After quite a few Congressional debates and revisions, the GENIUS Act is now on the verge of changing into legislation. The invoice, which goals to manage the stablecoin trade throughout america, is broadly anticipated to be signed.

In accordance with representatives from Digital Chamber, a D.C.-based advocacy group for the blockchain trade, the invoice approval will probably come earlier than the tip of June. Such a transfer would improve institutional adoption and strengthen the US greenback’s dominance globally.

When Will the GENIUS Act Go?

Poised for passage, the GENIUS Act is a landmark invoice that will federally regulate the US stablecoin trade.

Regardless of latest disagreements between Republican and Democratic Senators, the invoice handed a key procedural vote. Kristopher Klaich, Coverage Director at The Digital Chamber, strongly believes in its impending approval.

“I feel pretty strongly that there won’t be more hiccups… I think the industry has been such a strong player in politics for the last couple of years and supporting campaigns… there’s a high cost for members that may be the stick in the mud,” he informed BeInCrypto.

In accordance with Taylor Barr, the advocacy group’s Authorities Affairs and PAC Supervisor, 53 amendments have been made.

“Majority leader Thune is committed to having what he’s calling a fully open amendment process, which means every single amendment has the full right to go through a debate vote and to have full closure on each amendment. So at the end of the day, that could be a three-week-long process,” Barr informed BeInCrypto.

Nonetheless, Barr clarified {that a} totally open course of with 53 particular person debates is unlikely. He expects these amendments to be divided into three or 4 teams, leading to a extra environment friendly and abbreviated open modification course of, on condition that many are duplicative.

If Barr’s estimations are right, the invoice will go earlier than the tip of this month. When it does, the importance might be substantial for the better crypto trade.

Understanding Stablecoin Influence

Stablecoins are arguably probably the most globally adopted digital asset. In contrast to conventional cryptocurrencies like Bitcoin or altcoins, they supply worldwide entry to a steady medium of trade.

In accordance with a January report by crypto trade CEX.io, the full stablecoin transaction quantity reached 27.6 trillion in 2024, exceeding Visa’s whole fee quantity and Mastercard’s by 7.7%.

Tether and Circle dominate the market at $151 billion and $59 billion, respectively. Collectively, they’ve an 89% market share, in keeping with rwa.xyz.

Their heavyweight presence in world economies makes a invoice just like the GENIUS Act all of the extra important. That is very true within the context of a debilitated US greenback.

The Greenback’s Waning Affect

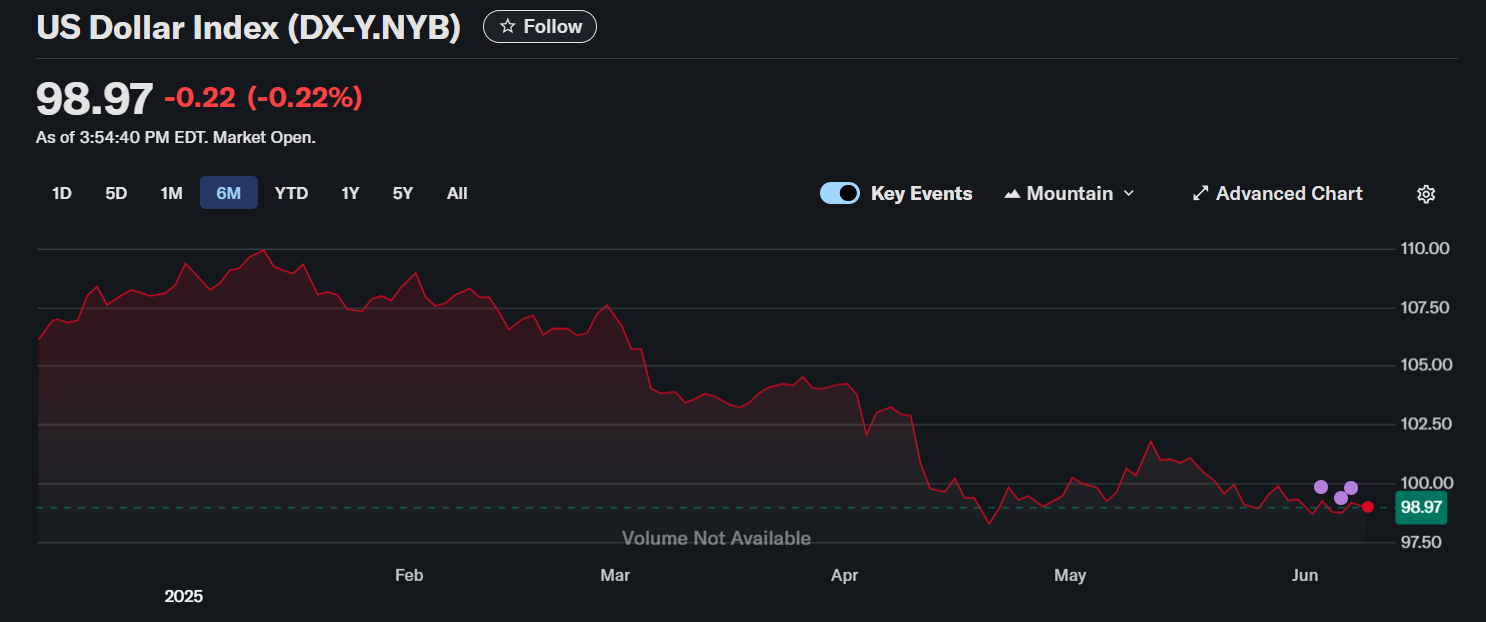

The US greenback began the 12 months exceptionally weakly. Two days in the past, the US Greenback Index (DXY)—a key measure closely influenced by the euro—fell almost 9% to simply beneath 99. The outcomes marked its weakest calendar 12 months opening since a minimum of the mid-Eighties.

Confronted with this knowledge, together with ongoing commerce uncertainties and recession fears, buyers are basically re-evaluating the greenback’s position of their portfolios.

This example and broader de-dollarization efforts by main US debt holders like China and Japan intensify issues concerning the greenback’s future.

Information from Ark Make investments illustrates this shift. In 2011, these three nations held 23% of the $10.1 trillion in excellent US Treasury debt.

By November 2024, regardless of the full excellent US Treasury debt rising to $36 trillion, their mixed holdings had dropped considerably to roughly 6%.

This substantial lower in holdings by key overseas collectors highlights rising worries concerning the greenback’s long-term stability and america’ capacity to refinance its large debt.

“Dollars are the world reserve currency. Demand for dollars has waned at the sovereign level. Over recent years, the largest purchasers of treasuries are cutting their holdings of treasuries. That is not a good situation for the United States as they try to refinance,” Klaich mentioned.

Klaich added that laws just like the GENIUS Act is essential:

“In my mind, there’s very little more important than the stablecoin bill being passed from an macroeconomic perspective… If demand for dollars diminishes at the sovereign level, structurally speaking, if that is or can be replaced by demand at a retail individual level, that is a huge boon to the US government.”

The info behind Klaich’s statements appears to again his evaluation.

What Position Will Stablecoins Play in Future US Debt Demand?

The stablecoin market is poised for important development. In accordance with an April report from Citigroup, the full stablecoin provide may attain $1.6 trillion by 2030. This development may create a requirement for US debt similar to the historic ranges supported by sovereign nations.

The GENIUS Act may facilitate this transition.

“Hopefully, when it passes, demand for stablecoins will explode because there are many companies and banks that are planning to introduce stablecoins that will provide the rails for them to operate at a consumer and business level. So the efficiencies companies and individuals realize will help push that,” Klaich defined.

By serving areas and other people uncared for or undermined by conventional banking methods, stablecoins may additionally assist counterbalance the worldwide de-dollarization motion.

“It allows anybody in the world to access US dollars. What that affords the US from an economic warfare standpoint is significant,” Klaich added.

With persistent inflation dangers, the Federal Reserve is unlikely to purchase again important quantities of US treasuries. Due to this fact, encouraging stablecoin use permits this market to successfully change at present ineffective monetary mechanisms.

Amendments to the Invoice

If the GENIUS Act is carried out appropriately, the stablecoin trade may develop into a useful monetary device for the US authorities to make sure long-term help for the US greenback.

The invoice underwent a troublesome revision course of. In accordance with Barr, the method was tedious and politically difficult.

“If you look at all of the progress we’ve made, we’ve worked on this for three Congresses now. We’ve worked on this [through] multiple different leaderships– minority, majority split. So we’re so close. We’ve done all this progress so we can see the finish line. We’re going to get there,” he mentioned.

Nonetheless, a number of revisions had been a prerequisite for its passage to make sure the invoice responsibly addressed client safety, nationwide safety, and market integrity points.

Klaich famous that these vital issues had been addressed pretty within the legislative course of. He emphasised that latest variations of the invoice successfully built-in these revisions.

“None of those issues are existential, and they’ve been negotiated into the latest version of the bill that’s being considered right now. I think the changes that have been made are reasonable and acceptable,” he mentioned.

The longer term will reveal if the invoice passes and achieves its desired impact in serving to the US overcome its sophisticated financial actuality.

Disclaimer

Following the Belief Venture tips, this characteristic article presents opinions and views from trade specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with an expert earlier than making choices primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.