Solana (SOL) is making an attempt to get well from an virtually 12% correction over the previous seven days. The RSI has surged into overbought territory, suggesting sturdy bullish momentum. Nevertheless, the BBTrend stays deeply destructive—although it’s starting to ease, hinting at potential stabilization.

In the meantime, the EMA traces are organising for a doable golden cross, signaling {that a} pattern reversal could possibly be forming if key resistance ranges are damaged. Nonetheless, with Ethereum overtaking Solana in DEX quantity for the primary time in six months and significant help ranges not far under, SOL stays in a fragile place.

SOL RSI Is Now At Overbought Ranges

Solana’s Relative Power Index (RSI) has surged to 72.91, up sharply from 38.43 only a day in the past—indicating a speedy shift in momentum from impartial to strongly bullish territory.

The RSI is a broadly used momentum oscillator that measures the pace and magnitude of value actions on a scale from 0 to 100.

Readings above 70 sometimes recommend an asset is overbought and could also be due for a pullback, whereas ranges under 30 point out oversold situations and potential for a rebound.

With Solana’s RSI now above 70, the asset has formally entered overbought territory, reflecting intense shopping for stress within the quick time period.

Whereas this will generally precede a correction or consolidation, it will probably additionally sign the beginning of a breakout rally.

Merchants ought to watch intently for indicators of continuation or exhaustion. If momentum holds, Solana might push greater, however any stalling might set off profit-taking and short-term volatility.

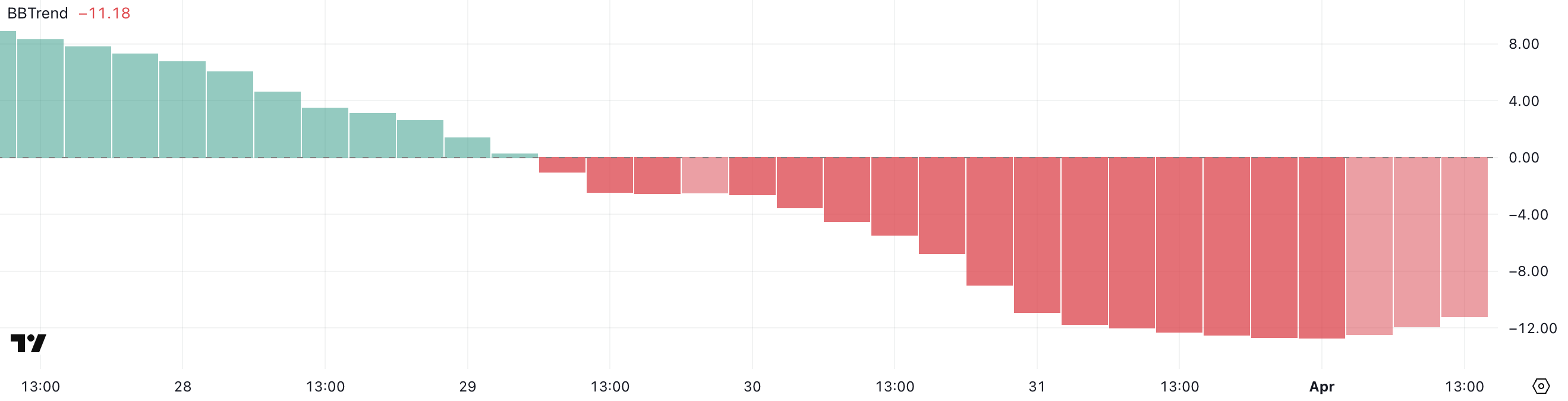

Solana BBTrend Is Reducing, However Nonetheless Very Damaging

Solana’s BBTrend indicator has climbed barely to -11.18 after hitting a low of -12.68 earlier right this moment. That implies that the bearish momentum is beginning to ease.

The BBTrend (Bollinger Band Pattern) measures the power and course of a pattern primarily based on how value interacts with the Bollinger Bands.

Values under -10 sometimes point out sturdy bearish stress, whereas values above +10 replicate sturdy bullish momentum. A rising BBTrend from deep destructive territory might be an early signal of a possible reversal or a minimum of a slowdown within the downtrend.

With SOL’s BBTrend nonetheless in bearish territory however bettering, the market could also be making an attempt to stabilize after a interval of intense promoting.

Nevertheless, broader ecosystem developments complicate the technical image. For instance, Ethereum just lately surpassed Solana in DEX quantity for the primary time in six months.

Whereas the easing BBTrend hints at restoration potential, Solana nonetheless wants a stronger affirmation to shift the pattern absolutely in its favor. Till then, cautious optimism could also be warranted, however the bears haven’t absolutely let go.

Solana Nonetheless Has Challenges Forward

Solana’s EMA traces are exhibiting indicators of an impending golden cross. A golden cross happens when a short-term shifting common crosses above a long-term one. That’s usually seen as a bullish sign that may mark the beginning of a sustained uptrend.

If this sample is confirmed and shopping for momentum continues, Solana value might push as much as take a look at the resistance at $131.

A profitable breakout above that stage might open the door to additional beneficial properties towards $136, and doubtlessly even $147.

Nevertheless, draw back dangers stay if patrons fail to carry current beneficial properties.

If SOL pulls again and loses the important thing help at $124, it might set off additional promoting stress, pushing the worth right down to $120.

Ought to the downtrend acquire power from there, SOL may revisit deeper help ranges round $112.

Disclaimer

In keeping with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.