The broader market downturn for the reason that starting of February has affected XRP’s worth. The fourth largest crypto by market capitalization has misplaced 10% of its worth over the previous week and now trades at $2.30.

This decline has intensified bearish sentiment, main XRP futures merchants to extend their quick positions towards any potential restoration.

XRP Faces Sturdy Promoting Stress as Bearish Sentiment Deepens

XRP’s persistent worth dip has strengthened the bearish bias towards it by its future merchants. On-chain knowledge displays the pessimism as XRP’s lengthy/quick ratio signifies that extra merchants are betting on additional draw back quite than a rebound this week. As of this writing, this ratio stands at 0.99.

An asset’s lengthy/quick ratio compares the variety of lengthy positions (bets that the value will rise) to quick positions (bets that the value will fall) out there. When the ratio is above 1, there are extra lengthy than quick positions, indicating that extra merchants are betting on a worth enhance.

Converesly, as in XRP’s case, a ratio under one means that merchants are largely betting on a worth decline. This indicators a robust bearish sentiment out there, reinforcing the probability of additional draw back.

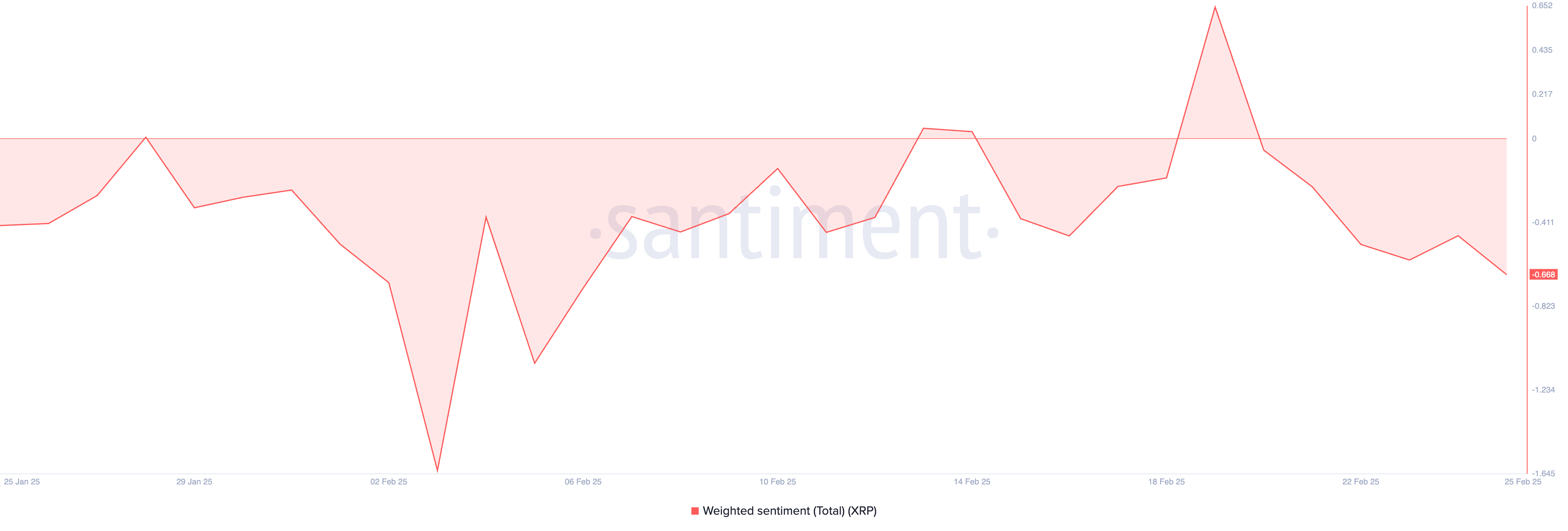

As well as, XRP’s detrimental weighted sentiment confirms this bearish bias. At press time, this metric is under zero at -0.66.

An asset’s weighted sentiment measures its general optimistic or detrimental bias, contemplating each the quantity of social media mentions and the sentiment expressed in these mentions. When it’s detrimental, as within the case of XRP, it’s a bearish sign.

It means that XRP traders are more and more skeptical about its near-term outlook, prompting them to commerce much less and worsening the value dip.

XRP Teeters on Key Assist

Since reaching an all-time excessive of $3.40 on January 16, XRP has traded inside a descending triangle. This bearish sample is fashioned when an asset’s worth creates decrease highs whereas sustaining a robust help stage, leading to a downward-sloping trendline that converges with a horizontal base.

The sample signifies that sellers are gaining management, and a breakdown under help might result in additional declines. At press time, XRP trades at $2.30, barely above this help fashioned at $2.27.

If this line breaks, XRP’s worth might drop to $2.13. If promoting strain beneficial properties momentum at this stage, the token’s worth might additional dip towards $1.47.

On the flip aspect, if market sentiment turns into bullish, it will drive up XRP’s demand and will trigger its worth to interrupt above the descending triangle to achieve $2.81.

Disclaimer

In keeping with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.