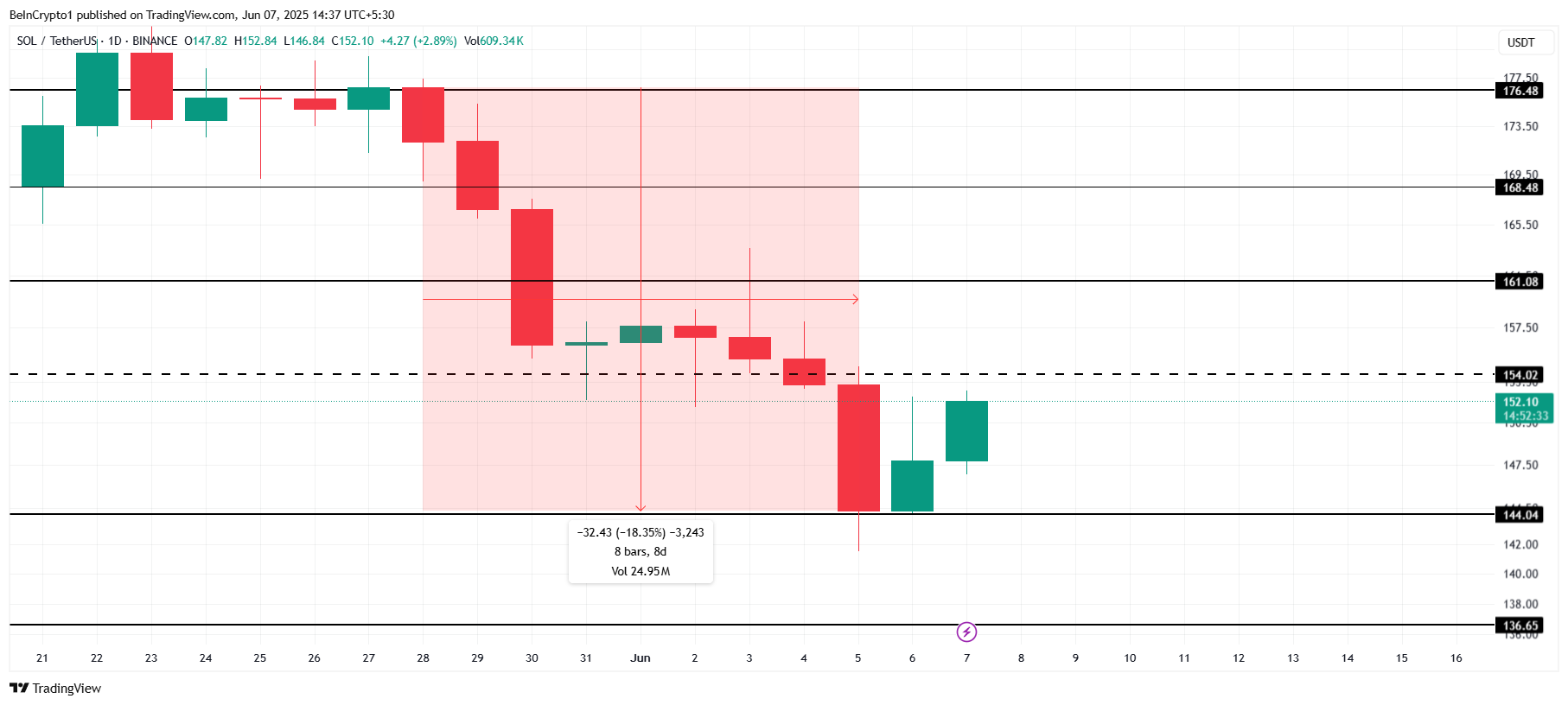

Solana (SOL) just lately skilled a pointy decline, dropping from $176 to $141 in simply eight days. After this vital downturn, many merchants hoped for a restoration.

Nonetheless, the altcoin’s path to regaining misplaced floor now faces challenges, primarily on account of a shift in investor conduct that would decelerate or forestall additional worth beneficial properties.

Solana Traders Are Promoting

Lengthy-Time period Holders (LTHs) have shifted from being staunch patrons to changing into sellers. Outflows from LTH wallets have just lately surged to a two-month excessive, a transfer that hasn’t been seen prior to now month.

This transformation in conduct indicators a major shift available in the market, as LTHs are sometimes thought-about the spine of an asset’s worth stability.

The constant promoting from these buyers raises doubts about Solana’s worth stability within the brief time period. Since LTHs are usually seen as extra affected person buyers, their choice to promote indicators a possible lack of confidence.

The macro momentum for Solana stays regarding as key technical indicators proceed to sign bearish market circumstances.

The 50-day Exponential Shifting Common (EMA) and 200-day EMA, which have been intently watched by merchants, are exhibiting indicators of continued bearishness. The Demise Cross, which started in March, remains to be in play.

Though the 50-day EMA got here near crossing over the 200-day EMA in late Might, it failed to take action, indicating that restoration will not be imminent. This continued bearish development places Solana’s restoration in jeopardy.

If the Demise Cross persists and the EMAs proceed to diverge negatively, it might sign additional worth declines.

SOL Value Wants A Push

Solana’s worth just lately dropped by 18% in simply eight days however noticed a slight restoration, rising 5% within the final 24 hours. At present buying and selling at $152, SOL faces vital resistance on the $154 degree.

This barrier is essential for any potential bullish transfer within the brief time period. If the worth fails to interrupt by this resistance, additional declines could also be on the horizon.

Contemplating the present market sentiment and technical indicators, Solana’s worth could wrestle to breach the $154 resistance. As a substitute, it might see a pullback towards $144. If this assist fails to carry, the worth might drop additional to $136.

Nonetheless, if broader market circumstances enhance, Solana might expertise a rally. A breakout above the $154 resistance would push the worth in the direction of $161. Reaching this degree would finish the Demise Cross sample, serving to to revive investor confidence and invalidate the bearish outlook.

Disclaimer

According to the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.