The crypto market is buzzing with exercise as Bitcoin surpassed the $100,000 mark on Might 8, reaching its highest degree since early February 2025.

This milestone added practically $300 billion to the full crypto market cap and sparked heated debates in regards to the subsequent strikes of Bitcoin and altcoins.

Why Would possibly the “Banana Zone” Be Triggered?

Raoul Pal, veteran investor and founding father of Actual Imaginative and prescient, believes Bitcoin Dominance (BTC.D) peaked on Might 8, 2025.

TradingView knowledge exhibits BTC.D dropped from 65.3% to beneath 64% in simply two days. This marked the sharpest decline after two months of regular will increase.

Pal supplied a broader perspective. He famous that the present BTC.D peak is decrease than the highs of 2021 and 2017, aligning with historic patterns. He predicted this might sign the following part of the “Banana Zone”—a time period he coined to explain a parabolic surge in crypto costs, forming a banana-shaped curve on the chart.

“I think BTC dominance topped today. There are daily, weekly and monthly DeMark tops in place and the top is well below 2021 top and that was below the 2017 top. If that plays out, it is the hallmark of the next phase of the Banana Zone,” Raoul Pal predicted.

The “Banana Zone” typically coincides with an altcoin growth. Traders sometimes shift funds from Bitcoin into altcoins looking for greater returns.

Nevertheless, not everybody agrees with Pal. Analyst Mark Harvey countered his view on X, claiming that Bitcoin Dominance is returning to 100%. Harvey argued that the rise of spot Bitcoin ETFs and powerful institutional inflows will assist Bitcoin reinforce its dominance.

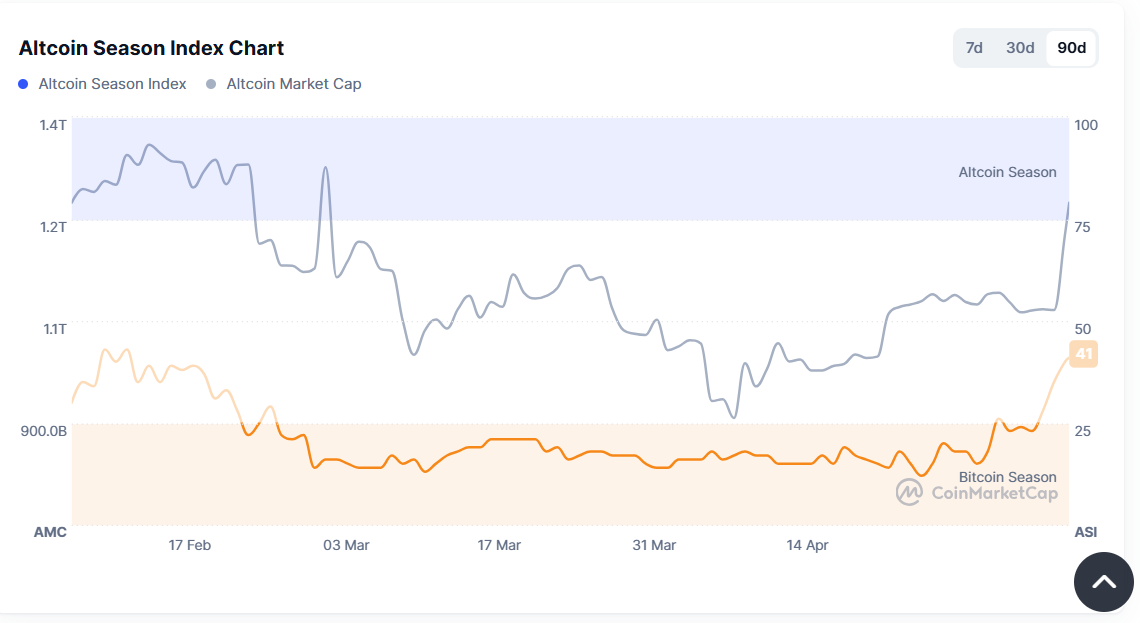

Altcoin Season Index Hits Two-Month Excessive

In the meantime, CoinMarketCap’s Altcoin Season Index knowledge exhibits the index has reached a two-month excessive of 41. Although nonetheless beneath the 75-point threshold that defines altcoin season, the indicator has exited the “Bitcoin season” zone and entered impartial territory, signaling a return of constructive sentiment.

Merlijn The Dealer, a widely known analyst, agreed that the altcoin season has begun. He cited Blockchain Heart’s index model and argued that it just lately broke by means of months-long resistance. He added that Tether Dominance (USDT.D) is trending down, which indicators an ideal setup for altcoin season.

“Altcoin Seaso signal just triggered… Now the index just snapped a multi-month downtrend. Bitcoin season dominance is cracking. If you’re not positioned now, you’ll be exit liquidity later. Alts are loading,” Merlijn The Dealer mentioned.

These differing views spotlight the complexity and unpredictability of the crypto market. Will Bitcoin’s Dominance actually reverse, permitting altcoins to surge, or will Bitcoin proceed to claim its dominance? The market’s response within the coming weeks—amid macroeconomic developments and shifting investor sentiment—might quickly present the reply.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.