Tron value held regular on Saturday, Sep. 21 as most SunPump tokens retreated.

Tron (TRX) rose to $0.1520, a couple of factors above this week’s low of $0.1467, and 11% beneath its highest level this 12 months.

SunPump tokens crash

Information by CoinGecko reveals that the majority SunPump meme cash have retreated up to now few days.

- Sundog (SUNDOG), the most important coin in its ecosystem, has dropped by 11.1% up to now seven days to $0.30, bringing its market cap to $305 million.

- Tron Bull retreated by 8%

- Muncat, 35%,

- SunWukong, 10%,

- Suncat tokens, 37% in the identical interval.

Altogether, the full market cap of all meme cash in Tron’s ecosystem has dropped from over $560 million to $514 million.

This efficiency has affected Tron’s DEX quantity, which has dropped by 10% within the final seven days to $453.6 million. Different chains like Solana (SOL), Binance Chain, and Sui have seen their DEX volumes bounce by 11%, 22%, and 70% on this interval.

On the optimistic aspect, the variety of transactions in Tron has risen, in response to Nansen. These transactions rose to over 8.2 million on Saturday, its highest level since Aug. 27 and far increased than this month’s low of 6.14 million.

Tron can also be some of the worthwhile networks within the crypto business.

Information by TokenTerminal reveals that its community charges this 12 months stand at over $1.2 billion, second solely to Ethereum’s $1.86 billion.

SunPump tokens have generated over $44.8 million in charges since inception.

One other optimistic is that Tron’s staking yield has bounced again to 4.97%, increased than final month’s low of 4.35%. This rebound occurred as the amount of Tron burn and gasoline charges rose in the course of the month.

Tron’s technicals are supportive

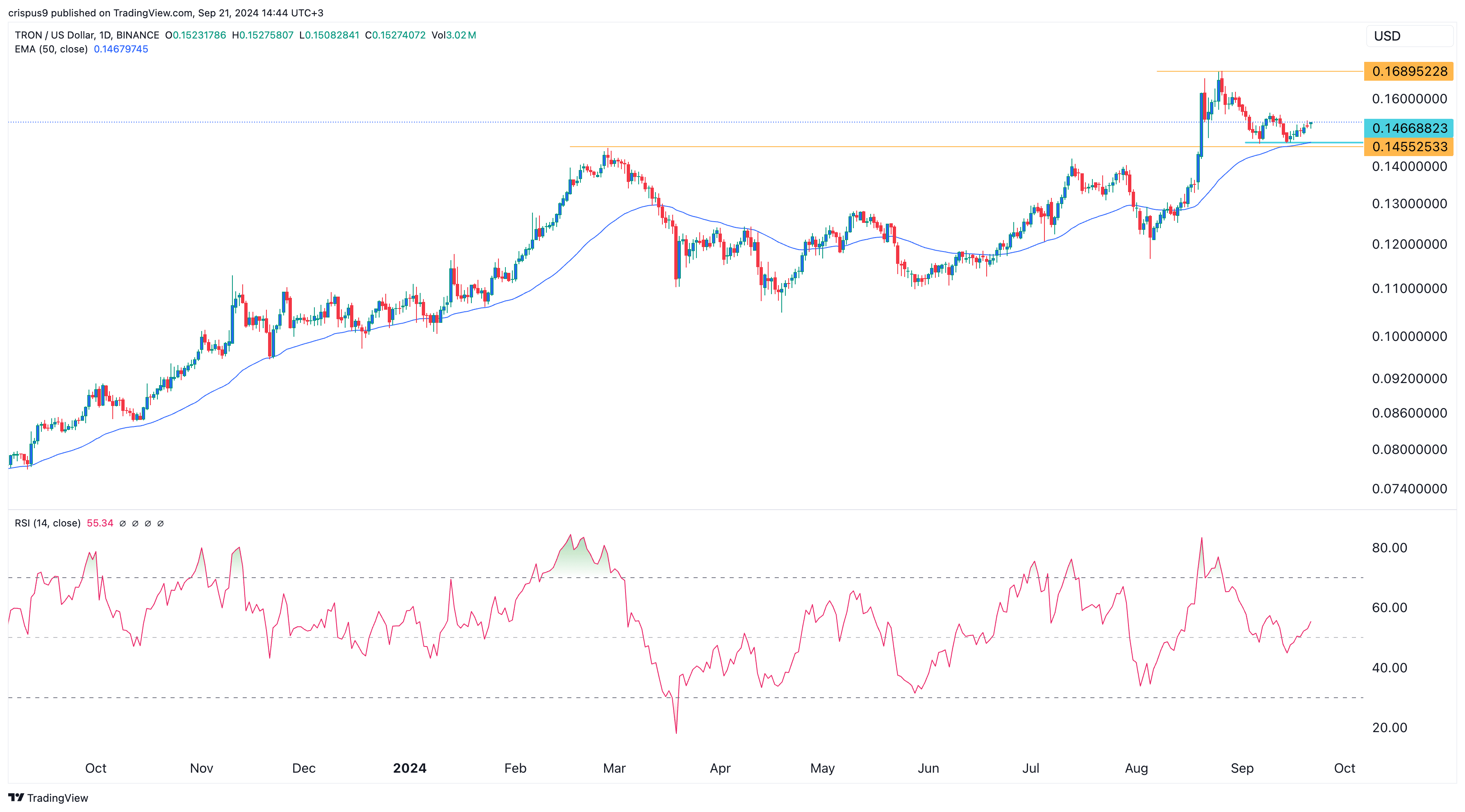

Technically, Tron has some encouraging metrics. It shaped a double-bottom sample at $0.1466 between August and September. This backside was a couple of factors above the important thing assist at $0.1455, its highest swing in February this 12 months.

Tron has additionally held regular above the 50-day shifting common whereas the Relative Energy Index has risen above 50. That may be a signal that it could proceed rising as bulls goal the year-to-date excessive of $0.1690.