Following Bitcoin’s surge to a brand new all-time excessive in Might, main altcoin Ethereum skilled a renewed uptick in buying and selling exercise, briefly buying and selling at a multi-month peak of $2,789 on Might 29.

Nonetheless, because the broader market has cooled over the previous two weeks, ETH’s value motion has tightened, consolidating inside a slim vary. Regardless of this, market analysts stay broadly bullish on ETH’s prospects for June.

Ethereum Outlook Turns Bullish as Institutional ETF Inflows Surge

In an unique interview with BeInCrypto, Temujin Louie, CEO of Wanchain, stated ETH’s outlook for the month is “increasingly bullish,” pushed by constant inflows in Ethereum exchange-traded funds (ETFs) and renewed community stability.

“Continued investment in Ethereum ETFs indicates that institutional interest remains strong, reinforcing ETH’s credibility as a long-term asset. Ethereum’s recent Pectra upgrade was also a significant success, and the internal disputes within the Ethereum Foundation have quieted; investor confidence in both Ethereum as a network and ETH as an asset is restoring,” Louie famous.

Additional, Dominick John, an analyst at Kronos Analysis, confirms this optimism, emphasizing the affect of surging ETF inflows on the coin’s value motion. In keeping with John:

“ETH ETFs have significantly shaped recent price action, signaling surging institutional interest that’s boosting market liquidity while tempering volatility. This wave of demand, paired with strong fundamentals like stablecoin strength and solid on-chain signals, are tightening supply and supporting sustained interest.”

In keeping with SosoValue, ETH-backed ETFs have witnessed an uptick in weekly inflows since Might 16. This week, internet inflows into these funding autos totaled $286 million, highlighting rising confidence amongst institutional buyers.

If this continues, it might create upward stress on ETH’s value, triggering a break above its slim vary in June.

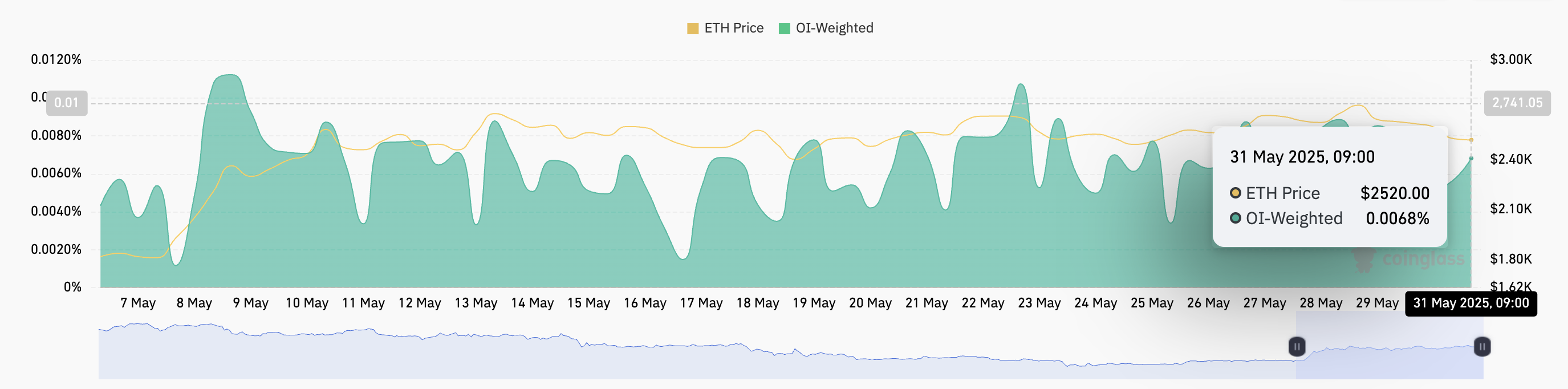

As well as, ETH’s constantly constructive funding charge additional helps this bullish outlook. As of this writing, ETH’s funding charge sits at 0.0068%, reflecting ongoing confidence from leveraged merchants keen to pay a premium to keep up their lengthy positions.

The funding charge is utilized in perpetual futures contracts to make sure that contract costs align with the underlying asset’s spot value. When an asset’s funding charge is constructive, merchants holding lengthy positions are paying these holding brief positions. This means market sentiment is bullish, as extra market members are betting on value will increase.

ETH’s sustained constructive funding charge aligns with the numerous institutional inflows into ETH-backed ETFs. It provides one other layer of affirmation that market members are positioning for additional upside in June.

There Is A Catch

Regardless of the bullish outlook for ETH in June, these analysts warning that broader macroeconomic circumstances might nonetheless pose dangers to the asset’s short-term efficiency.

Louie emphasised that whereas ETH’s fundamentals stay robust, the main altcoin “remains vulnerable to macroeconomic conditions.”

“Despite current bullish momentum, the crypto market as a whole remains speculative, reacting sharply to inflation data, interest rate expectations, Federal Reserve policy shifts, and other external factors. While Ethereum’s fundamentals remain strong, short-term price trends can be quickly reversed by adverse macroeconomic trends,” he acknowledged.

John additionally added that the Federal Reserve’s upcoming June 17 FOMC assembly is one to look out for.

“Broader macro trends, particularly inflation data and the Fed’s rate policy, remain pivotal to price action. A dovish pivot could reinforce ETH’s breakout, especially with sustained ETF inflows. However, a hawkish stance may inject fresh volatility, even as stablecoin dominance, staking yields, and Layer-2 growth continue to signal underlying strength in the ecosystem,” he defined.

As ETH enters June with rising optimism, buyers ought to watch macroeconomic indicators carefully, as they are going to doubtless form the trajectory of ETH’s value within the coming weeks.

Disclaimer

Consistent with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.