This week in crypto marked days of reckoning and revelation. BlackRock raised eyebrows with its cautionary stance on quantum computing’s potential to crack Bitcoin.

In the meantime, Pi Community unveiled a large $100 million fund to energy Web3 startups amid recent scrutiny. The next is a roundup of all weekly crypto headlines, together with Coinbase coming below fireplace for mishandling a large insider information leak.

BlackRock Flags Quantum Computing as Existential Danger to Bitcoin

A key spotlight this week in crypto was BlackRock’s newest ETF submitting replace. The submission ignited recent debate after the asset supervisor warned that advances in quantum computing may finally undermine Bitcoin’s cryptographic foundations.

“To be clear. These are just basic risk disclosures. They are going to highlight any potential thing that can go wrong with any product they list or underlying asset that is being invested in. It is completely standard. And honestly makes complete sense,” ETF analyst James Seyffart famous.

The disclosure, embedded in BlackRock Bitcoin ETF’s danger assertion, stated quantum breakthroughs may render present safety requirements out of date. This commentary marked a stark admission from a monetary large betting on BTC’s long-term viability.

Whereas the state of affairs stays hypothetical, BlackRock’s feeling compelled to incorporate it alerts rising institutional consciousness of dangers past volatility or regulation.

The sentiment is that, in principle, Bitcoin’s reliance on elliptic curve cryptography might be susceptible to future quantum decryption. Nevertheless, some dismiss the menace as distant however agree it’s not too early to arrange post-quantum protections.

With trillions of {dollars} probably flowing into tokenized markets within the coming decade, BlackRock’s stance provides urgency to ongoing efforts to future-proof blockchain safety.

Pi Community Unveils $100 Million Fund However Faces Criticism

One other spotlight this week in crypto was Pi Community’s $100 million fund. BeInCrypto reported the community’s daring plan to allocate 10% of its native token provide to assist builders constructing apps inside its enclosed mainnet ecosystem.

The fund goals to nurture real-world purposes and stimulate long-term utility for its customers.

“Pi Network Ventures has officially launched—a $100 million initiative, held in Pi and USD, to invest in startups and businesses that advance the utility and real-world adoption of Pi,” learn the announcement.

Nevertheless, the announcement was controversial, with some critics saying the mission lacks transparency. They cite questionable ecosystem progress, missed guarantees, and referral reward failures, amongst different shortfalls.

Nonetheless, the funding marks a critical dedication to bootstrapping Web3 startups from inside, aligning with Pi Community’s long-standing promise of grassroots crypto adoption.

Analysts Say Ethereum Has a Shot at Flipping Bitcoin

Analysts additionally stated this week in crypto that Ethereum could also be on the point of difficult Bitcoin’s market dominance. They are saying it may problem BTC in value and basic utility.

The analysts pointed to Ethereum’s large lead in each day energetic customers, community income, and ecosystem improvement as indicators {that a} “flippening” may nonetheless occur.

“ETH is absolutely killing Bitcoin right now. Ethereum could become the number 1 digital asset soon at this rate. Bitcoin Maxi’s in disbelief,” Investor Gordon stated.

Whereas Bitcoin stays the final word retailer of worth, Ethereum is driving innovation in DeFi, NFTs, and layer-2 scaling.

Web Capital Markets Tokens: Crypto’s Rising Development?

As conventional finance (TradFi) creeps onto the blockchain, web capital markets tokens have gotten a scorching new frontier. BeInCrypto reported this week’s standouts, citing Launch Coin (LAUNCHCOIN), Dupe (DUPE), and CreatorBuddy (BUDDY).

These tokens transcend hypothesis, actively facilitating the on-chain model of legacy monetary merchandise. Nevertheless, Launch Coin is the spotlight, bringing forth the Consider app’s token and standing on the heart of the Web Capital Markets development.

Launch Coin on Consider transforms meme coin creation on Solana. Customers can launch immediately from X with a ticker and title, as neighborhood hype drives funding. Nonetheless, as Consider controls the backend, dangers of publicity loom giant.

Knowledge on the Dune dashboard exhibits the platform boasts over 17,000 tokens launched and 267,386 energetic merchants.

Whereas the overall buying and selling quantity has reached a considerable $2.2 billion, highlighting the rising curiosity and participation, momentum could also be easing.

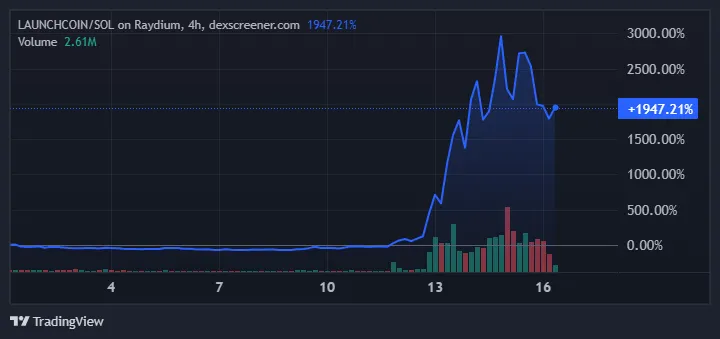

Knowledge on DexScreener corroborates this outlook, displaying simple momentum in value motion. Nonetheless, the worth stays properly above its ground, up 1,947% on the 4-hour timeframe.

Coinbase Refused Ransom Demand, Faces Backlash Amid Knowledge Leak Scandal

One of many greatest tales this week in crypto was the Coinbase information breach incident. The change confirmed that rogue assist brokers leaked delicate buyer information, affecting some customers.

The perpetrators are demanding $20 million in ransom, which Coinbase has rejected. The platform now gives a $20 million bounty to determine the culprits.

Nevertheless, with leaked data starting from authorities IDs to information as delicate as dwelling addresses, customers have security issues. Some clients have reportedly suffered focused phishing makes an attempt and impersonation scams.

In the meantime, the actual outrage stems from the timeline, with allegations that the breach reportedly occurred in January however was solely disclosed not too long ago.

“Coinbase knew they had their user data stolen since January, but said nothing until now? We’ve had endless reports of Coinbase users being drained by impersonators. Now we know why,” wrote Duo 9, a famend analyst.

Critics argue the delay left customers uncovered for months. This incident highlights the dangers of centralized information programs and should speed up requires decentralized id and self-custody options.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.