VanEck’s proposed spot Solana ETF (exchange-traded fund) is formally registered with the DTCC (Depository Belief & Clearing Company) beneath the ticker VSOL. This marks a significant step towards potential regulatory approval.

The itemizing indicators growing momentum behind institutional adoption of Solana and pushes the product nearer to buying and selling on US exchanges.

VanEck’s VSOL ETF Strikes Nearer to Approval After DTCC Itemizing

The DTCC itemizing, beneath the “active and pre-launch” class, confirms that the fund is eligible for future digital buying and selling and clearing pending approval from the US SEC (Securities and Trade Fee).

It’s crucial to notice that VanEck’s VSOL can’t but be created or redeemed. Nevertheless, the agency views the itemizing as a key a part of the launch course of, although it doesn’t assure approval.

Bloomberg ETF analysts James Seyffart and Eric Balchunas estimate that the SEC might quickly approve the fund, amongst different issues. Nevertheless, this forecast is contingent on filings progressing easily.

“SEC is engaging on S-1 for Solana Staking ETFs and that’s a *very* positive sign. Still, timelines for approvals are less certain IMO,” Seyffart famous in a put up.

Certainly, this registration comes shortly after the SEC instructed issuers to submit amended S-1 filings for his or her Solana ETFs. Analysts say this signifies ongoing engagement between regulators and fund managers.

A number of companies, together with Bitwise, CoinShares, and Franklin Templeton, have entered the race to supply Solana-based ETFs. Nevertheless, the SEC has delayed a choice on Franklin Templeton’s Solana ETF.

VanEck has beforehand launched Bitcoin and Ethereum futures ETFs and a number of international digital asset funds. It goals to supply regulated publicity to next-generation blockchain networks like Solana.

SEC Engagement and Polymarket Odds Sign Rising Confidence in Solana ETF

Whereas the SEC has already authorised spot ETFs for Bitcoin and Ethereum, Solana stays ready. Nevertheless, optimism is rising.

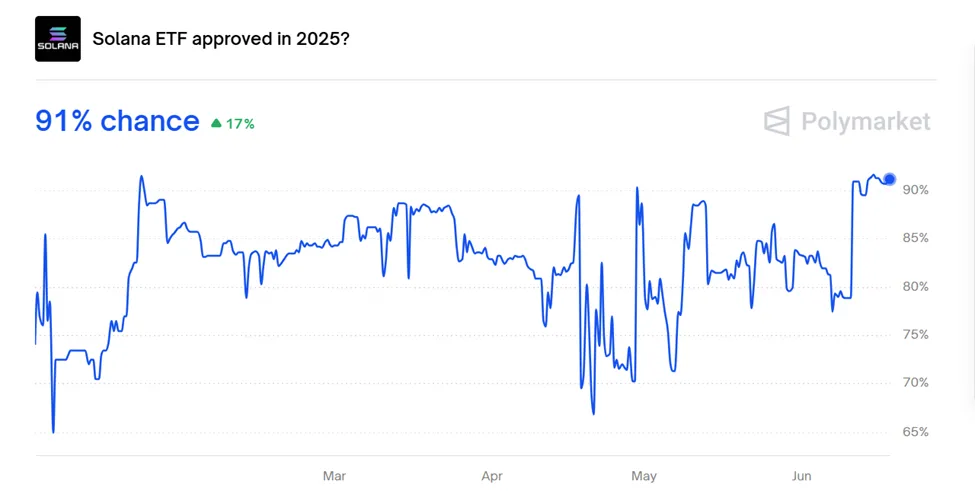

On the decentralized prediction platform Polymarket, merchants now assign a 91% likelihood {that a} Solana spot ETF will likely be authorised in 2025.

The DTCC’s recognition of VSOL follows a development of rising institutional readiness. Earlier this 12 months, the group additionally listed futures-based Solana ETFs, SOLZ and SOLT, although these stay in redeemable-only standing.

Past ETFs, DTCC has signaled deeper curiosity in blockchain infrastructure, together with plans to launch a stablecoin and tokenized collateral platform.

Solana’s excessive transaction throughput, energetic developer ecosystem, and rising DeFi and NFT use circumstances have positioned it as a reputable contender for mainstream monetary merchandise.

The SEC’s willingness to have interaction spot Solana ETFs and its approval of Solana’s futures on the CME counsel the community might quickly develop into the third crypto to achieve full ETF standing within the US.

Although VanEck has not set an official buying and selling date for VSOL, the looks on DTCC’s record is a significant milestone. If authorised, VSOL might catalyze additional ETF innovation, doubtlessly together with staking-enabled merchandise or multi-asset crypto baskets.

The transfer might additionally drive a Solana value surge. Nevertheless, regardless of the DTCC itemizing, SOL was buying and selling for $148.72 as of this writing, down practically 3% within the final 24 hours.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.