Shiba Inu (SHIB) is displaying early indicators of restoration, gaining floor from current lows as its RSI rebounds and key assist ranges maintain. Regardless of these constructive indicators, SHIB failed to interrupt above the RSI 51 mark and continues to face strain from bearish EMA alignments.

On the identical time, whale exercise has been steadily declining, suggesting lowered confidence from massive holders and elevating questions on long-term assist. With value motion caught between main assist and resistance zones, SHIB’s subsequent transfer will seemingly depend upon whether or not momentum strengthens—or fades as soon as once more.

Shiba Inu Momentum Improves, However RSI Rejection Indicators Warning

Shiba Inu has seen a shift in momentum, with its Relative Energy Index (RSI) rising to 47 from 30.18 simply three days in the past, signaling a restoration from near-oversold situations.

Nonetheless, it’s value noting that SHIB failed to interrupt above the 51 RSI mark yesterday, suggesting that bullish momentum stays fragile for now.

Whereas the current bounce displays easing promoting strain, the shortcoming to push into clearly bullish territory signifies ongoing hesitation amongst patrons.

The RSI, or Relative Energy Index, is a momentum oscillator that gauges the velocity and magnitude of value adjustments, serving to determine overbought or oversold situations.

Readings beneath 30 level to oversold ranges, whereas values above 70 counsel overbought territory. With SHIB’s RSI now sitting at 47, the asset stays in a impartial zone—neither overextended nor deeply discounted.

This mid-range positioning leaves room for both a breakout or a reversal, relying on how value motion develops round present resistance and assist ranges.

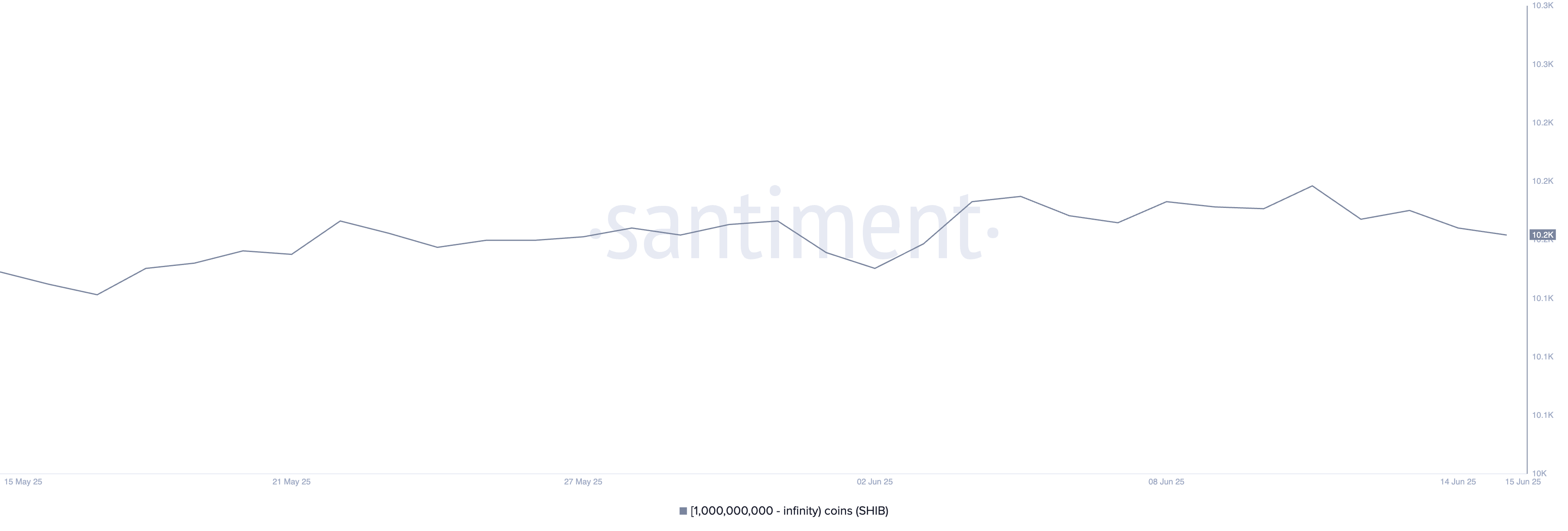

Decline in SHIB Whales Indicators Potential Weak point Forward

The variety of Shiba Inu whales—wallets holding no less than 1 billion tokens—has been regularly declining since June 11, falling from 10,259 to 10,231.

Whereas the drop could appear modest, it displays a sluggish however regular discount in massive holder participation, which may sign weakening confidence amongst main gamers.

A constant downtrend in whale exercise usually correlates with diminished assist throughout unstable phases, making SHIB extra weak to cost swings.

Monitoring whale conduct is essential as a result of massive holders can affect value actions by sudden buys or sells. A rising whale depend usually suggests accumulation and long-term confidence, whereas a declining quantity could indicate distribution or exit.

With SHIB whale wallets shrinking, it may point out that main traders are both taking earnings or hedging towards additional draw back.

If this pattern continues, it might add strain on SHIB’s value, particularly if retail curiosity fails to offset the whale outflows.

SHIB Holds Key Assist, However Bearish EMAs Hold Bulls in Examine

Shiba Inu value not too long ago examined and held the important thing assist stage at $0.0000119, providing a brief flooring regardless of broader bearish indicators.

The token’s Exponential Shifting Averages (EMAs) stay in a bearish alignment, with short-term EMAs positioned beneath long-term ones—indicating ongoing downward strain.

If this assist is retested and fails to carry, SHIB may slide towards the subsequent essential stage at $0.0000114, doubtlessly opening the door for additional draw back.

Nonetheless, if sentiment shifts and SHIB manages to construct upward momentum, the value may problem the instant resistance at $0.0000128.

A breakout above this stage could set off a rally towards $0.0000136, and if shopping for strain continues, even a push to $0.0000146 is feasible.

For now, SHIB is trapped between essential assist and resistance zones, and a transparent break in both path will seemingly outline its short-term trajectory.

Disclaimer

In step with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.