Pi Community (PI) is exhibiting mounting technical weak spot, down practically 15% over the previous seven days and 4.4% within the final 24 hours, with its market cap now sitting at $5.12 billion. Buying and selling quantity has surged 25% up to now day, reaching $104.6 million, signaling heightened exercise amid a deepening downtrend.

Key indicators just like the ADX, CMF, and EMA construction all level to rising bearish momentum, with promoting stress intensifying and worth motion struggling to carry help. Until momentum shifts, PI seems weak to additional draw back within the close to time period.

PI Community’s Bearish Development Strengthens

The Directional Motion Index (DMI) chart for Pi Community (PI) exhibits a notable rise within the Common Directional Index (ADX), which has climbed to 21 from 11.46 only a day earlier.

The ADX measures the energy of a development, no matter path. Usually, an ADX beneath 20 suggests a weak or non-trending market, whereas readings above 20 point out {that a} development is starting to achieve energy.

With PI’s ADX now breaking above this threshold, the information suggests {that a} extra decisive transfer—both bullish or bearish—could also be growing.

Wanting deeper, the +DI (Optimistic Directional Indicator) has dropped to 13.21 from 20.93 two days in the past, whereas the -DI (Destructive Directional Indicator) has surged to 31.92 from 23.48.

This widening hole, with -DI clearly dominant, alerts growing downward stress on PI. When the -DI rises above the +DI alongside a strengthening ADX, it usually confirms a bearish development gaining momentum.

In brief, the indications are aligning to counsel PI could also be coming into a stronger downtrend, and merchants ought to watch carefully for follow-through in worth motion.

Indicators Present Robust Promoting Stress

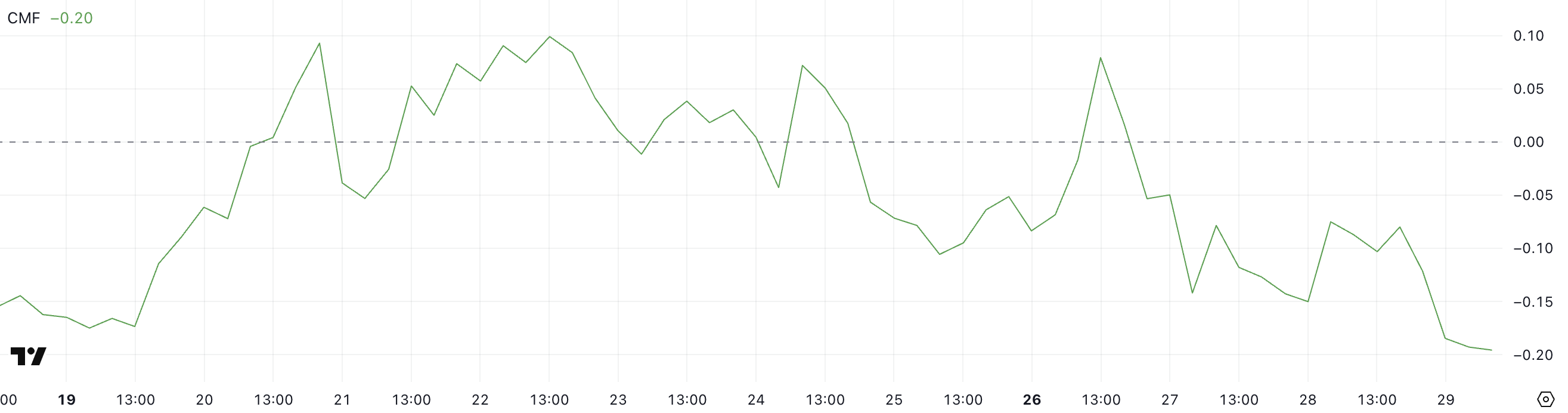

The Chaikin Cash Stream (CMF) for Pi Community (PI) has dropped sharply to -0.20, down from 0.08 three days in the past and -0.08 simply at some point in the past.

The CMF is a volume-weighted indicator that measures the stream of cash into and out of an asset over a set interval, usually 20 or 21 days.

Values above 0 usually point out shopping for stress and accumulation, whereas values beneath 0 counsel promoting stress and distribution. A CMF studying past ±0.10 is often thought of vital, with deeper damaging values pointing to sustained outflows.

With PI’s CMF now at -0.20—its lowest studying since Could 17—there’s a robust sign that sellers are in management.

This steep drop displays growing capital leaving the asset, and when mixed with current worth weak spot, it reinforces a bearish outlook.

If CMF continues to say no or holds at deeply damaging ranges, it might counsel that any bounce makes an attempt may face heavy resistance on account of a scarcity of bullish quantity help.

PI Value Eyes Decrease Help

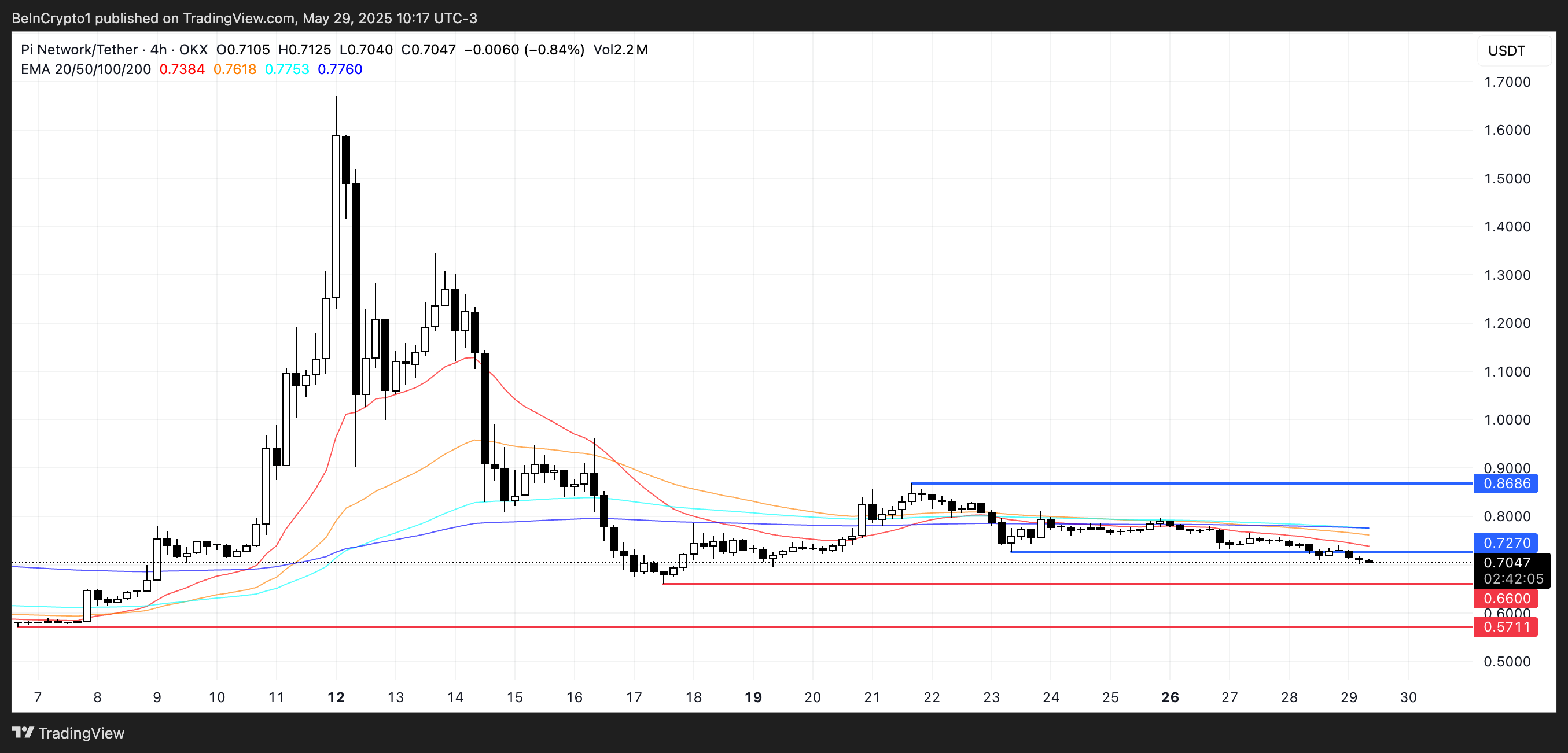

The Exponential Transferring Common (EMA) indicators for PI stay bearish, with short-term EMAs positioned beneath long-term ones—a transparent signal that downward momentum continues to be in management.

The rising distance between these EMA traces reinforces the energy of the present downtrend. If PI continues to slip, the subsequent help stage lies at $0.66, and dropping that would open the door for an additional decline towards $0.57.

On the flip facet, if PI manages to reverse its present trajectory, the primary key resistance to look at is at $0.727. A breakout above that stage may sign a short-term restoration and doubtlessly ship the worth increased towards the $0.86 mark.

Nevertheless, till short-term EMAs begin to flatten or cross above the longer-term ones, any bullish makes an attempt could stay weak to promoting stress.

Disclaimer

Consistent with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.