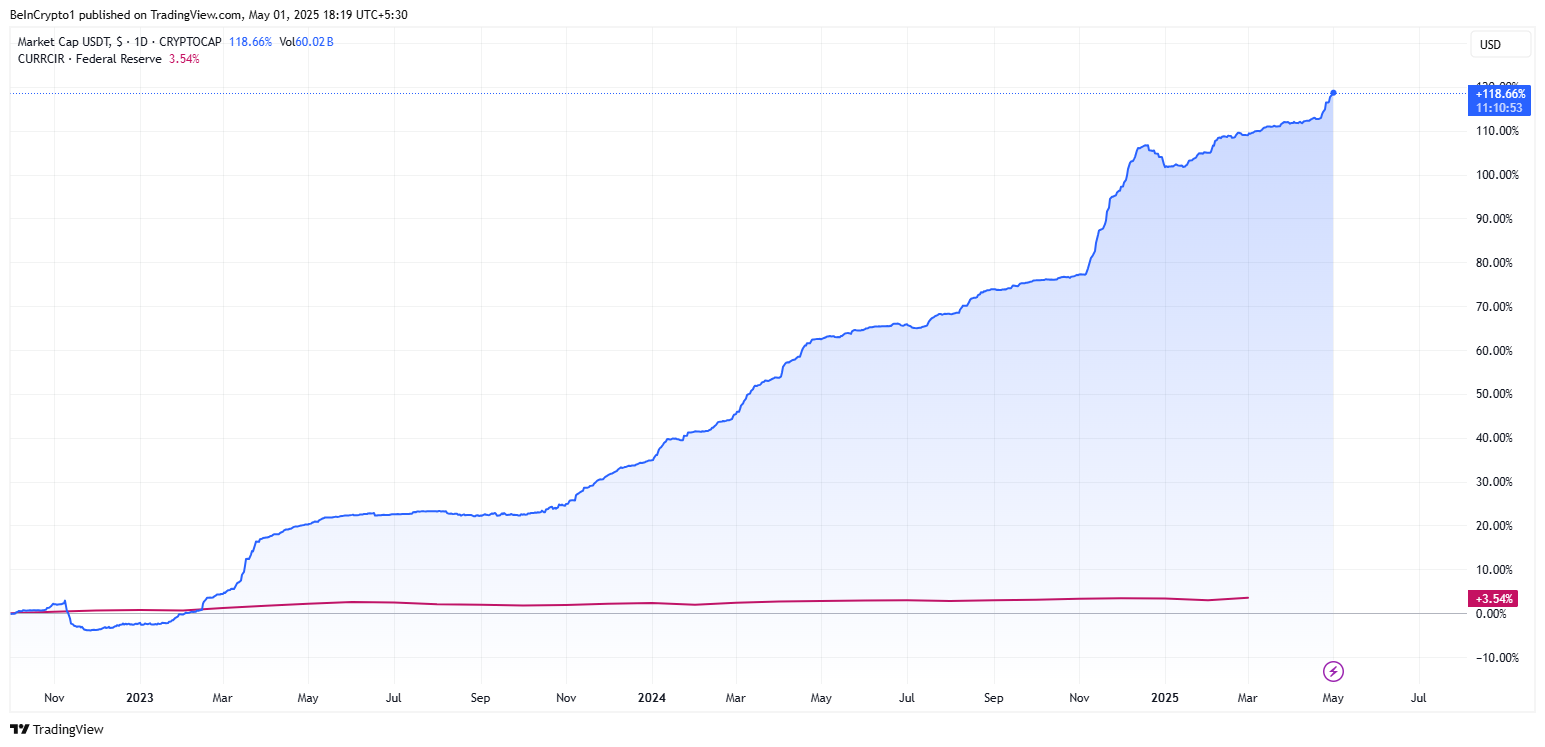

The chart reveals the market cap of USDT (blue), which accounts for over 60% of the full stablecoin market cap. It has grown considerably since November 2023 in comparison with the Federal Reserve’s forex in circulation (crimson), which stays nearly flat.

This illustrates the speedy rise of stablecoins relative to the US greenback, highlighting their rising dominance available in the market.

Byte-Sized Alpha

- Eric Trump proclaims integration of World Liberty Monetary’s USD1 stablecoin with Tron at Token2049, with USD1 turning into the stablecoin of alternative for MGX’s $2 billion funding in Binance.

- Bitcoin has carried out nicely regardless of financial uncertainty, hitting a brand new all-time excessive in Argentina, suggesting it may act as a haven.

- Trump’s crypto wealth may account for 37% of his whole belongings. This contains the TRUMP meme coin and World Liberty Monetary.

- Bitcoin ETFs noticed a $56 million outflow, marking the primary since April 16, signaling a slowdown in institutional demand.

- Robinhood’s Q1 crypto income doubled to $252 million, with buying and selling volumes rising by 28% YoY, signaling robust progress.

- Bitcoin value $61 billion nears profitability as early bull indicators seem. BTC worth reveals indicators of restoration, with the MVRV ratio bouncing off a traditionally robust degree, signaling potential early bull market situations.

- Base surpasses Arbitrum as the biggest Ethereum Layer-2 after a transition from Stage 0 to succeed in Stage 1 degree maturity.

- AI agent tokens have led the crypto market restoration, seeing a 39.4% progress over the previous 30 days, outperforming meme cash and decentralized AI.

Crypto Equities Pre-Market Overview

| Firm | On the Shut of April 30 | Pre-Market Overview |

| Technique (MSTR) | $380.11 | $393.91 (+3.63%) |

| Coinbase International (COIN) | $202.89 | $209.94 (+3.47%) |

| Galaxy Digital Holdings (GLXY.TO) | $21.92 | $22.78 (+3.94%) |

| MARA Holdings (MARA) | $13.37 | $13.95 (+4.34%) |

| Riot Platforms (RIOT) | $7.24 | $7.52 (+3.87%) |

| Core Scientific (CORZ) | $8.10 | $8.65 (+6.79%) |

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.