Solana’s worth has confronted important volatility over the previous week on account of current market troubles. This has led to a pointy decline in its futures market sentiment as leveraged merchants seem reluctant to take bullish positions.

This insecurity will increase the chance of an extra worth drop, with SOL eyeing a dip beneath the $130 stage within the close to time period.

Solana Struggles as Merchants Exit

SOL’s unfavorable funding fee is an indicator of the waning bullish bias amongst its futures merchants.

Based on Coinglass knowledge, SOL perpetual futures have maintained a unfavorable funding fee for the previous three days, indicating that quick sellers are paying to carry their positions. At press time, this stands at -0.0060%.

The funding fee is a periodic charge exchanged between lengthy and quick merchants in perpetual futures contracts to maintain the contract worth aligned with the spot market.

As with SOL, when this fee is unfavorable, it signifies that quick sellers (these betting on a worth decline) are paying charges to lengthy merchants, indicating a bearish sentiment out there.

Subsequently, extra merchants are positioned for a worth drop, reinforcing the downward strain on the coin’s worth.

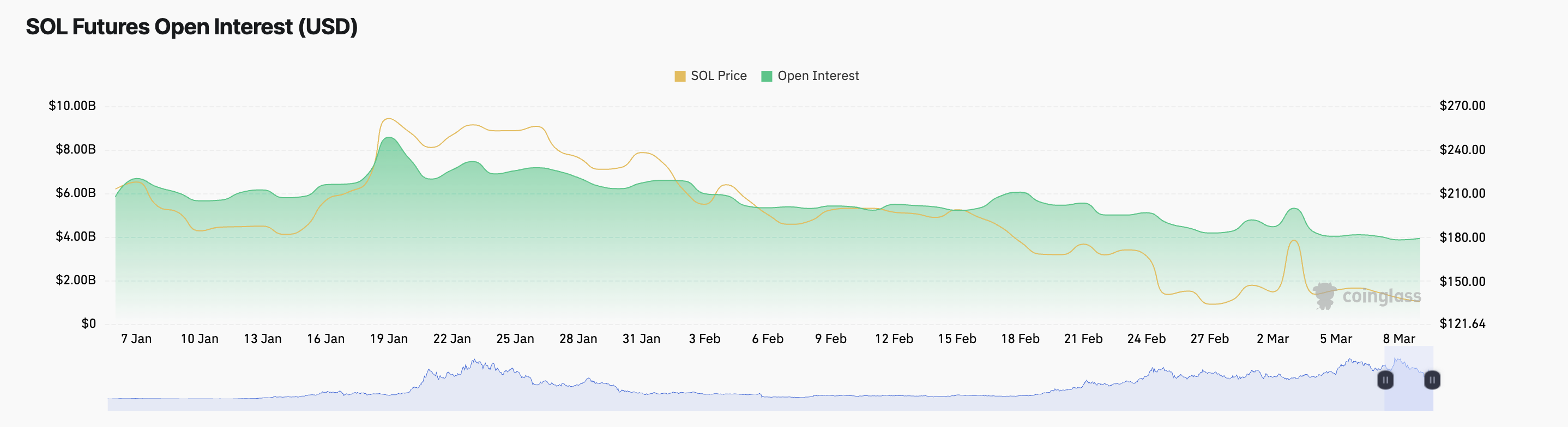

Furthermore, the insecurity amongst SOL futures merchants is mirrored by its plummeting open curiosity. At press time, that is at $3.94 billion, falling 19% for the reason that starting of March.

An asset’s open curiosity tracks the overall variety of lively futures contracts that haven’t been settled.

When this falls, particularly throughout a interval of worth decline, it means that merchants are closing positions with out opening new ones. This confirms the lowered conviction in a short-term SOL worth restoration amongst its futures merchants.

Solana Bulls Weaken—Can They Stop a Drop Under $130?

At press time, SOL trades at $137.70, resting simply above the assist ground of $136.62. As bullish sentiment tapers, this stage dangers being flipped right into a resistance zone.

Ought to this occur, SOL’s worth might slip beneath $130 to alternate arms at $120.72.

Alternatively, if bullish momentum returns to the SOL market, this bearish projection will likely be invalidated. In that state of affairs, new demand might drive the coin’s worth to $182.31.

Disclaimer

Consistent with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.