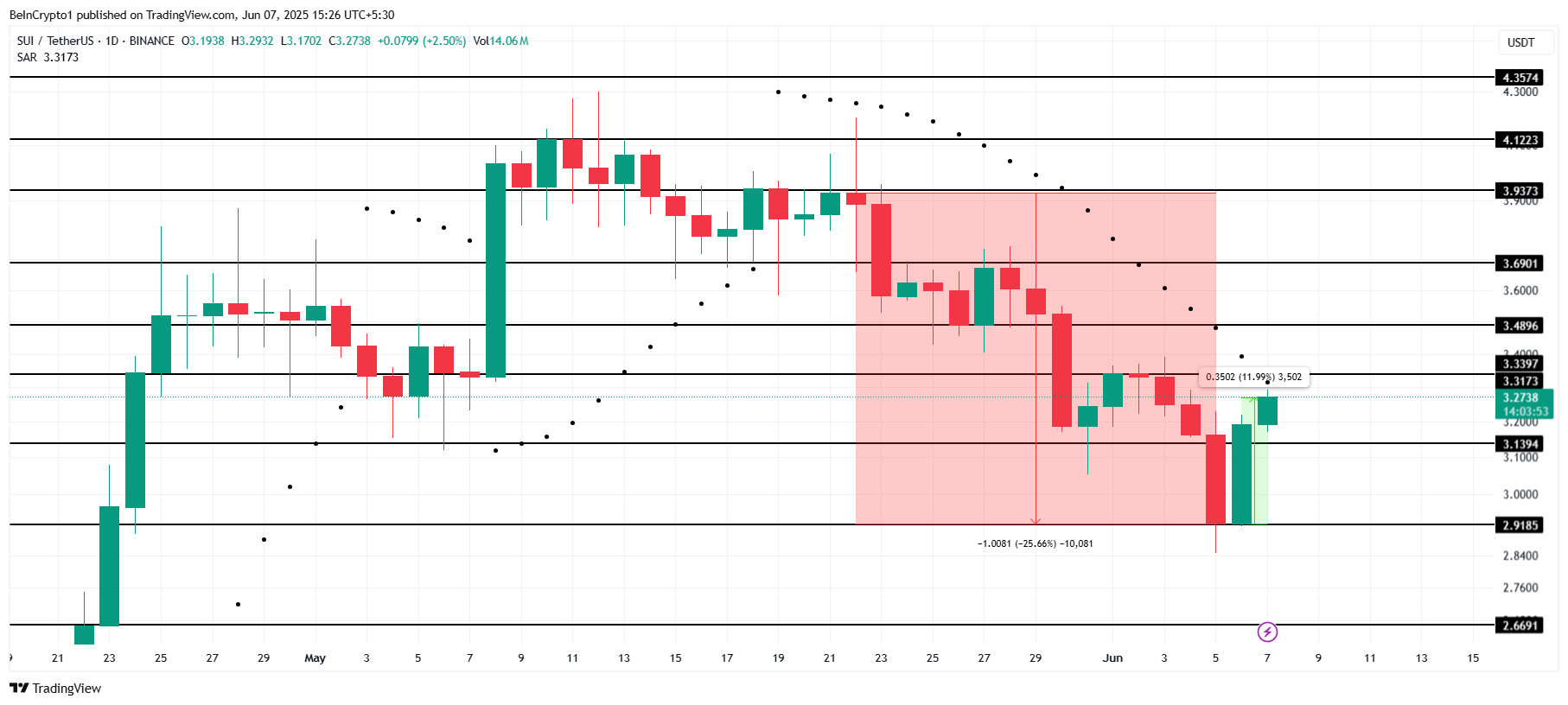

SUI has lately seen a 12% rise prior to now 24 hours, bringing again some investor confidence. Nevertheless, this worth enhance may show disastrous for merchants, as it might set off important liquidations if the altcoin reaches a key worth degree.

The latest rally is a double-edged sword with potential penalties for brief merchants.

SUI Merchants Face Losses

In line with liquidation information, SUI faces a possible $96 million value of liquidations if its worth hits $3.48. This is able to primarily influence quick merchants, who’ve positioned themselves for a worth decline.

Ought to SUI rise in direction of this vital degree, quick contracts could be liquidated, forcing merchants to cowl their positions and additional propelling the worth enhance.

This potential liquidation occasion highlights the volatility of SUI and the dangers concerned for merchants who’re betting towards it. With a surge in worth, quick merchants may be pressured to exit their positions, inadvertently fueling the uptrend.

Because of this, this state of affairs may exacerbate the worth rally, placing each quick and lengthy merchants on the mercy of unpredictable worth actions.

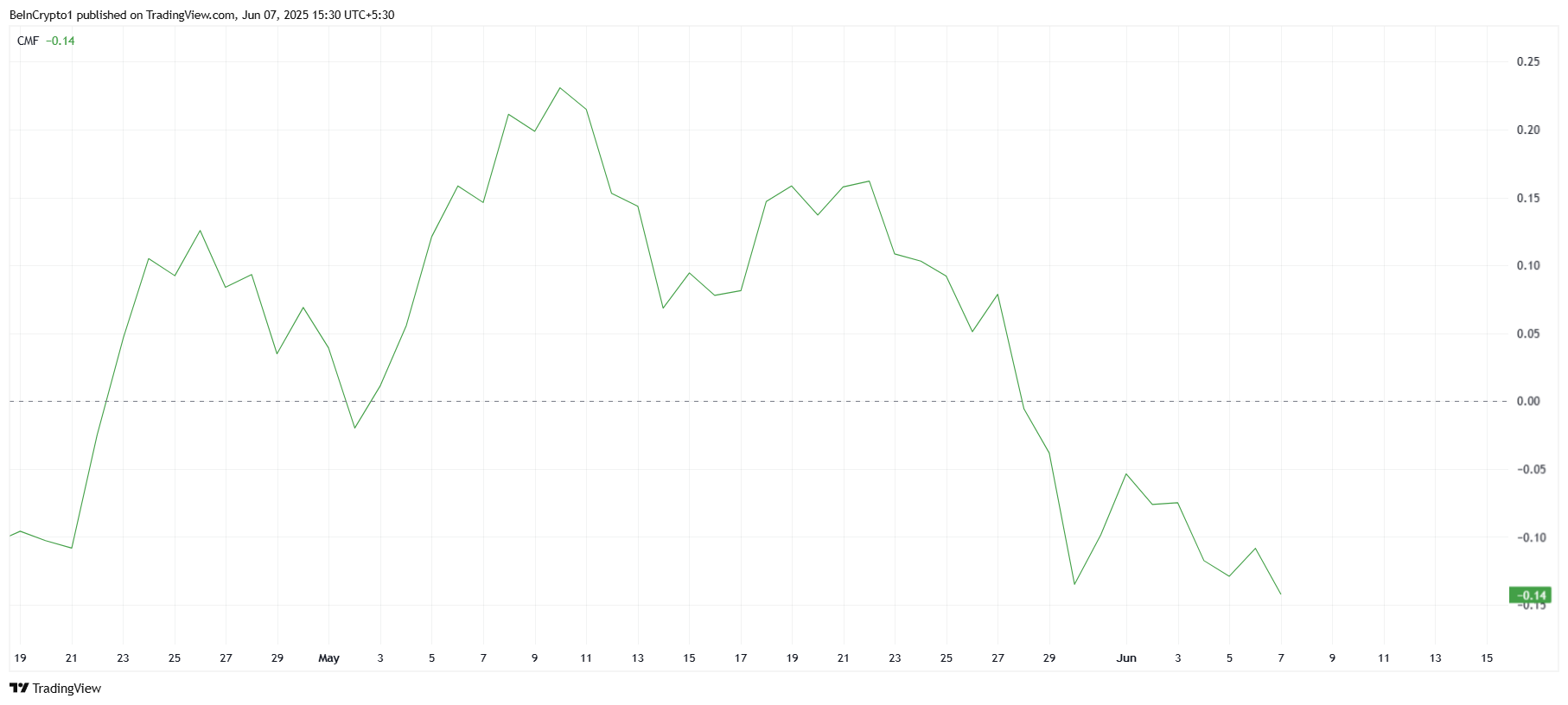

Regardless of the latest 12% rise, the Chaikin Cash Circulation (CMF) signifies a decline, signaling an absence of funding inflows. The CMF is at the moment exhibiting detrimental momentum, suggesting that buyers should not totally backing SUI’s worth rise.

The latest positive aspects seem like pushed extra by quick overlaying slightly than a broad-based surge in shopping for curiosity.

Ought to the outflows proceed, SUI’s worth may face extra strain. The dearth of robust shopping for help, coupled with the decline in CMF, means that the latest rally will not be sustainable.

If these outflows persist, they might result in a worth reversal, diminishing the optimism generated by the latest positive aspects.

SUI Value Makes an attempt Surge

On the time of writing, SUI is buying and selling at $3.27, having risen by 12% within the final 24 hours. The worth is at the moment going through resistance at $3.33, which has confirmed to be a big barrier prior to now.

Given the continued outflows, it appears unlikely that SUI will break by this resistance degree within the close to time period.

If SUI fails to breach the $3.33 resistance, it may retrace to decrease ranges, corresponding to $3.13 or $2.91, wiping out the latest positive aspects. This is able to mark a continuation of the consolidation section, as the shortage of robust shopping for strain prevents additional upward motion.

Nevertheless, the Parabolic SAR indicator is approaching a key degree, with a possible flip under the candlesticks that would sign the beginning of an uptrend.

If SUI efficiently breaks by $3.33, the worth may rise to $3.48. A breach of this degree would invalidate the bearish outlook, triggering a wave of liquidations on quick positions and additional boosting the worth.

Disclaimer

In keeping with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.