In Q1 2025, the Bitcoin mining business confronted quite a few challenges as a result of halving occasion and the elevated community issue.

This evaluation will use knowledge from publicly listed Bitcoin mining corporations resembling Cipher Mining, Riot Platforms, Core Scientific, Hut 8 Corp, TeraWulf, Bitfarms, and Cango to summarize, examine, and consider their monetary efficiency, mining output, and improvement methods.

Monetary Efficiency

Bitcoin mining corporations in Q1 2025 exhibited vital disparities in monetary efficiency.

Riot Platforms recorded the best income at $161.4 million, primarily from Bitcoin mining ($142.9 million), with an output of 1,530 BTC. Nonetheless, per-unit mining prices surged to $43,808/BTC from $23,034/BTC year-over-year, reflecting the influence of the halving and elevated community issue.

Core Scientific reported a formidable web revenue of $581 million, largely pushed by non-cash valuation changes ($622 million). Income dropped 55.7% to $79.525 million, and adjusted EBITDA was damaging at $6.107 million.

Bitfarms noticed a 33% income enhance to $67 million, however its gross revenue margin fell from 63% to 43%, with a web lack of $36 million. Cango achieved income of $145.2 million, with $144.2 million from Bitcoin mining, producing 1,541 BTC at a excessive common price of $70,602/BTC.

In the meantime, Hut 8 Corp and TeraWulf confronted vital challenges, with revenues declining by 58% ($21.8 million) and $34.4 million, respectively, alongside substantial web losses ($134.3 million and $61.4 million).

Mining Output and Bitcoin Holdings

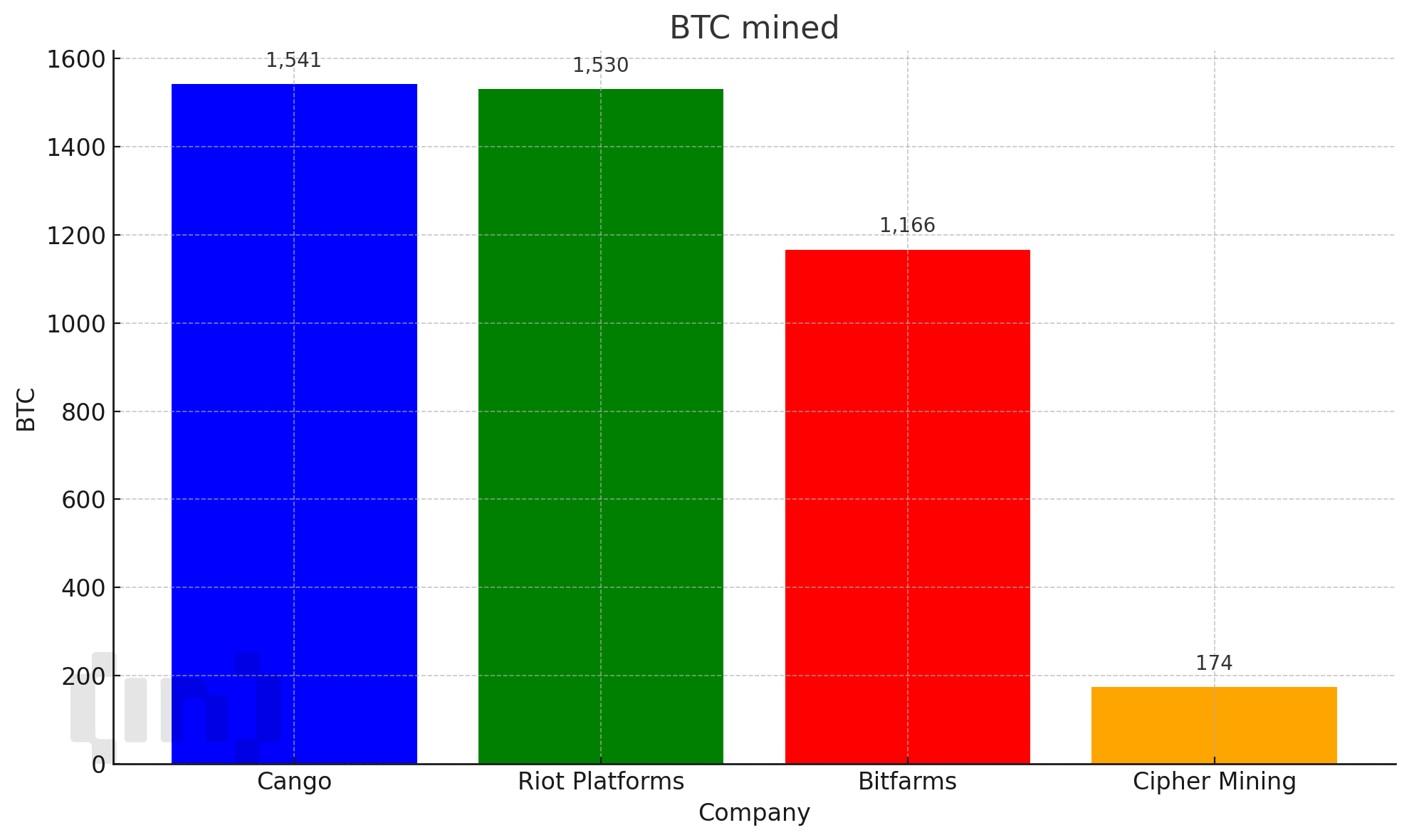

Concerning mining output, Cango led with 1,541 BTC, adopted by Riot Platforms (1,530 BTC) and Bitfarms (1,166 BTC). Cipher Mining mined 174 BTC in April however bought 350 BTC, decreasing its holdings to 855 BTC, of which 379 BTC had been collateralized.

Riot Platforms held the most important Bitcoin reserve with 19,223 unrestricted BTC, Bitfarms held 1,166 BTC, and Cango maintained vital money and short-term investments ($347.4 million).

Core Scientific didn’t disclose particular Bitcoin holdings however targeted on increasing managed providers with a 250MW contract for CoreWeave, anticipated to generate $360 million in income by 2026.

Q1 2025 was difficult for Bitcoin mining corporations as a result of Bitcoin halving and elevated community issue. Riot Platforms and Cango led in output and income, however excessive mining prices posed challenges. Core Scientific and Hut 8 are pivoting towards sectors like AI to scale back reliance on mining.

The submit Q1 2025 Knowledge Reveal Sky-Excessive Prices and a New Pecking Order in Bitcoin Mining appeared first on BeInCrypto.