Solana (SOL) has climbed 13% over the previous seven days, showcasing sturdy short-term efficiency. Whereas momentum indicators just like the RSI and EMA traces stay supportive, latest worth motion means that bullish energy could also be stalling just under a key breakout level.

On the identical time, the sharp drop in BBTrend signifies weakening development energy and fading volatility, typically an indication of incoming consolidation or market indecision. With technicals at a crossroads, SOL’s subsequent transfer will seemingly rely on whether or not patrons can regain management or if a broader pullback begins to unfold.

SOL RSI Rises Sharply, however Pause in Momentum Alerts Warning

Solana’s Relative Energy Index (RSI) is presently at 60.35, marking a noticeable rise from 45 simply two days in the past.

This bounce indicators rising bullish momentum, though the RSI has remained steady since yesterday, suggesting that upward stress could also be easing for now.

The rise displays renewed shopping for curiosity in latest classes, pushing SOL nearer to overbought territory however not fairly there but. This leveling off might point out that the market is taking a breather earlier than deciding its subsequent transfer.

The RSI is a momentum oscillator that measures the pace and magnitude of worth actions, starting from 0 to 100. Values above 70 sometimes point out that an asset is overbought and could also be due for a pullback, whereas readings under 30 counsel oversold situations, probably signaling a shopping for alternative.

With Solana’s RSI at 60.35, the asset is approaching bullish territory however hasn’t but entered an excessive zone.

This positioning means that whereas latest momentum is constructive, SOL might face some short-term consolidation or resistance earlier than persevering with larger—except sturdy shopping for curiosity resumes and pushes the RSI nearer to overbought ranges.

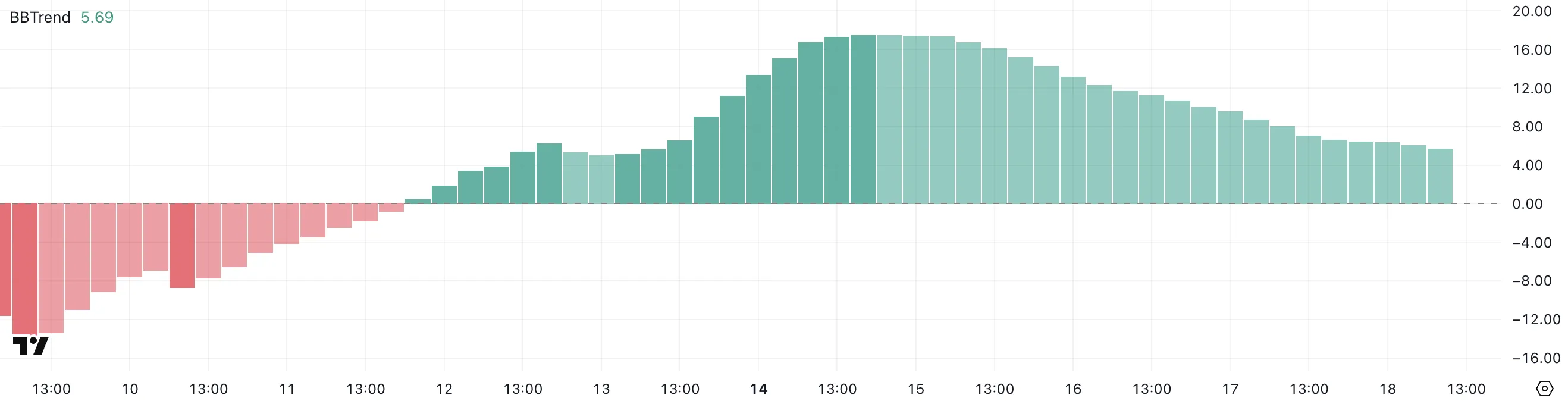

SOL Pattern Energy Weakens as BBTrend Falls Beneath 6

Solana’s BBTrend indicator is presently at 5.69, a major drop from the 17.5 studying noticed simply 4 days in the past.

This sharp decline means that volatility round SOL’s worth has cooled notably, and the energy of the prior development is weakening.

Whereas BBTrend doesn’t sign path by itself, the drop signifies that the sturdy motion, seemingly bullish, has misplaced momentum, and SOL could also be coming into a part of consolidation or uncertainty.

BBTrend, quick for Bollinger Band Pattern, measures the energy of a worth development primarily based on the enlargement or contraction of Bollinger Bands.

Larger values counsel a powerful, directional transfer (both up or down), whereas decrease values level to weaker traits and lowered volatility. With BBTrend now at 5.69, Solana is in a a lot much less risky atmosphere, which frequently precedes a breakout or a reversal.

For now, this studying indicators that the latest momentum is fading. Until volatility picks up once more, SOL’s worth could stay range-bound within the quick time period.

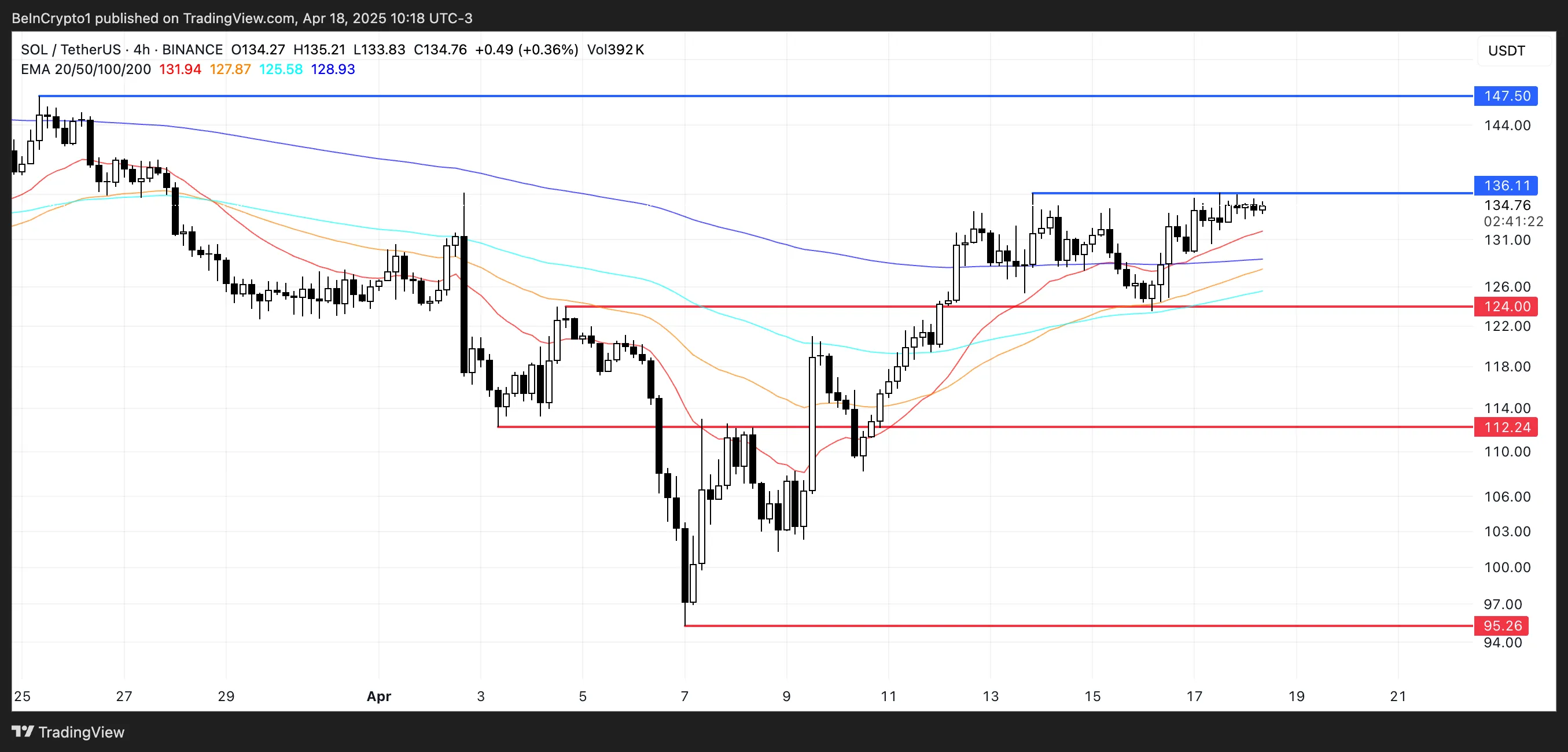

Golden Cross Looms for SOL, However $136 Barrier Nonetheless Holding Sturdy

Solana’s EMA traces proceed to replicate a bullish construction, with the short-term common trending above the long-term one—suggesting that constructive momentum stays intact.

A possible golden cross can be forming, which, if confirmed, would additional reinforce the bullish outlook.

Nevertheless, regardless of this favorable setup, Solana worth has struggled to interrupt via the $136 resistance stage over the previous few days, indicating that patrons could also be shedding steam at this key threshold.

Tracy Jin, COO of MEXC advised BeInCrypto:

“Amid widespread volatility, Solana has stood out with notable strength. A combination of favorable technical setups and institutional tailwinds — such as the launch of the first spot Solana ETFs in North America — has helped drive a short-term rally. The token’s reclaim of leadership in decentralized exchange activity and rising total value locked further support the bullish case.”

If SOL manages to push above $136 with sturdy quantity, it might open the trail towards the following targets at $147 and probably larger. But when the present momentum fades and the worth reverses, a take a look at of help at $124 turns into seemingly.

About Solana subsequent strikes, Jin advised BeInCrypto:

“Despite recent gains, SOL’s near-term outlook remains sensitive to broader liquidity conditions. Any deterioration in market confidence — whether from macro shocks or renewed volatility in Bitcoin — could cap upside potential.”

A breakdown under that would speed up losses towards $112, and within the occasion of a deeper correction, SOL might even revisit the $95 area.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.