Uniswap (UNI), the governance token of the decentralized finance protocol on Ethereum, has posted spectacular positive aspects over the previous seven days. The latest settlement with the Commodities Futures Buying and selling Fee (CFTC) additional contributed to the general optimistic outlook.

Nevertheless, regardless of Uniswap’s latest positive aspects, information signifies {that a} short-term pullback could also be on the horizon because the broader market experiences difficult circumstances.

Uniswap Surge Causes Greed within the Market

An outline of the highest 20 cryptocurrencies reveals that just about all have posted detrimental returns over the previous week. Nevertheless, Uniswap (UNI) has bucked this development with an 8.57% worth enhance. Following this improvement, on-chain information from Santiment revealed a notable spike in Uniswap’s social dominance.

Social dominance refers back to the proportion of discussions a few particular asset in comparison with different prime 100 cryptocurrencies. The next rating means extra posts or messages are being shared about that asset.

In Uniswap’s case, social dominance surged to 4%, indicating that conversations across the altcoin are among the many most prevalent right this moment. Importantly, social dominance is commonly linked to cost actions, with elevated consideration doubtlessly influencing market conduct.

Learn extra: How To Purchase Uniswap (UNI) and Every part You Want To Know

From a worth perspective, the surge in Uniswap’s social dominance indicators a possible Concern of Lacking Out (FOMO), as late patrons are inclined to enter the market throughout these intervals. Traditionally, this typically precedes a worth decline.

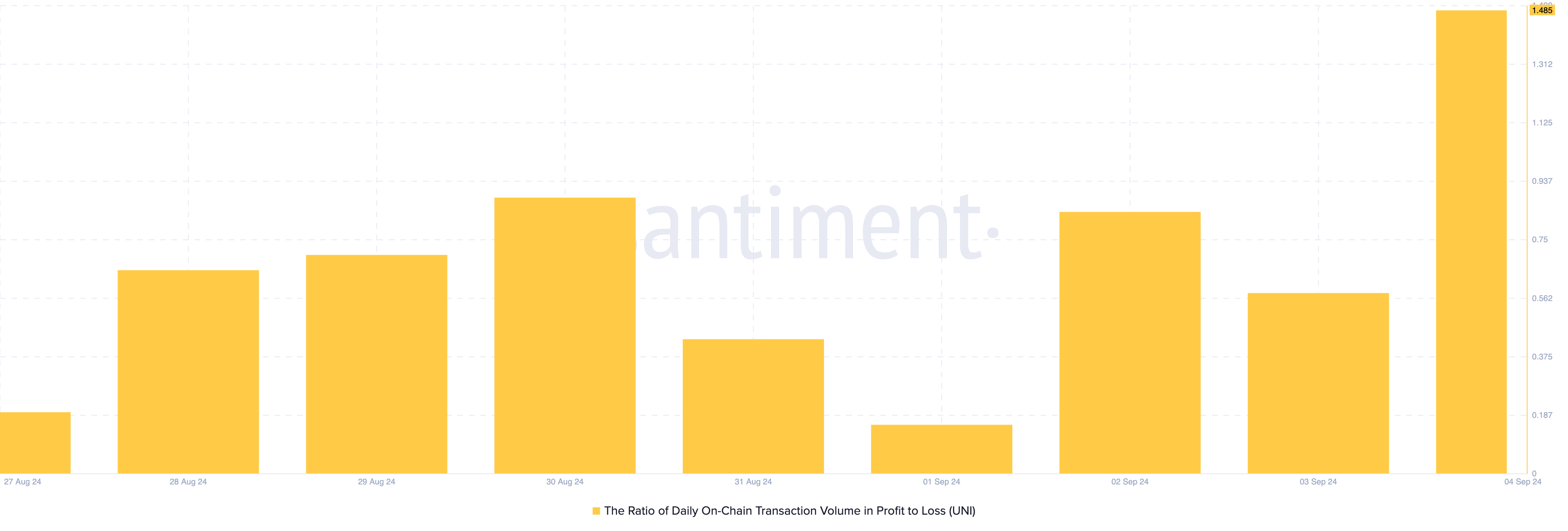

Moreover, the ratio of day by day on-chain transaction quantity in revenue to loss has risen to 1.48, which means extra market individuals are realizing positive aspects than losses. Usually, a detrimental studying suggests excessive realized losses.

Nevertheless, in Uniswap’s case, the large rise within the optimistic area signifies that market individuals are making extra income. Ought to this proceed, UNI’s worth would possibly drop under the peak it has lately launched.

UNI Worth Prediction: The Token Is Set to Fall Beneath $6

In keeping with the 4-hour UNI/USD chart, the token has shaped increased lows. This means that it may need an excellent probability of reaching a better worth. Nevertheless, as the worth elevated, so did the Relative Energy Index (RSI).

The RSI is a technical oscillator measuring momentum, and important in recognizing overbought and oversold circumstances. Scores over 70.00 imply a cryptocurrency is overbought, whereas these at 30.00 or under imply it’s oversold. At press time, UNI is buying and selling at $6.45, with a Relative Energy Index (RSI) of 64.77, indicating it’s nearing the overbought zone.

Learn extra: Uniswap (UNI) Worth Prediction 2023/2025/2030

If Uniswap enters this area, a reversal may happen, doubtlessly driving the token’s worth all the way down to $5.64. Nevertheless, if shopping for stress will increase, this forecast could possibly be invalidated, and UNI’s worth could rise to $6.67 as an alternative.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.