This week is essential for the crypto market as a number of important occasions are on the horizon. These developments embody the discharge of the FOMC minutes, updates on EigenLayer, and the introduction of Arbitrum’s new staking initiative.

Traders and observers pay shut consideration to those occurrences to evaluate their potential affect on asset valuation and total monetary actions. Let’s discover what lies forward in depth.

FOMC Minutes Loom: What’s Subsequent for Bitcoin and the Crypto Market?

The Federal Open Market Committee (FOMC) will launch its minutes on August 21 at 14:00 ET. In its earlier July assembly, the FOMC determined to maintain the Fed Funds rate of interest regular at 5.25% to five.50%. This resolution aligned with market expectations and underscored the Federal Reserve’s cautious strategy towards inflation.

Fed Chair Jerome Powell hinted at a attainable fee reduce if inflation continues its downward development. The market has priced in a possible fee discount in September, with additional cuts anticipated by year-end.

Historic knowledge from 10x Analysis exhibits a robust correlation between Bitcoin’s efficiency and inflation developments. Sometimes, Bitcoin rallies when inflation decreases, and vice versa. On the time of writing, Bitcoin is buying and selling at $58,575, reflecting a 1.45% lower within the final 24 hours.

Learn extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

Arbitrum’s New Staking Proposal with stARB Token

On August 16, the Arbitrum Decentralized Autonomous Group (DAO) permitted a proposal to introduce ARB staking for the Ethereum layer-2. The proposal garnered overwhelming assist, with 91% of collaborating voters backing the initiative.

By implementing ARB staking, the governance will actively use solely about 10% of the present circulating provide of ARB tokens — roughly 100 million ARB out of the 1 billion in circulation. This new initiative goals to extend voter participation and make sure that the DAO’s decision-making course of is safer and consultant of the broader group.

The staking mechanism will introduce a liquid staking token, stARB, which can provide auto-compounding options and compatibility with numerous DeFi protocols. The preliminary staking rewards might be streamed from a number of DAO-generated sources, reminiscent of sequencer charges, MEV charges, validator charges, token inflation, and treasury diversification. The launch of this staking system is anticipated to start in late August, with additional updates and particular timelines to be offered within the coming weeks.

EigenLayer Expands ERC-20 Token Assist

EigenLayer, a distinguished restaking protocol, introduced the upcoming launch of permissionless token assist on its mainnet. This replace, anticipated later this week, will permit customers to restake any ERC-20 token, broadening the belongings that contribute to the safety of decentralized networks.

“Currently, this feature is on the testnet for a short permissioned testing phase. EigenDA will be the first AVS to test and use permissionless token support. Mainnet deployment, a protocol-level update, is scheduled for [this] week. User Interface support for restakers will be added later in Q3,” the EigenLayer crew said.

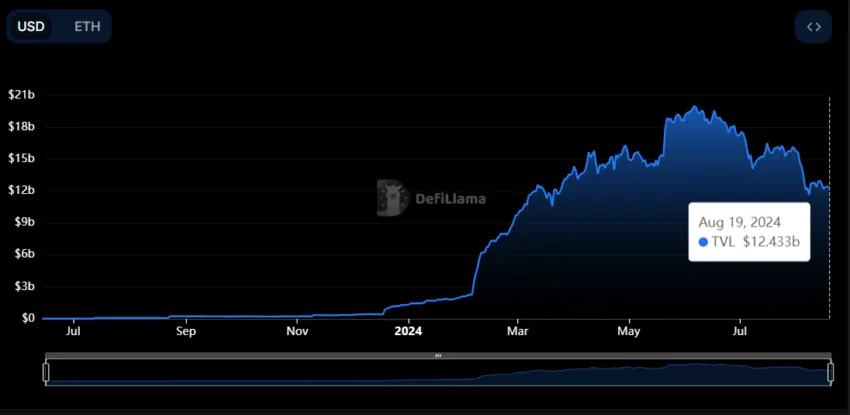

This growth marks one other milestone for EigenLayer, which continues to dominate the DeFi market. On the time of writing, DefiLlama knowledge exhibits EigenLayer is the second-largest DeFi protocol, with a complete worth locked of roughly $12.4 billion.

Babylon to Start Section 1 of Its Bitcoin Staking Mainnet Launch

This week, Babylon, a Bitcoin staking protocol, will start part 1 of its Bitcoin Staking Mainnet Launch. This part permits Bitcoin holders to start out locking their BTC for staking inside a safe, self-custodial setting. Stakers can delegate their voting energy to a finality supplier, with the choice to unbond their stake earlier than its expiration.

The preliminary staking cap is ready at 1,000 BTC, with strict limits on transaction sizes to encourage broad participation. Whereas no direct staking rewards might be distributed throughout this part, some extent system will observe stakers’ actions. This method is designed to put the groundwork for future staking phases.

AVAX and Different Main Token Unlocks This Week

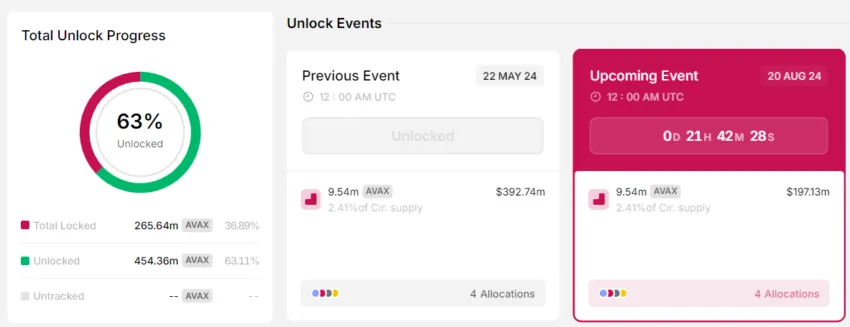

This week may even see important token unlocks, totaling over $230 million. Among the many largest is Avalanche’s launch of 9.54 million AVAX tokens, valued at over $197 million. This unlock may affect the asset’s worth, particularly as no further tokens might be allotted to the crew or strategic companions following this occasion.

Learn extra: What Is Avalanche (AVAX)?

Different main token unlocks embody Area ID (ID), PIXEL, and Ethena (ENA). Learn this text for additional detailed info on main crypto token unlocks this week.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.