SUI, the native coin of Layer-1 (L1) blockchain Sui Community, rallied to an all-time excessive of $2.36 on October 14. Nonetheless, as profit-taking exercise positive aspects momentum, SUI has initiated a downward pattern.

The altcoin trades at $2.04 as of this writing, noting a 14% decline previously two days. Its technical setup means that SUI is poised to increase this fall. The query stays: how low will SUI go?

Sui Merchants Promote For Earnings

At its present worth, SUI trades simply above the resistance shaped at $1.97. If rising promoting strain causes this stage to fail to carry, SUI’s worth will search assist at its Ichimoku Cloud, which tracks its market developments and momentum and acts as assist/resistance ranges.

As in SUI’s case, the Ichimoku Cloud can act as a assist stage if the value approaches from above. If its worth enters or breaks under the cloud, it signifies a pattern reversal from bullish to bearish. The cloud typically acts as a transition zone; falling into or under it exhibits weakening momentum and will sign a possible bearish section.

Learn extra: All the things You Have to Know Concerning the Sui Blockchain

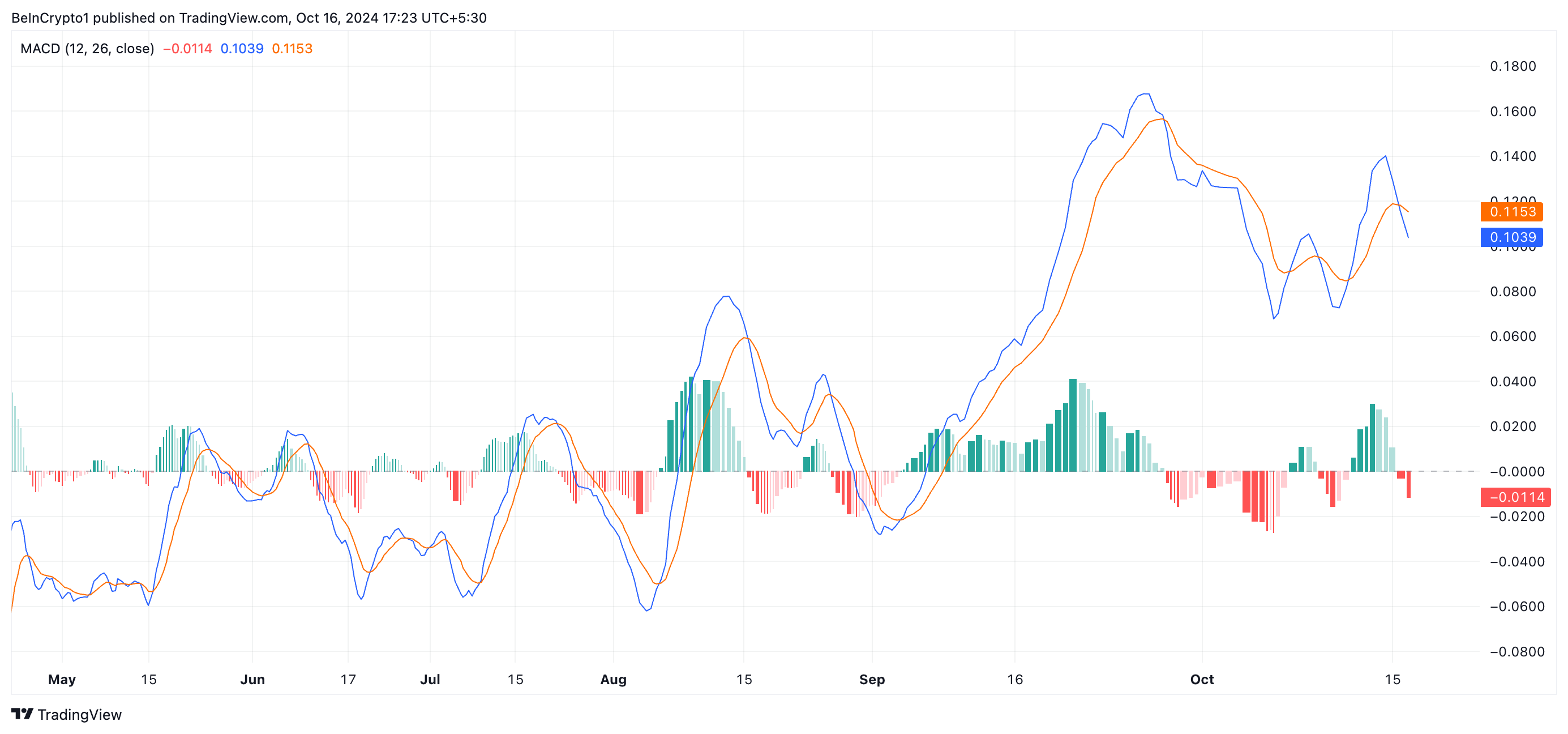

Readings from SUI’s shifting common convergence/divergence (MACD) affirm this bearish outlook. Its MACD line (blue) lately crossed under its sign line (orange), signaling a shift out there’s sentiment from bullish to bearish.

The cross under the sign line exhibits that an asset’s shorter-term shifting common (represented by the MACD line) is falling sooner than the longer-term common (sign line). This sometimes displays elevated promoting strain out there, which many merchants view as an indication to promote or exit lengthy positions.

SUI Worth Prediction: Curiosity in Coin Has Dropped

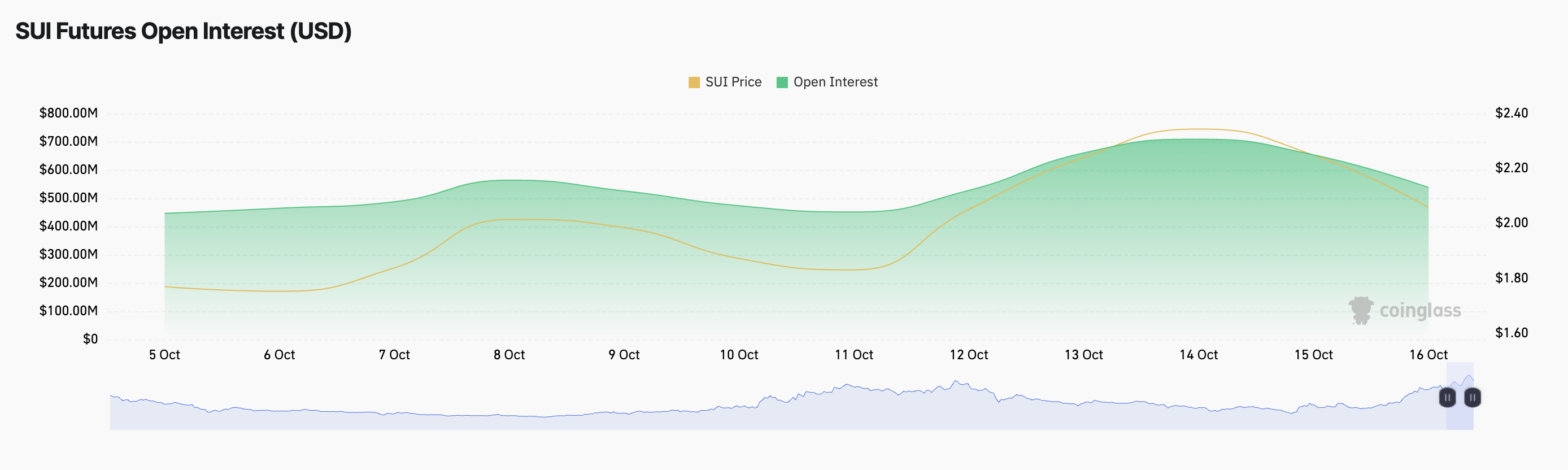

SUI’s declining open curiosity is one other robust indicator of decreased curiosity within the altcoin. After reaching an all-time excessive of $709 million on October 14, open curiosity has steadily trended downward, signaling that fewer merchants are sustaining energetic positions in SUI. It has fallen by 24% in simply two days, now at $538 million.

This drop suggests a discount in market participation and will point out that traders are closing out positions, probably anticipating additional worth declines. If the promoting strain will increase, SUI’s worth could fall by 55% to commerce at $0.91.

Learn extra: A Information to the ten Finest Sui (SUI) Wallets in 2024

Nonetheless, this bearish outlook might be invalidated if new demand enters the market. SUI could reclaim its all-time excessive of $2.36 and probably surge past it.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.