Widespread altcoin Solana has witnessed a 30% rally over the previous 30 days. It has traded inside an ascending channel since mid-April, highlighting the surge in shopping for strain out there.

Nonetheless, this bullish momentum now seems to be going through a big headwind, as merchants’ sentiment begins to shift.

Solana’s Lengthy/Brief Ratio Hits Month-to-month Low

In keeping with Coinglass knowledge, Solana’s lengthy/brief ratio has dropped to 0.86, its lowest degree up to now 30 days. This decline signifies that bearish sentiment is at its highest level in a month, with merchants more and more favoring brief positions over longs.

The lengthy/brief ratio measures the proportion of lengthy positions to bearish brief ones out there. When the ratio is above one, there are extra lengthy positions than brief ones. This means bullish sentiment, with many merchants anticipating the asset’s worth to rise.

Then again, a protracted/brief ratio beneath one alerts a choice for brief positions as merchants guess on an asset’s worth decline.

For SOL, the dip within the ratio signifies a rising variety of merchants are positioning for a pullback, as they count on the coin’s rally to lose extra steam. If this pattern continues, SOL may face short-term strain, growing the chance of consolidation or a drop from its latest highs.

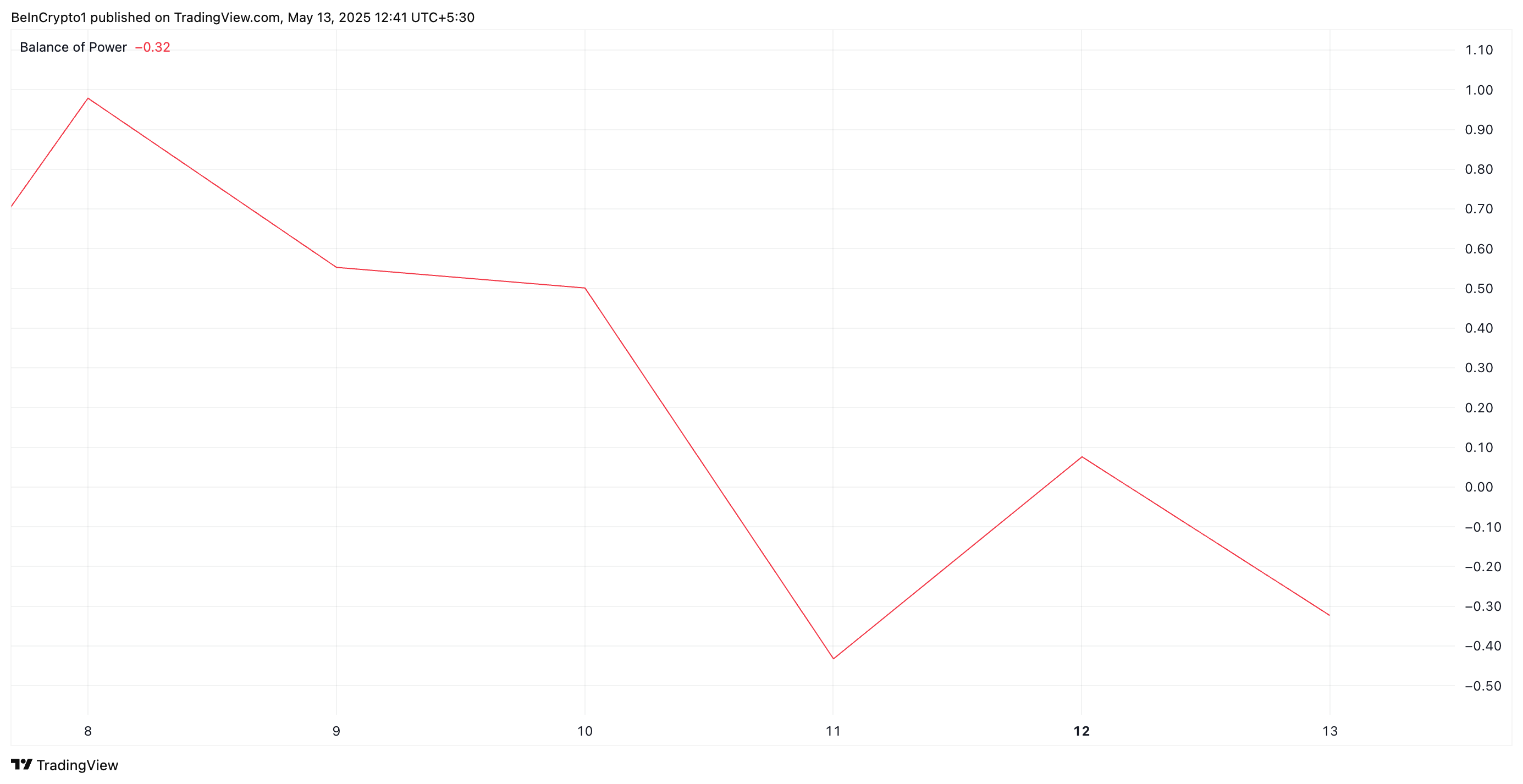

Moreover, on the every day chart, SOL’s damaging Steadiness of Energy (BoP) confirms this bearish outlook. As of this writing, this key momentum indicator stands at -0.32.

The BoP indicator measures the energy of shopping for versus promoting strain in an asset’s worth motion. When it’s damaging, it alerts that sellers are at the moment dominating the market, suggesting elevated profit-taking or bearish momentum.

Solana Faces Promote Stress as Market Cools

Amid the broader market decline of the previous day, SOL’s worth has fallen by 3%. If brief curiosity continues to rise and promote strain builds, the coin may battle to take care of its latest breakout ranges within the days forward.

On this case, SOL’s worth may break beneath the decrease line of its ascending channel, which at the moment varieties help at $161.85. A break beneath this degree strengthens the worth dip and will drive SOL to drop to $142.32.

Nonetheless, if the bulls regain dominance and shopping for strain spikes, SOL’s worth may climb to $181.45.

Disclaimer

Consistent with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.