Since April 23, Solana’s value has oscillated inside a good buying and selling vary, dealing with resistance close to $153.67 and discovering assist round $145.68.

A rising wave of bearish stress threatens to interrupt this vary to the draw back, with a key technical indicator on the verge of confirming a serious promote sign.

Solana Faces Breakdown Danger as Sellers Tighten Grip

SOL’s Transferring Common Convergence Divergence (MACD) indicator is poised to type a loss of life cross, a bearish crossover the place the MACD line dips under the sign line.

As of this writing, the coin’s MACD line (blue) rests close to the sign line (orange), awaiting a catalyst to push it beneath. This sample typically precedes a sustained downtrend and is extensively seen by merchants as an indication of weakening value energy.

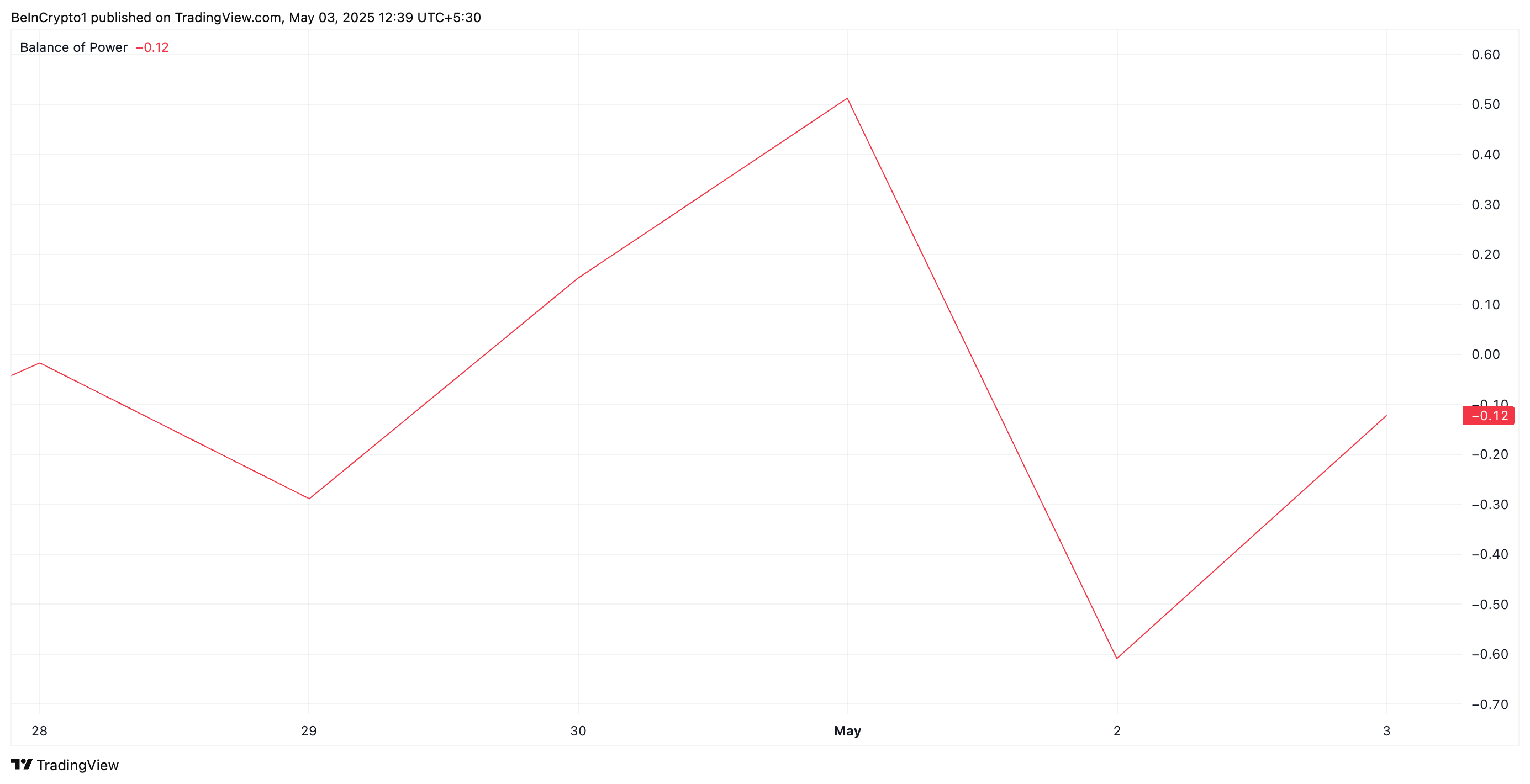

Additional, SOL’s Stability of Energy (BoP) is presently detrimental, reinforcing the downtrend. This means that sellers have gained market management. At press time, this stands at -0.12.

The BoP indicator measures the energy of shopping for versus promoting stress by evaluating the closing value to the buying and selling vary over a given interval.

When an asset’s BoP is optimistic, it indicators that patrons are in management, indicating robust upward momentum and potential for continued value acquire.

However, as with SOL, a detrimental BoP worth signifies that sellers dominate the market. It suggests a rise in downward stress on SOL and hints on the potential graduation of a brand new decline section.

SOL Faces Key Assist Check Amid Mounting Promote Stress

As bearish momentum builds, SOL dangers breaking under the assist stage at $145.68. A decisive break beneath this threshold would verify a short-term downtrend and doubtlessly set off a deeper decline towards $142.32.

Ought to patrons fail to regain management at that time, SOL might slide additional to check the decrease assist at $133.94.

Nevertheless, this bearish outlook could possibly be invalidated if contemporary demand emerges and shopping for curiosity strengthens. In that bullish state of affairs, SOL could overcome resistance at $153.67, opening the door for a rally towards $171.50.

Disclaimer

In step with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.