The US greenback fell to its 3-year low towards the Euro and British Pound, presumably creating new alternatives for crypto as the worldwide reserve foreign money hits new difficulties.

The European Central Financial institution once more minimize rates of interest immediately, however the US has but to take action. The greenback’s falling dominance displays that decade-old fiat warning from Bitcoin’s creator, Satoshi Nakamoto.

Might Greenback Troubles Profit Crypto?

The US greenback is the world’s most vital fiat foreign money for a number of causes: powering an enormous client economic system, the worldwide stream of petroleum, US Treasury bonds, and extra.

Nonetheless, the greenback’s 3-year low may signify an issue for TradFi and a possibility for crypto as de-dollarization fuels Bitcoin adoption worldwide.

Regardless of a current bullish report from the Atlanta Fed, warnings of a US recession have gotten more and more obvious. The greenback is down relative to the Euro, British pound, and different currencies, whereas the crypto market is in a state of greed.

There are additionally distressing indicators from the housing market, which may have very critical implications.

Nic Puckrin, crypto analyst and founding father of The Coin Bureau, mentioned these matters and extra in an unique commentary shared with BeInCrypto. In response to Puckrin, nevertheless, crypto is proof against a few of these considerations in a approach that the greenback shouldn’t be:

“Even if we do experience stagflation, Bitcoin can still protect portfolios as it is increasingly being seen as a fallback option for investors fleeing US assets or losing faith in the US economy, and it is inflation-proof by design. Bitcoin is very different from the rest of the crypto market – there really are no other assets that possess the same safe-haven characteristics,” he stated.

Puckrin described a Bitcoin maximalist imaginative and prescient for crypto funding, as Satoshi Nakamoto designed it to withstand greenback turmoil.

Bitcoin and the entire crypto ecosystem have been born out of the wreckage of the 2008 collapse, therefore its robust emphasis on trustless, decentralized governance.

Sadly, immediately’s group can neglect the arduous expertise that cast this ethos.

Questions of Governance

How are US establishments responding to the greenback’s hassle, particularly in comparison with the crypto group? The European Central Financial institution lowered its rates of interest immediately, which President Trump has repeatedly begged Fed Chair Jerome Powell to do.

Nonetheless, it is probably not that easy. The EU is a vital client bloc and financial area, however the US is the bedrock of the fashionable economic system.

If the Fed cuts charges now, it’d exhaust its skill to answer future crises. In spite of everything, it could’t minimize charges beneath zero, and it solely has so many instruments to make use of.

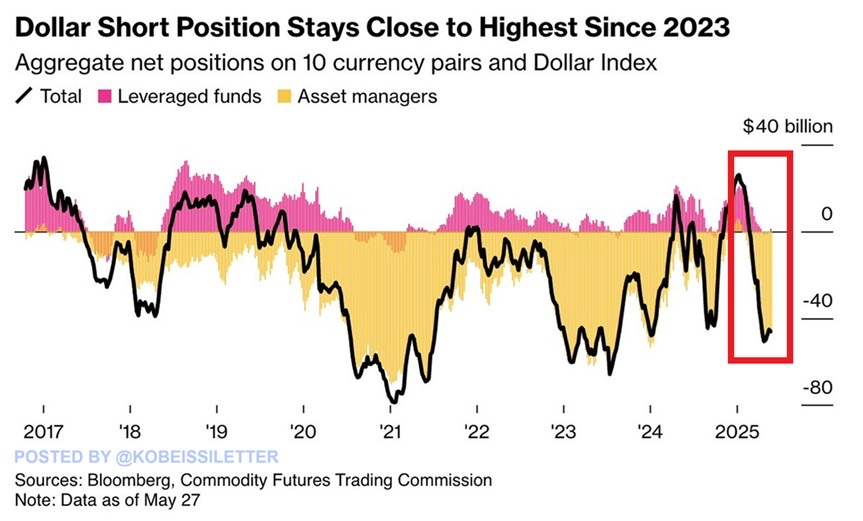

In the meantime, institutional traders are fleeing the greenback and largely transferring to Bitcoin.

Moreover, President Trump’s insistence on imposing tariffs could also be a whole mistake. Regardless of tariff aid pumping the US economic system, he lately introduced plans to impose them on the EU.

Equally, Trump reported constructive negotiations with President Xi immediately, however threatened sanctions on China lower than per week in the past.

These chaotic commerce insurance policies are inflicting havoc on the greenback, whereas crypto liquidations are at a relative low. All this discord reaffirms the explanations that Satoshi constructed Bitcoin to be separated from the world’s governments.

Trustless and leaderless, Bitcoin is proof against considerations that extremely influence nation-states. Puckrin predicts this to gas BTC funding:

“We could see the split that already exists between Bitcoin and altcoins intensifying, as investors turn to Bitcoin as a store of value, but shun more speculative, risky assets like altcoins. The only other safe haven options would be real-world assets (RWAs), like gold-backed tokenized assets, for example,” he claimed.

Nonetheless, though there are very bearish indicators, the disaster hasn’t absolutely matured but. If a savvy investor desires to tug property from {dollars} into crypto earlier than additional devaluation happens, there’s nonetheless time.

In the end, there’s no absolute approach to predict which approach the market will go.

The submit US Greenback Drops to 3-Yr Low – Is Fiat Failing as Satoshi Predicted? appeared first on BeInCrypto.