A number of occasions are within the pipeline for the crypto trade this week, like Frax Finance revamping its FRAX stablecoin into a brand new BUIDL-backed asset, Sui unlocking 64 million governance tokens, and 6 Israeli funding corporations launching Bitcoin mutual funds.

Web3 SDK platform Empyreal can even launch a no-code AI Agent Launchpad. Moreover, Pendle will carry out an airdrop, Motion’s Mainnet Launch is scheduled, and GammaSwap’s yield tokens are having an audit. Total, it’s a jam-packed week for the crypto neighborhood to kickstart 2025.

Frax Votes for BUIDL-Backed Stablecoin

Frax Finance is voting to make use of BlackRock’s tokenized fund BUIDL because the backing asset for its refreshed frxUSD stablecoin, which is able to finish tomorrow.

The DeFi “Central Bank of Crypto” has been launching stablecoin options for years, and now it’s planning to transform its present FRAX stablecoin into frxUSD. On the time of writing, the voters unanimously favor adopting the proposal.

“Securitize has submitted a proposal to integrate BlackRock’s BUIDL token as a reserve backing for Frax’s soon-to-be-relaunched frxUSD stablecoin. By bridging institutional-grade assets with decentralized finance, we’re driving the next wave of innovation in stablecoins,” Securitize claimed by way of social media.

In October, BlackRock publicly claimed that it desires exchanges to make use of its BUIDL token as collateral for spinoff belongings. Though Frax Finance’s new product isn’t one in all these, it’s not the one BUIDL-backed stablecoin to launch just lately. Earlier this month, Ethena Labs used BUIDL to again its new USDtb asset.

BlackRock has directed BUIDL to make a number of main expansions within the crypto house just lately. Frax’s vote will shut in at some point, and the neighborhood has no substantial opposition to the proposal. It’s extraordinarily possible that this plan will undergo.

Sui to Unlock 64 Million Tokens

The favored layer-1 blockchain Sui community is making ready for a serious token unlock this week. On January 1, the protocol will unlock 64 million SUI tokens, subsequent to a present circulating provide of two.92 billion. Even after this main launch, the overwhelming majority of tokens will stay out of circulation.

SUI is a governance token, and the first beneficiaries of this unlock can be early buyers and contributors. Particularly, unlocked tokens will go to Collection A and B contributors, the neighborhood reserve, and the Mysten Labs treasury.

Bitcoin ETFs Elusive for Israel, Mutual Funds Launch

Six Israeli funding corporations are making ready to launch Bitcoin-based mutual funds this week. Bitcoin mutual funds have been the most popular a number of years in the past when the ETFs didn’t have regulatory approval.

In 2024, nonetheless, new crypto mutual funds are principally for belongings that don’t have a viable ETF. Though Israeli companies are combating for them, there’s been little success.

“The investment houses have been pleading for more than a year for ETFs to be approved, and started sending prospectuses for bitcoin funds in the middle of the year. The regulator marches to its own tune. It has to check the details,” an nameless funding home government advised native media.

In different phrases, these plans might come too late to make a considerable affect, contemplating that Bitcoin might be on the verge of a bear market.

Moreover, no matter Bitcoin’s efficiency, native funding components have an outsized affect on these merchandise. For instance, Hong Kong’s Bitcoin ETFs have been hotly anticipated, but their precise launch was very disappointing.

Total, the timing of this launch is questionable as BTC mutual funds are out of the limelight, due to the ETF craze. Since Israel’s newest warfare started in 2023, overseas funding has cratered, with capital flight surging 63% by October 2024.

The nation’s home tech sector additionally suffers from decreased funding. With these unfavorable components in play, BTC mutual funds might flop, too.

Empyreal To Energy No-Code AI Agent Launchpad

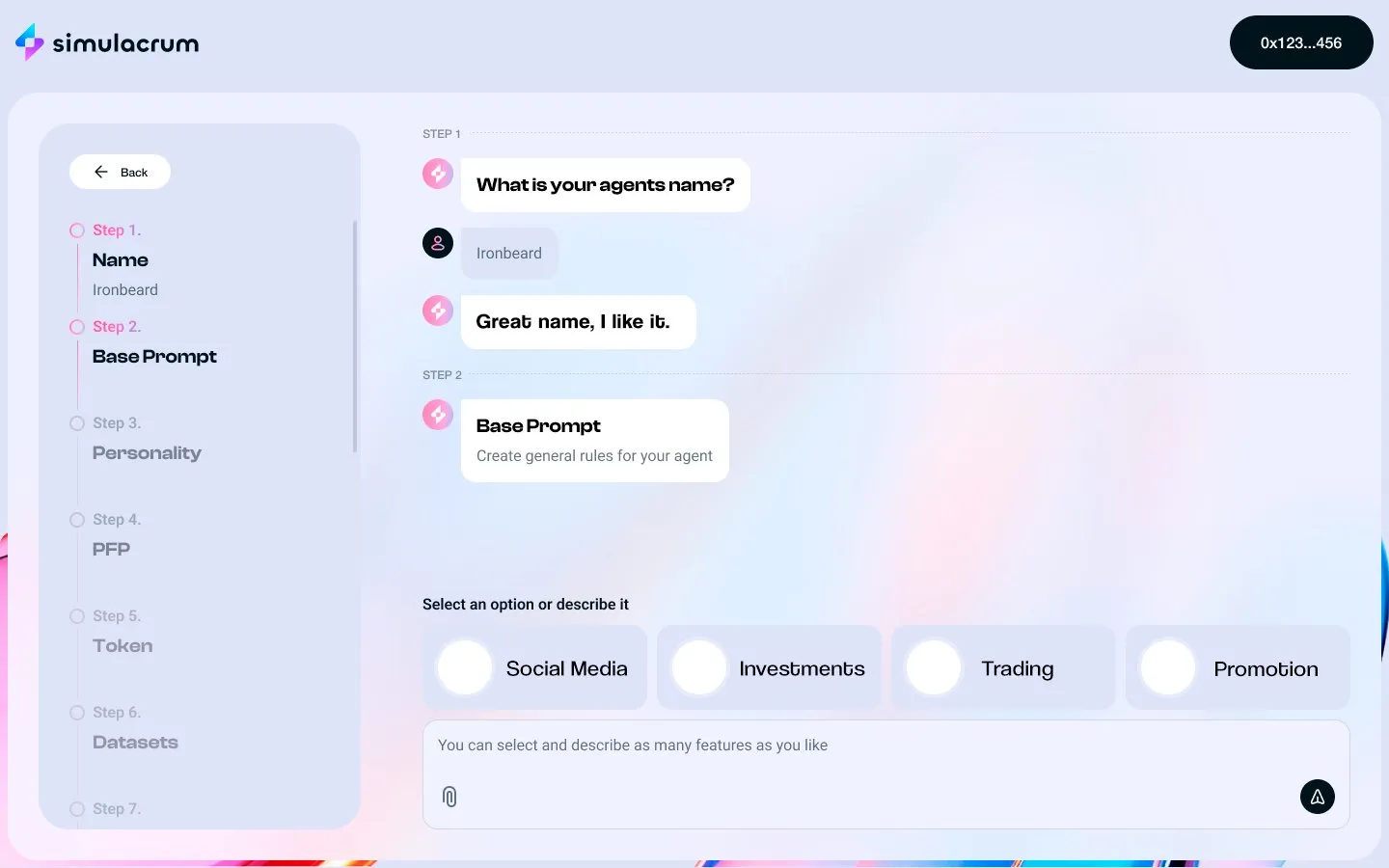

Empyreal, a web3 infrastructure firm, is about to deploy a launchpad for no-code AI brokers. Simulacrum AI is conducting the principle operation, whereas Empyreal’s underlying know-how will energy the principle features.

By means of this no-code platform, customers will be capable to customise these AI brokers in a number of methods, together with their interactions with customers and customized datasets. These brokers can even be capable to launch tokens and handle their treasuries. The primary reside check can be performed by Simulacrum, an AI protocol.

Pendle Airdrop, Motion Mainnet, GammaSwap Audit

On December 31, Pendle will take a snapshot of customers who’ve staked the agency’s vePENDLE asset, and these customers will obtain a brand new airdrop of extra tokens. Pendle’s token worth has suffered regardless of the crypto bull market, as one in all its greatest advocates, Arthur Hayes, dumped large quantities of it.

Motion is making ready for a Mainnet launch in January after a profitable beta deployment earlier this month. The platform’s MOVE token jumped within the crypto market after this launch, and builders expect additional success for the primary Transfer-based Ethereum L2.

GammaSwap, an on-chain perpetual choices protocol, has an audit scheduled for in the present day. This audit issues GammaSwap’s Yield Tokens, which might allow customers to earn 60-80% APY for Ethereum.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.