- If authorised, VanEck might be the primary issuer of an Avalanche ETF

- Avalanche’s token, AVAX, has dropped almost 52% in year-to-date worth

- There was a flurry of varied ETF altcoin purposes in latest months

Funding firm VanEck has registered for an Avalanche exchange-traded fund (ETF) within the US regardless of a decline in market costs.

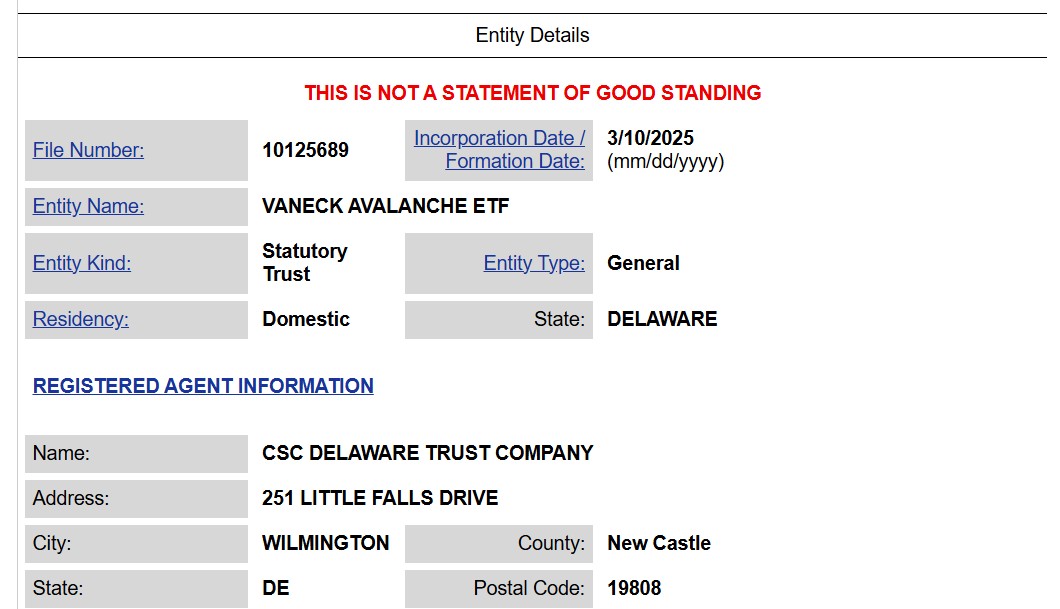

The New York-headquartered firm filed the VanEck Avalanche ETF within the state of Delaware on March 10, in accordance with the Delaware’s Division of State web site.

The transfer from VanEck means that it might file an S-1 type for an official spot AVAX ETF with the US Securities and Trade Fee (SEC). Information of this comes as market costs are down for Avalanche’s AVAX token.

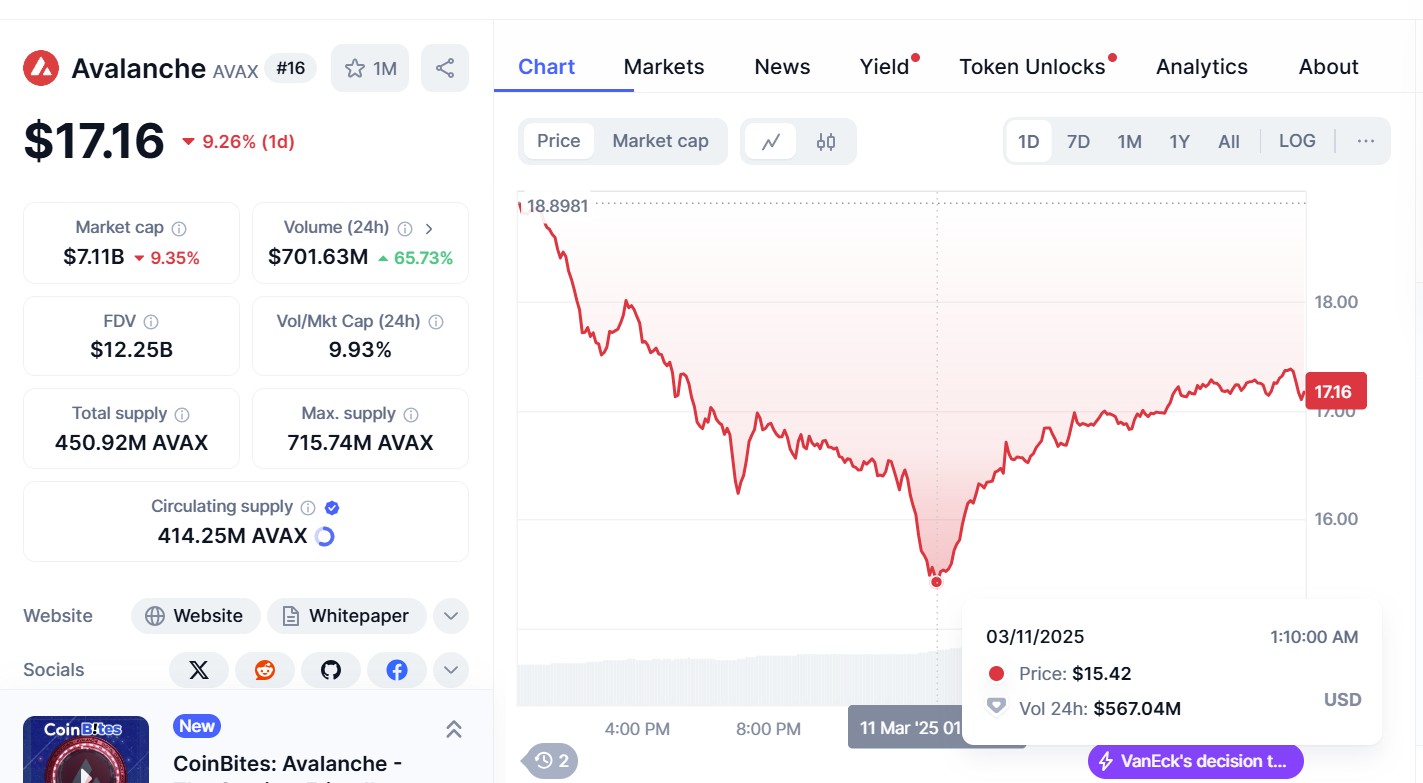

Knowledge from CoinMarketCap exhibits that its year-to-date decline is at almost 52%. Over the previous 24 hours, it has dropped round 10% and is buying and selling at $17.15. This can be a slight rise from early morning buying and selling when it was valued at simply over $15.

ETF purposes

If authorised, VanEck might change into one of many first to problem an AVAX ETF. It could additionally comply with on from its Solana ETF, which it filed for final June. It could be part of the likes of Bitcoin and Ethereum ETF merchandise, which had been the primary to obtain SEC approval final January and July.

VanEck is amongst a number of issuers making use of for numerous altcoin ETFs in latest months. Final month, the Chicago Board Choices Trade (Cboe) filed 4 separate filings on behalf of issuers to launch spot XRP ETFs.

In January, Nasdaq filed a 19b-4 type for a Canary Litecoin ETF. This was adopted by Nasdaq submitting for a Hedera ETF on the finish of February. Earlier this month, the NYSE Arca filed a 19b-4 type to checklist the Bitwise Dogecoin ETF.