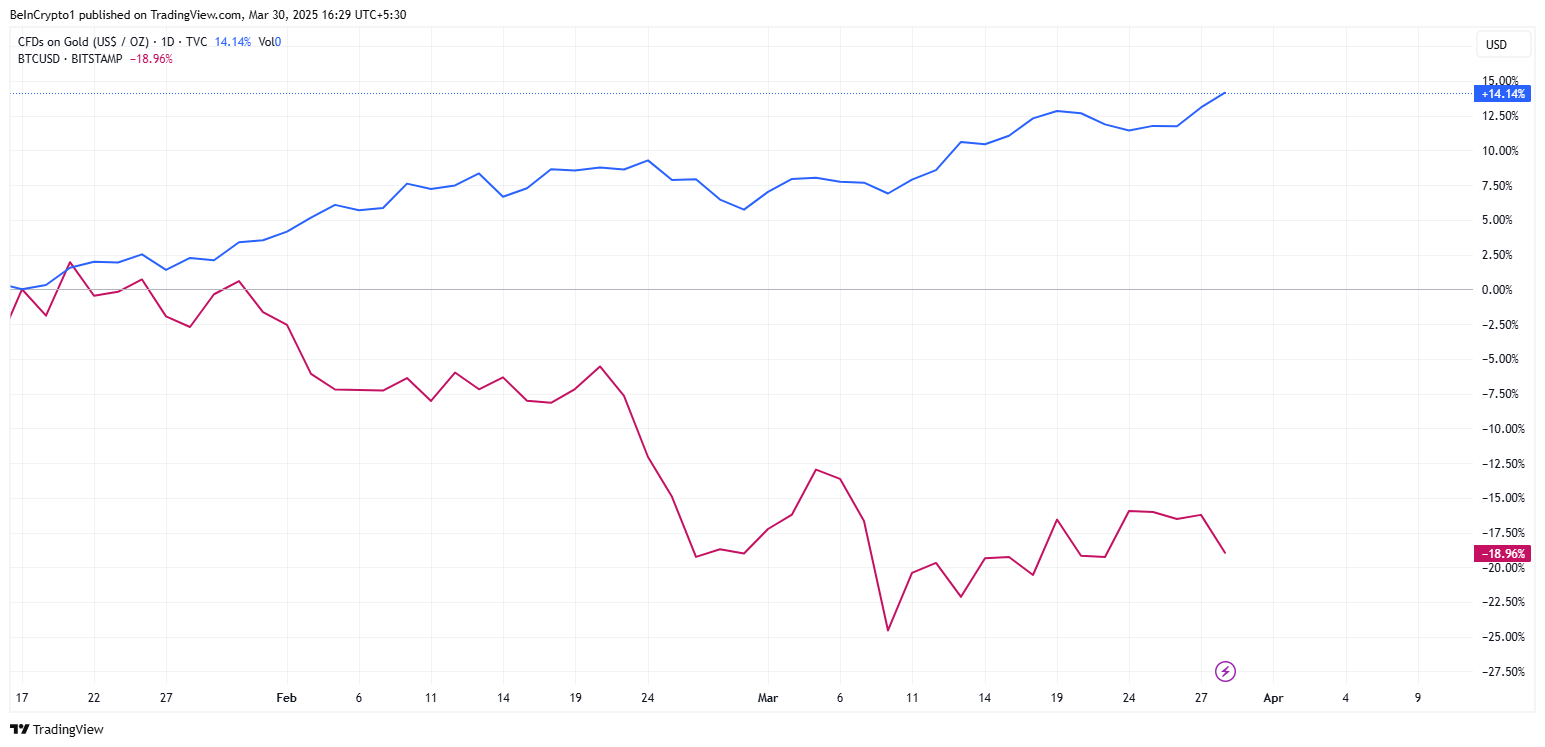

Bitcoin (BTC) has lengthy been touted as “digital gold.” Nonetheless, as the worldwide financial system reels from escalating commerce struggle tensions underneath Trump’s second time period, institutional buyers are fleeing to the true factor.

A latest Financial institution of America (BofA) survey discovered that 58% of fund managers view gold because the best-performing haven in a commerce struggle—leaving Bitcoin with solely a 3% choice.

Bitcoin’s Haven Standing Faces a Actuality Examine

Gold is proving its dominance because the disaster asset of selection whereas Bitcoin struggles to carry its floor. This comes amid rising geopolitical dangers, the ballooning US deficit, and uncertainty driving capital flight.

“In a recent Bank of America survey, 58% of fund managers said gold performs best in a trade war. This compares to just 9% for 30-year Treasury Bonds and 3% for Bitcoin,” The Kobeissi Letter famous.

For years, Bitcoin advocates have championed it as a hedge towards financial instability. But, in 2025’s unstable macro setting, Bitcoin struggles to earn institutional buyers’ full belief.

The Financial institution of America survey displays this standing, with long-term US Treasury bonds and even the US greenback dropping attraction as commerce wars and monetary dysfunction shake market confidence.

The US deficit disaster—now projected to exceed $1.8 trillion—has additional eroded confidence in conventional protected havens like US Treasuries.

“This is what happens when the global reserve currency no longer behaves as the global reserve currency,” a dealer quipped in a put up.

Nonetheless, as a substitute of seeking to Bitcoin instead, establishments are overwhelmingly selecting gold, doubling bodily gold purchases to report ranges.

Boundaries To Bitcoin Institutional Adoption

Regardless of its fastened provide and decentralization, Bitcoin’s short-term volatility stays a key barrier to institutional adoption as a real safe-haven asset.

Whereas some merchants nonetheless view Bitcoin as a long-term retailer of worth, it lacks the fast liquidity and risk-averse attraction that gold supplies throughout crises.

Additional, President Trump is predicted to announce sweeping new tariffs on “Liberation Day.” Specialists flag the occasion as a possible set off for excessive market volatility.

“April 2nd is much like election evening. It’s the largest occasion of the yr by an order of magnitude. 10x extra vital than any FOMC, which is lots. And something can occur, “Alex Krüger predicted.

Commerce tensions have traditionally pushed capital into safe-haven belongings. With this announcement looming, buyers preemptively place themselves once more, favoring gold over Bitcoin.

“Gold’s no longer just a hedge against inflation; it’s being treated as the hedge against everything: geopolitical risk, de-globalization, fiscal dysfunction, and now, weaponized trade. When 58% of fund managers say gold is the top performer in a trade war, that’s not just sentiment that’s allocation flow. When even long bonds and the dollar take a back seat, it’s a signal: the old playbook is being rewritten. In a world of rising tariffs, FX tension, and twin deficits, gold might be the only politically neutral store of value left,” dealer Billy AU noticed.

Regardless of Bitcoin’s wrestle to seize institutional safe-haven flows in 2025, its long-term narrative stays intact.

Particularly, the worldwide reserve foreign money system is altering, US debt considerations are mounting, and financial insurance policies proceed to shift. Regardless of all these, Bitcoin’s worth proposition as a censorship-resistant, borderless asset remains to be related.

Nonetheless, within the quick time period, its volatility and lack of widespread institutional adoption as a disaster hedge imply gold is taking the lead.

For Bitcoin believers, the important thing query will not be whether or not Bitcoin will someday problem gold however how lengthy establishments will undertake it as a flight-to-safety asset.

Till then, gold stays the undisputed king in instances of financial turmoil. In the meantime, Bitcoin (BTC exchange-traded funds however) fights to show its place within the subsequent monetary paradigm shift.

“The ETF demand was real, but some of it was purely for arbitrage…There was a genuine demand for owning BTC, just not as much as we were led to believe,” analyst Kyle Chassé stated just lately.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.