Though the “altcoin season” has not formally begun, Solana (SOL) is witnessing rising curiosity from institutional traders, with important accumulation strikes famous in Might 2025.

Latest experiences and analyses point out that Solana is attracting capital from establishments and experiencing progress in new developer exercise, alongside constructive alerts from on-chain information.

Altcoin Season But to Arrive, However SOL Attracts Institutional Consideration

Knowledge exhibits that the spot buying and selling quantity of altcoins stays decrease than the degrees seen in January 2025 and 2024. Naturally, it’s nonetheless removed from the height ranges of 2021. This implies that the altcoin market as an entire has but to succeed in the vibrancy wanted to kickstart a powerful progress cycle.

“We have a long way to go before we see the same levels of interest in alts that we saw in previous rallies,” shared Nic Puckrin, co-founder of Coin Bureau.

Nevertheless, regardless of this backdrop, Solana (SOL) is rising as a vibrant spot, capturing the eye of institutional traders.

Particularly, a number of establishments have elevated their SOL holdings earlier than the altcoin season. In line with OnchainLens, a whale not too long ago elevated its holdings by 17,226 SOL whereas investing $1 million in FARTCOIN and $300,000 in LAUNCHCOIN.

One other whale withdrew 296,000 SOL from FalconX and staked it, signaling a development of accumulation and long-term dedication to the Solana ecosystem.

Furthermore, DeFi Growth Corp not too long ago elevated its Solana holdings by over 170,000 SOL, pushing the overall worth above $100 million. Equally, SOL Methods added over 122,524 SOL to its funding portfolio in Might.

These strikes replicate sturdy confidence from institutional traders in Solana’s future progress potential.

Solana Ecosystem Thrives

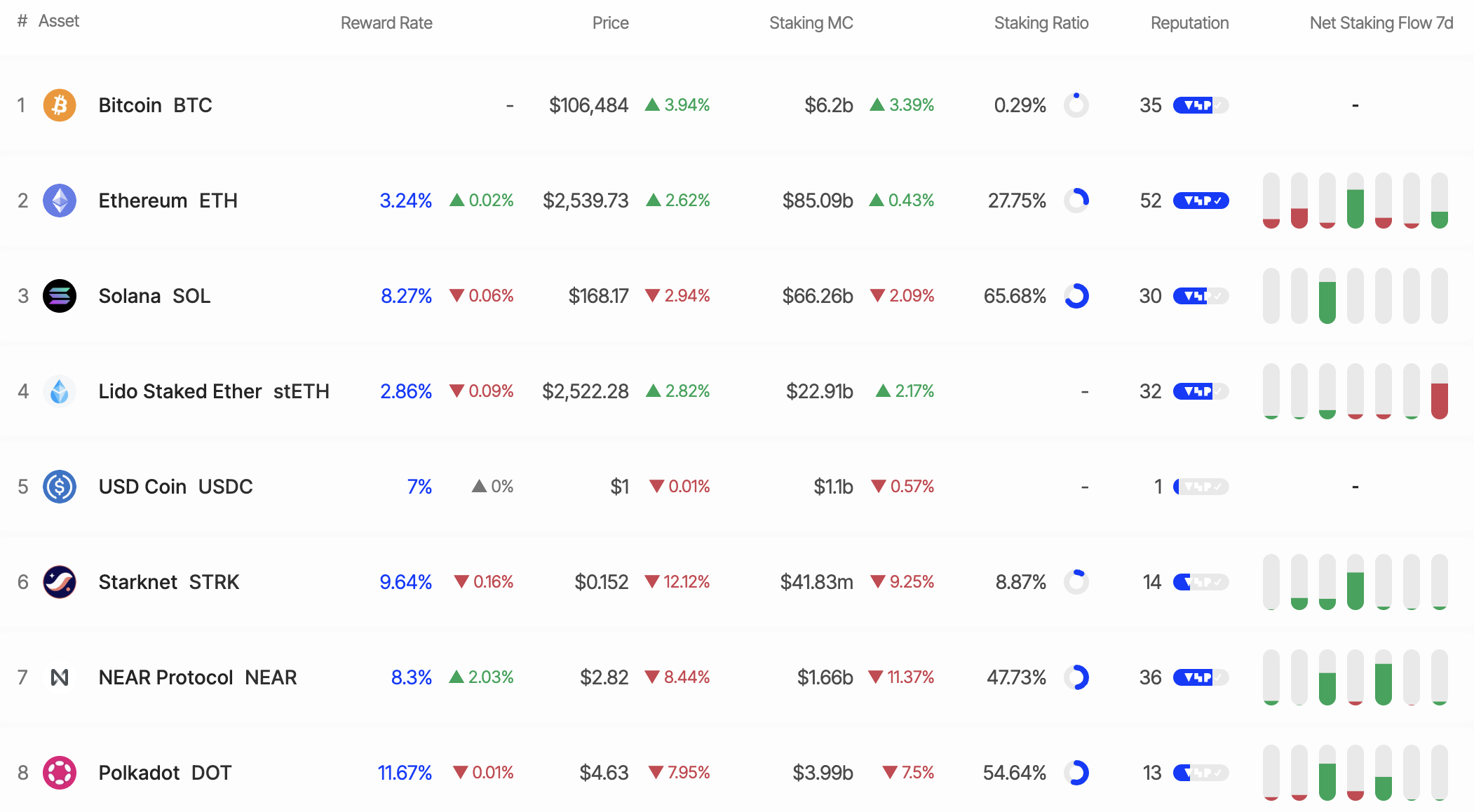

Past the curiosity from institutional traders, Solana can also be seeing constructive alerts from its ecosystem. The truth that 65% of SOL’s complete provide is at present staked is a constructive signal, reflecting the neighborhood’s confidence in Solana’s stability and long-term potential.

As beforehand reported by BeInCrypto, Solana achieved a complete app income of $1.2 billion in Q1 2025. This outcome marks a 20% progress in comparison with the earlier quarter ($970.5 million). It’s the highest-performing quarter for Solana previously 12 months, demonstrating a powerful ecosystem restoration after a yr of great volatility.

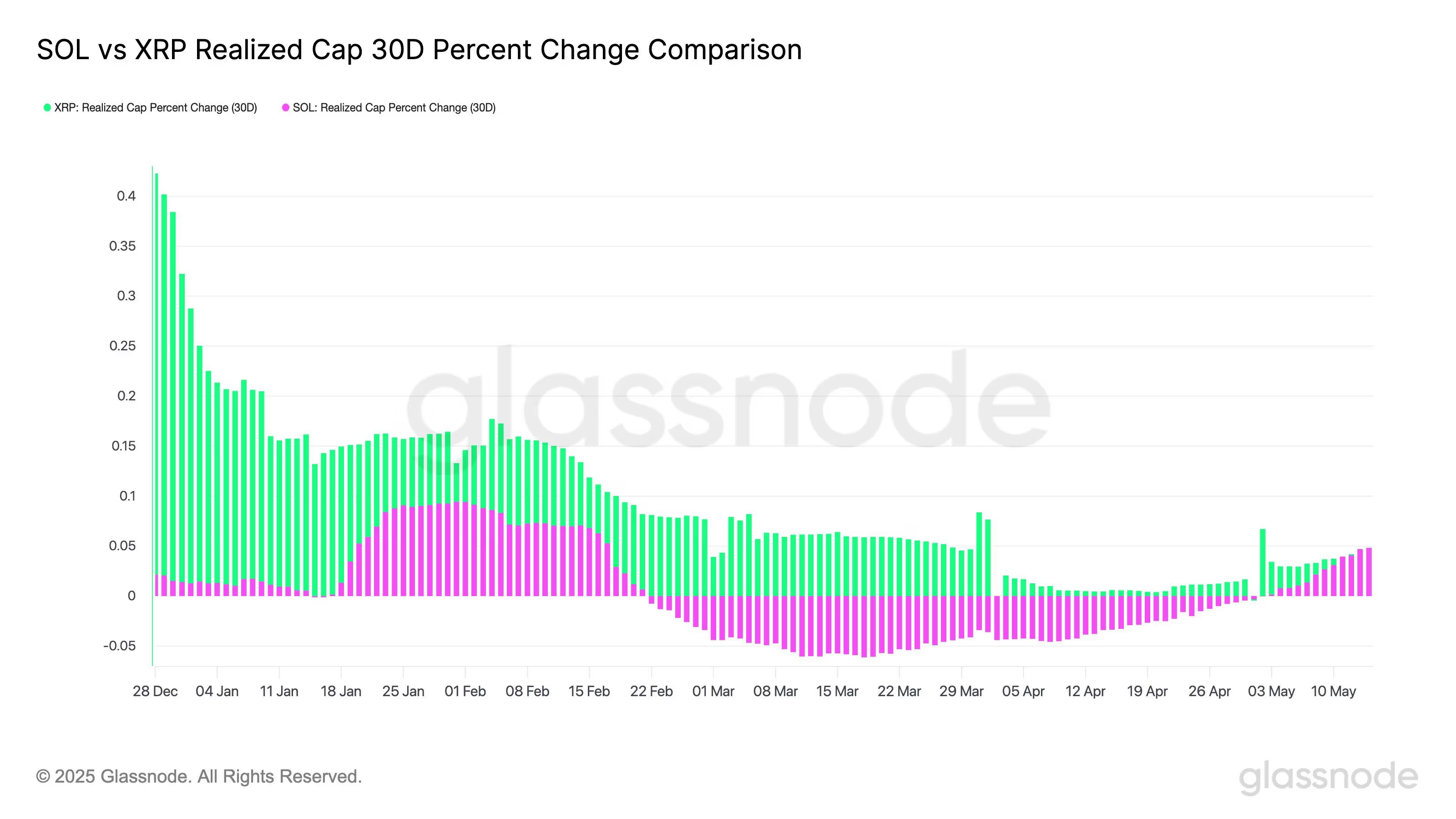

Moreover, Glassnode information exhibits that the actual capital influx into SOL over the previous 30 days has returned to constructive territory, rising at a price on par with XRP. These alerts point out that on-chain demand for Solana exhibits indicators of restoration, although the broader altcoin market has but to take off absolutely.

Solana Mirrors Ethereum’s 2021 Efficiency

One other noteworthy evaluation from the X account jon_charb means that SOL’s ATH worth in the beginning of 2025 bears placing similarities to Ethereum in 2021. Particularly, SOL skilled a major worth surge earlier this yr, very like Ethereum’s breakout earlier than the 2021 altcoin season.

If historical past repeats itself, Solana could also be in an accumulation section forward of a brand new progress cycle, particularly as institutional traders proceed to pour capital into its ecosystem. This parallel reinforces confidence in SOL’s potential and highlights the chance that this blockchain may lead the upcoming altcoin season.

Nevertheless, it’s price noting that the altcoin market continues to be within the early levels of restoration. Spot buying and selling volumes, that are decrease than earlier highs, point out that market sentiment stays cautious.

Nonetheless, the buildup strikes by institutional traders and the event of Solana’s ecosystem counsel that SOL could also be gearing up for a major leap when market situations develop into extra favorable.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.