Bitcoin is again to $105,900 after the Israel-Iran ceasefire on Tuesday. Nonetheless, sudden panic and FUD from newer Bitcoin whales are more and more fueling volatility for the biggest cryptocurrency.

CryptoQuant highlights massive realized losses by new whales as a key driver. These buyers have offered Bitcoin aggressively below strain, amplifying market downturns.

How New Whales Drive Bitcoin’s Latest Value Swings

Since mid-June, Bitcoin has fluctuated broadly. It began June close to $107,000, rose above $110,000, and plunged under $100,000.

Between June 14 and June 22, whales realized roughly $228 million in Bitcoin losses, in response to CryptoQuant analyst JA Maartunn. A major spike occurred on June 17, with $95 million in losses in a single day.

Most of those losses—almost $85 million—got here from new whales, in comparison with solely $8.2 million from older whale buyers.

One other notable spike appeared on June 22, totaling $51 million, extra evenly break up between new and previous whales.

New whales, who not too long ago entered at increased worth ranges, seem extra vulnerable to panic promoting amid geopolitical tensions. Their speedy exits intensify worth swings and reinforce resistance at important ranges, notably close to $111,000.

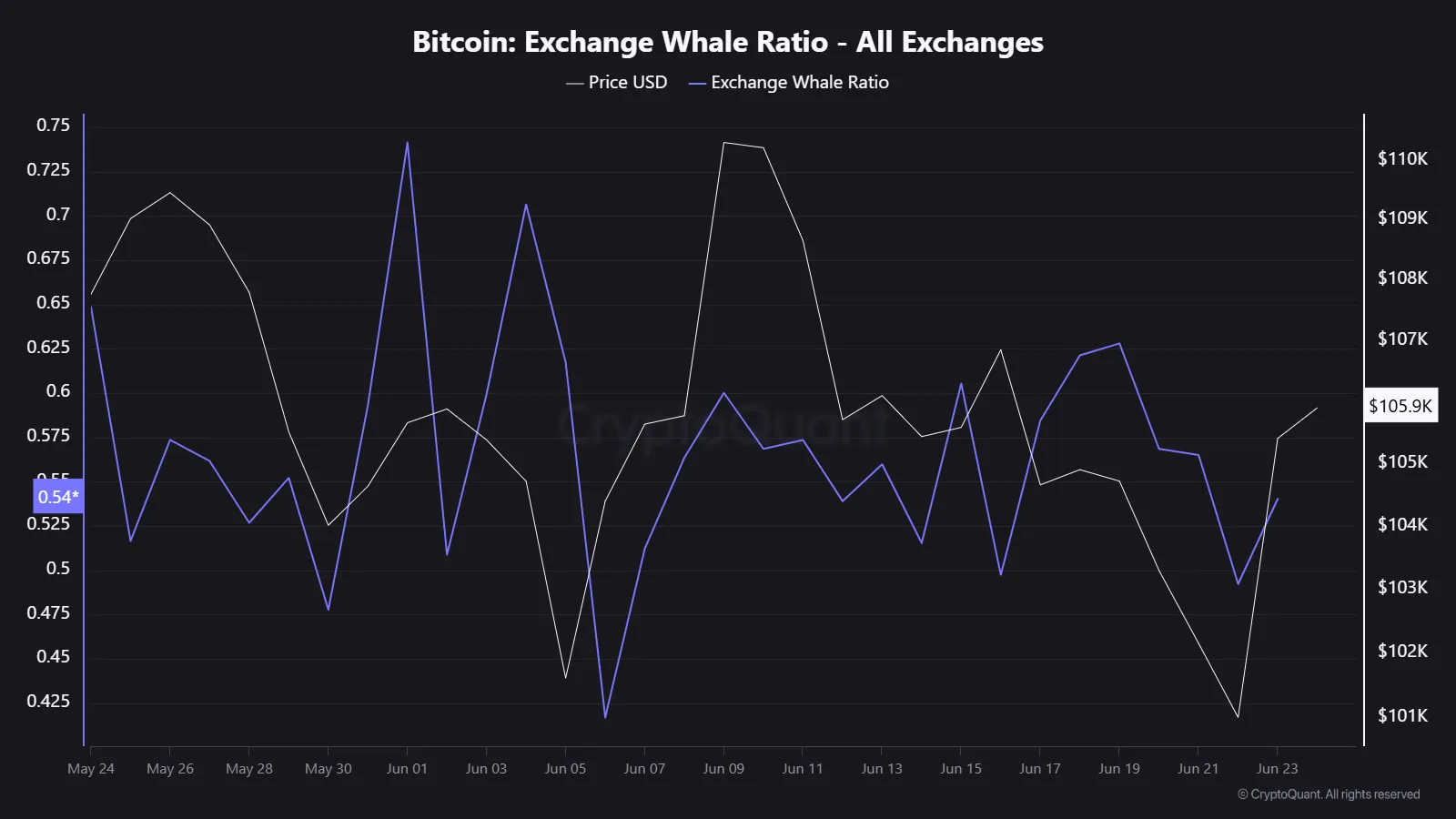

Trade Whale Ratio Reveals Promoting Strain

Additional supporting this pattern, CryptoQuant’s Trade Whale Ratio remained elevated by a lot of June.

This indicator is a measure of whale exercise on exchanges. A excessive ratio signifies whales actively depositing Bitcoin to exchanges, sometimes forward of promoting.

Knowledge reveals this ratio rising round Bitcoin’s makes an attempt to interrupt above $110,000. Whales appeared to arrange promote orders at this degree, limiting potential upward momentum.

The ratio briefly fell as Bitcoin dipped under $102,000, then climbed once more when costs rebounded towards $105,900.

This exercise suggests whales repeatedly handle danger, creating promoting strain and market uncertainty.

Geopolitical Uncertainty Amplifies Whale Anxiousness

Latest geopolitical occasions—together with the Israel-Iran conflict and subsequent ceasefire announcement—have elevated market nervousness.

Newer whale buyers appear particularly delicate, reacting shortly to damaging headlines.

Such speedy promoting triggers additional volatility. Leveraged merchants face margin calls, amplifying worth declines and hindering sustained upward momentum.

To maintain a breakout above the important thing $111,000 degree, analysts say whale promoting should ease. Decrease realized losses and diminished alternate inflows would point out improved market confidence.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.