XRP surged 30% yesterday after being included within the US crypto reserve. This pushed its worth above $2.90 for the primary time in a month. This large rally ignited robust bullish momentum, however the altcoin slumped 10% a day later.

XRP is seeing notable correction at this time, suggesting that profit-taking is underway. Whether or not the value can regain bullish momentum or proceed its retracement will depend upon key resistance and help ranges, with merchants intently watching $2.75 on the upside and $2.52 on the draw back.

XRP RSI Is Impartial After Reaching Overbought Ranges

XRP noticed a major surge in momentum after being included within the US crypto reserve. Its worth rallied 30%, pushing its Relative Power Index (RSI) to a peak of 84.5.

The RSI, a extensively used momentum oscillator, measures the velocity and alter of worth actions on a scale of 0 to 100. Readings above 70 point out that an asset is overbought and may very well be due for a pullback. Readings under 30 counsel oversold situations and a possible shopping for alternative.

XRP’s RSI reached 84.5 – its highest degree since December 2, 2024 – signaling excessive bullish sentiment, usually previous a short-term correction.

Now sitting at 63, XRP’s RSI has cooled off from its overbought zone, reflecting the latest retracement in worth. Whereas a studying above 60 nonetheless suggests bullish momentum, the decline from excessive ranges might point out that purchasing strain is waning.

If RSI continues to say no towards the impartial 50 zone, XRP might see additional consolidation or perhaps a deeper pullback.

Nonetheless, if consumers step in once more and push RSI again above 70, it might sign renewed power and one other potential try at greater worth ranges.

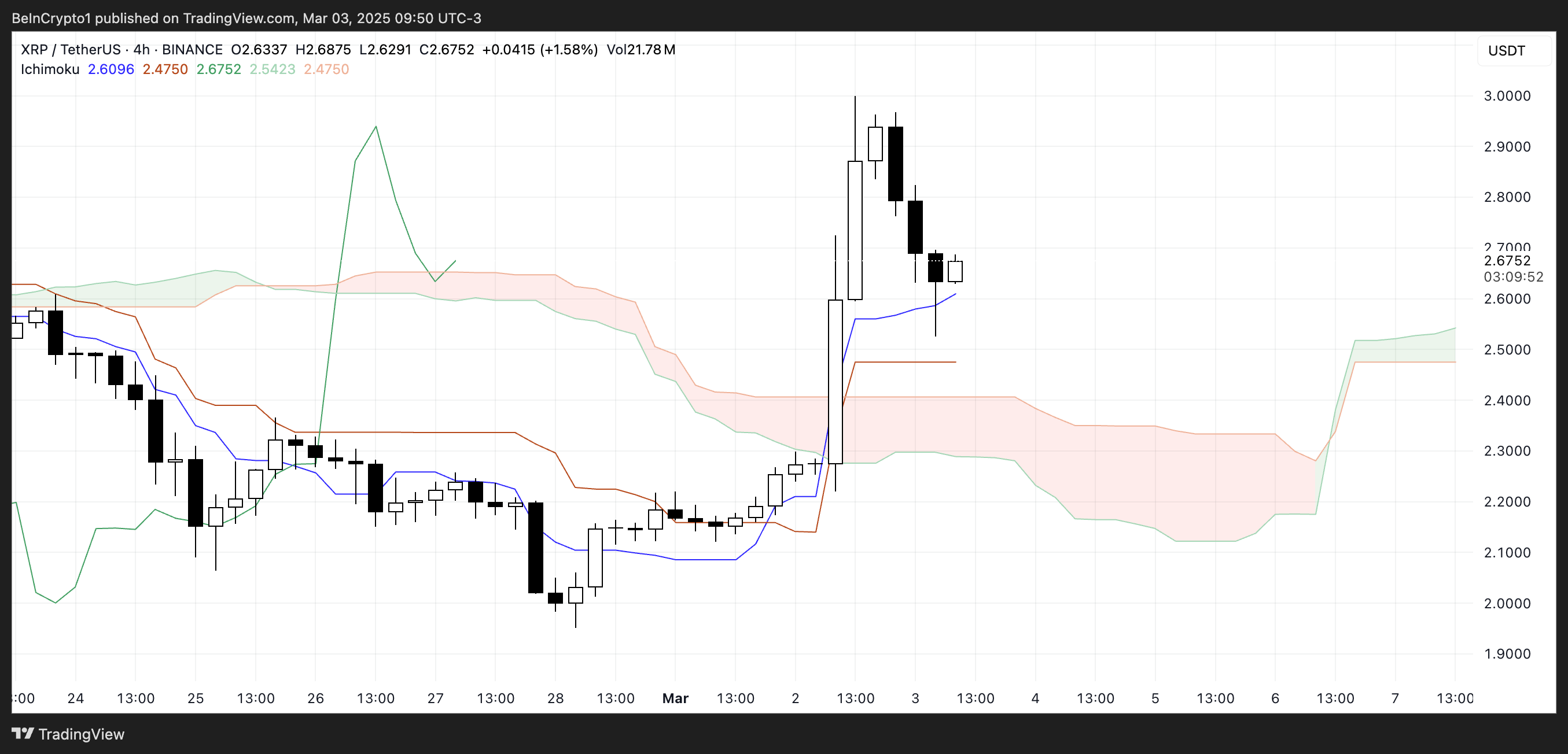

Ichimoku Cloud Reveals the Bullish Setup Is Nonetheless Right here, However This Might Change

XRP Ichimoku Cloud chart evaluation exhibits that the value noticed a pointy breakout above the cloud (Kumo) following its 30% surge after being included within the US crypto reserve.

This breakout confirmed a robust bullish transfer, with XRP transferring properly above each the Tenkan-sen (blue line) and Kijun-sen (crimson line), signaling short-term and medium-term pattern power.

The sharp spike pushed XRP into overextended territory. Nonetheless, as seen in the previous few candles, a pullback has began, bringing the value nearer to the Kijun-sen.

This means that whereas the uptrend stays intact, the market is reassessing its latest good points, and XRP is testing key short-term help.

If the value holds above the Kijun-sen, XRP worth might consolidate earlier than making one other try at greater resistance ranges.

Nonetheless, if the correction deepens and XRP falls again towards the cloud, it might point out a lack of momentum. The longer term cloud (Senkou Span A and B) stays bullish however with some flattening. That signifies that the market is at a pivotal level.

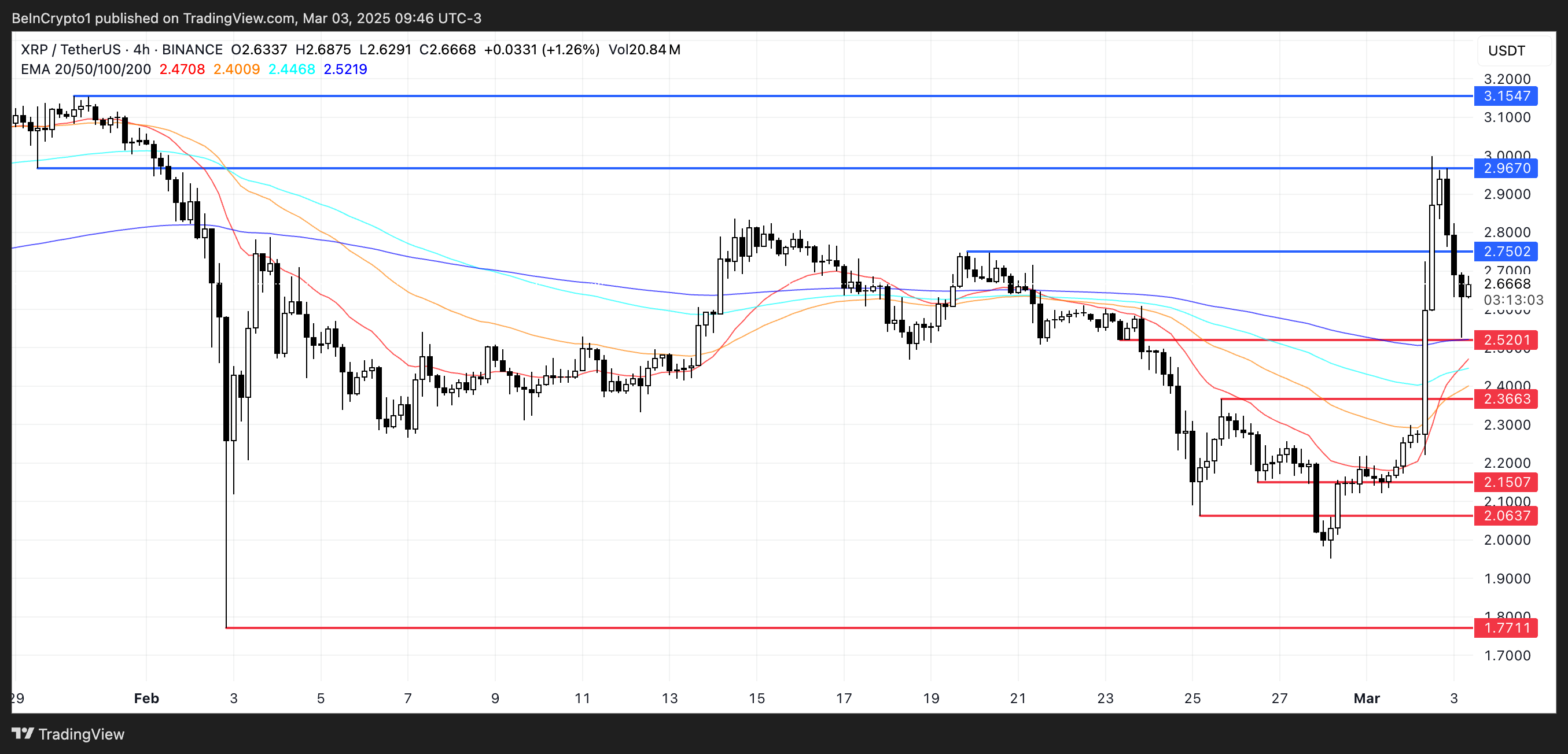

XRP Value Can Have a Exhausting Time to Attain $3

XRP surged to almost $2.95 following its inclusion within the US crypto reserve, marking a pointy bullish transfer.

Nonetheless, after this fast climb, the value has began to appropriate in the previous few hours, suggesting that some merchants are taking income.

The technical outlook now depends upon whether or not the uptrend can regain power. If shopping for strain returns, XRP might check the $2.75 resistance once more. A breakout above this degree might see it retesting $2.96, which acted as a barrier throughout yesterday’s rally.

A profitable transfer previous this resistance would open the door to a push towards $3.15, marking the primary time XRP has traded above $3 since February 1. The SEC dropping the case towards XRP may very well be a possible drive for that.

On the draw back, if the correction continues and promoting strain will increase, XRP worth might discover help at $2.52. A breakdown under this degree would put the subsequent key help at $2.36 in focus. Additional declines might probably drive the value towards $2.15 and $2.06.

This may very well be pushed if extra questions in regards to the asset being included within the US crypto reserve begin to emerge. Harrison Seletsky, director of enterprise growth at digital identification platform SPACE ID, instructed BeInCrypto that these property are odd selections to the reserve:

“I’m certainly surprised that US President Donald Trump has chosen to announce a full-blown crypto strategic reserve, rather than just a Bitcoin strategic reserve, as everyone had been expecting. Beyond that, the choice of assets is also unusual. ETH and SOL make sense, given their strong and growing developer activity. But it’s not clear to me why XRP and ADA were included at all, considering they are virtually ghost chains compared to Ethereum and Solana. Indeed, the total value locked (TVL) and stablecoin capabilities on XRPL and Cardano are tiny compared to other ecosystem players – $80 million and $460 million, respectively. In my eyes, it somewhat delegitimizes the whole idea of crypto reserve assets like industry mainstays Bitcoin, Ether and Solana,” Harrison Seletsky instructed BeInCrypto.

If bearish momentum strengthens considerably, XRP might fall under the psychological $2 mark, with $1.77 rising as the subsequent main help degree.

Disclaimer

According to the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.