Solana (SOL) is at a essential level after just lately breaking above $150 and surpassing a significant milestone of 400 billion whole transactions.

On-chain exercise stays sturdy, however momentum indicators like RSI and narrowing EMA gaps counsel bullish power has began to chill. SOL is now buying and selling close to an necessary assist stage at $145.59, with each draw back dangers and upside alternatives in play.

Solana Community Surpasses 400 Billion Transactions

Solana simply shattered a significant milestone, surpassing 400 billion whole transactions. The achievement comes throughout renewed momentum for SOL, with the value just lately pushing above $150 for the primary time since early March earlier than going through a modest pullback.

On-chain exercise stays sturdy, with decentralized alternate (DEX) quantity surging to $21 billion over the past seven days—a 44% improve that retains Solana firmly on the prime of the leaderboard.

Since hitting all-time low at $9.98 on January 1, 2023, SOL has delivered a staggering 1412% rally, standing out as one of many cycle’s prime performers.

Solana has additionally seen an ecosystem explosion within the final yr. Pump alone has generated over $75 million in charges over the previous month, whereas heavyweight protocols like Raydium, Meteora, Jupiter, and Jito proceed to generate tens of millions in month-to-month income.

Momentum Cools for SOL as RSI Falls Sharply From Latest Highs

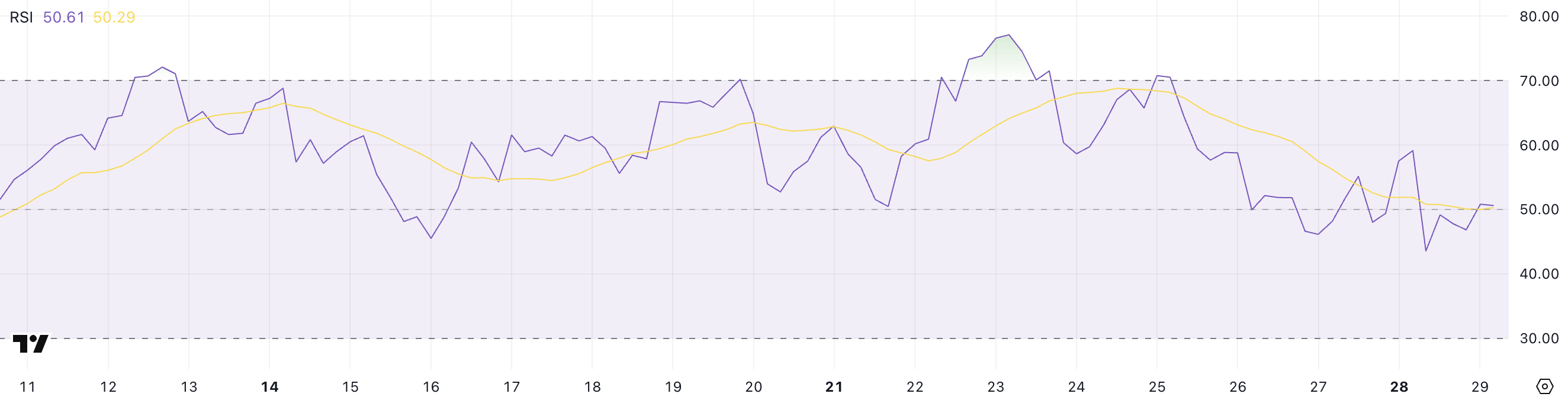

Solana’s Relative Power Index (RSI) has cooled sharply, dropping to 50.61 after hitting 70.52 4 days in the past.

The quick decline mirrors the slowdown in SOL’s value momentum after its rally above $150, suggesting that bullish power is shedding steam.

The RSI, a broadly used momentum indicator, measures how shortly and strongly costs transfer over a given interval. Readings above 70 sign overbought circumstances, and beneath 30 point out oversold territory. A stage round 50 usually displays a impartial stance, the place shopping for and promoting forces are extra balanced.

The market is at a key crossroads with Solana’s RSI now hovering close to 50.

If bullish strain picks up once more, the RSI might rise again towards overbought ranges, paving the best way for one more leg larger. However, a continued drift decrease might verify weakening momentum, opening the door for a broader value correction.

SOL’s momentum has clearly cooled for now, and merchants are watching carefully for the following decisive transfer.

SOL’s Bullish Setup Faces Take a look at: Help or Breakout Forward?

Solana’s EMA strains nonetheless sign a bullish setup, with short-term averages above long-term ones. Nevertheless, the hole between them has narrowed in contrast to some days in the past, reflecting a lack of momentum.

Solana value is presently hovering close to a key assist stage at $145.59—an space merchants are watching carefully.

If this assist breaks, the value might slip towards $133.82, and if promoting strain intensifies, a deeper transfer to $123.46 could possibly be in play.

Conversely, if patrons regain the momentum seen earlier this month, Solana might bounce and retest resistance round $157.

A transparent breakout above that zone would doubtless set off a push towards $180, reviving the bullish development.

Disclaimer

In keeping with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.