After hovering to a document excessive of practically $112,000, Bitcoin has slipped amid a wave of profit-taking, rising geopolitical pressure, and cautious alerts from the Federal Reserve. The 7% dip, whereas notable, comes within the context of a broader rally pushed by surging demand for spot ETFs and a tightening provide.

With Bitcoin (BTC) adoption accelerating—corporations like GameStop and Trump Media including it to their treasuries—and each day mining output capped at simply 450 cash, the current pullback could merely be a pause in what many buyers view as a longer-term structural uptrend.

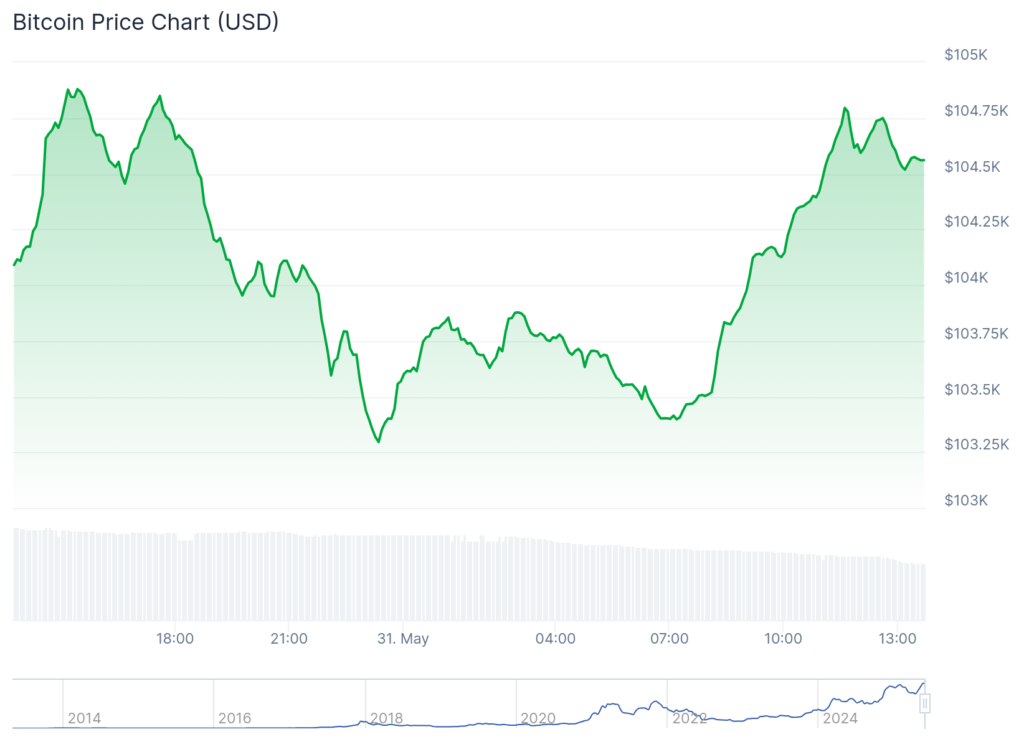

Take into account the numbers: Bitcoin dropped to beneath $104,000 on Saturday, down by 7% from its all-time excessive of $111,900.

The decline occurred as buyers booked income after it jumped by 50% from its lowest level in April to its highest degree this month. It’s common for Bitcoin and different belongings to drop after such a powerful rally.

Bitcoin additionally dropped as issues about commerce rose. Scott Bessent, the Treasury Secretary, mentioned that talks between the U.S. and China had stalled, whereas Trump accused China of not honoring its commitments. He additionally mentioned that the U.S. would improve its tariffs on metal and aluminum to 50%.

Eventually verify on Saturday, Bitcoin hovered above $104,550. See beneath.

In the meantime, the Federal Reserve minutes confirmed that officers will not be in a rush to chop rates of interest. As a substitute, they’re having a wait-and-see method as they observe the affect of tariffs on the financial system.

Fortuitously, Bitcoin has sturdy provide and demand dynamics. Demand for spot Bitcoin ETFs is rising, with the cumulative inflows rising to over $44 billion. Firms like Trump Media and GameStop have began shopping for Bitcoin for his or her treasury.

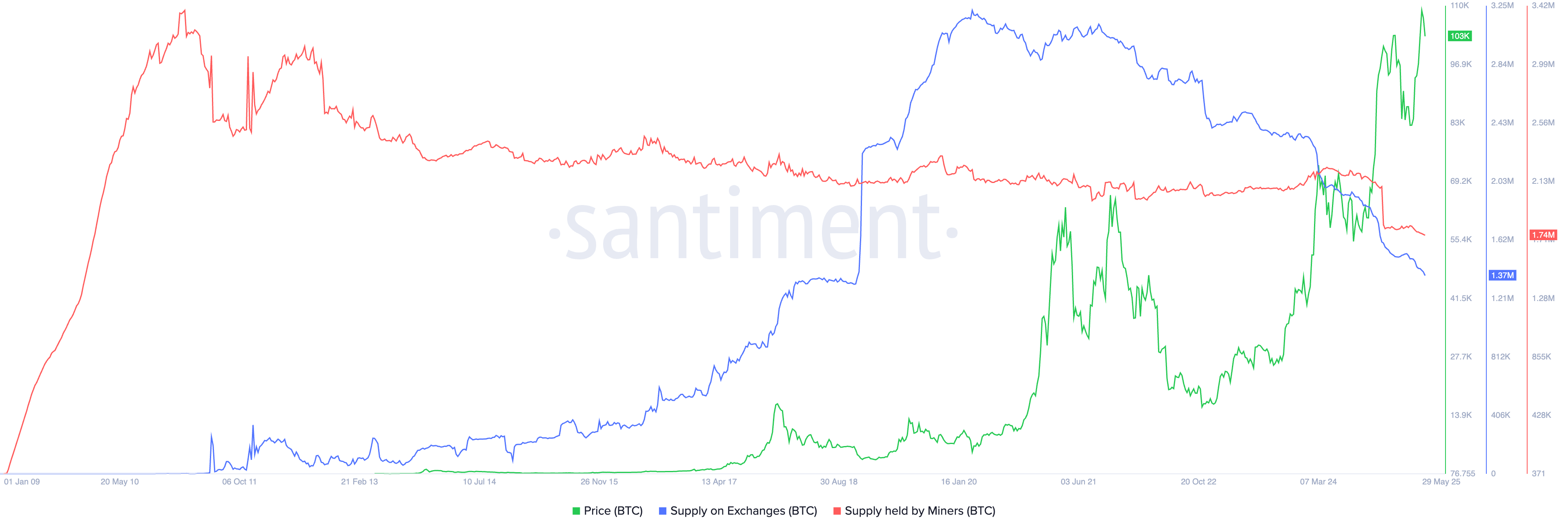

On the identical time, the availability of Bitcoin on exchanges has dropped by 57% from its highest level in March 2020, and the decline is accelerating. Bitcoin’s provide has dropped from 3.22 million to 1.37 million in the identical interval.

This provide crunch could maintain falling since solely 450 cash are mined each day, and an organization like Technique is shopping for hundreds per week. The provision held by miners has dropped to 1.74 million, its lowest degree since 2010. Subsequently, the availability and demand dynamics imply that the coin will proceed rising.

Bitcoin value technical evaluation

The each day chart beneath exhibits that the BTC value has fallen from its all-time excessive of $111,900 to $104,170.

This chart exhibits that it has remained above the 50-day and 100-day Exponential Shifting Averages. Additionally, it has fashioned a bullish flag sample, a well-liked continuation sign up technical evaluation.

The Bitcoin value has fashioned a cup-and-handle sample and is presently within the deal with section. The depth of the cup is roughly 32%, which suggests a goal value of $144,650. This goal is calculated by measuring the depth of the cup from its higher edge.