XRP is up greater than 8% over the previous seven days, however it hasn’t been capable of keep the robust momentum sparked by the SEC dropping its lawsuit towards Ripple.

After the preliminary surge, XRP has entered a part of consolidation, with value motion caught between key assist and resistance ranges. Technical indicators now replicate a market on pause, with momentum fading and course unclear.

XRP RSI Is Presently Impartial

XRP’s Relative Energy Index (RSI) is presently at 52.89, a notable drop from 63.90 simply someday in the past. This sharp decline indicators a weakening in current bullish momentum, as patrons seem like shedding management over the brief time period.

RSI has now slipped nearer to impartial territory, suggesting that market members are more and more unsure concerning the subsequent transfer.

Importantly, XRP hasn’t reached RSI ranges above 70—generally related to overbought and strongly bullish situations—since March 19, over per week in the past, indicating a scarcity of robust shopping for strain throughout this era.

RSI, or Relative Energy Index, is a broadly used momentum oscillator that measures the velocity and alter of value actions on a scale from 0 to 100.

An RSI studying above 70 usually indicators that an asset is overbought and may very well be due for a pullback, whereas a studying under 30 suggests it might be oversold and primed for a bounce. Values between 50 and 70 typically replicate bullish momentum, whereas readings between 30 and 50 lean bearish.

With XRP now sitting at 52.89, it stays above the midpoint however is edging nearer to impartial, suggesting the current bullish part could also be cooling off except renewed shopping for exercise steps in.

Ichimoku Cloud Exhibits An Indecisive Market

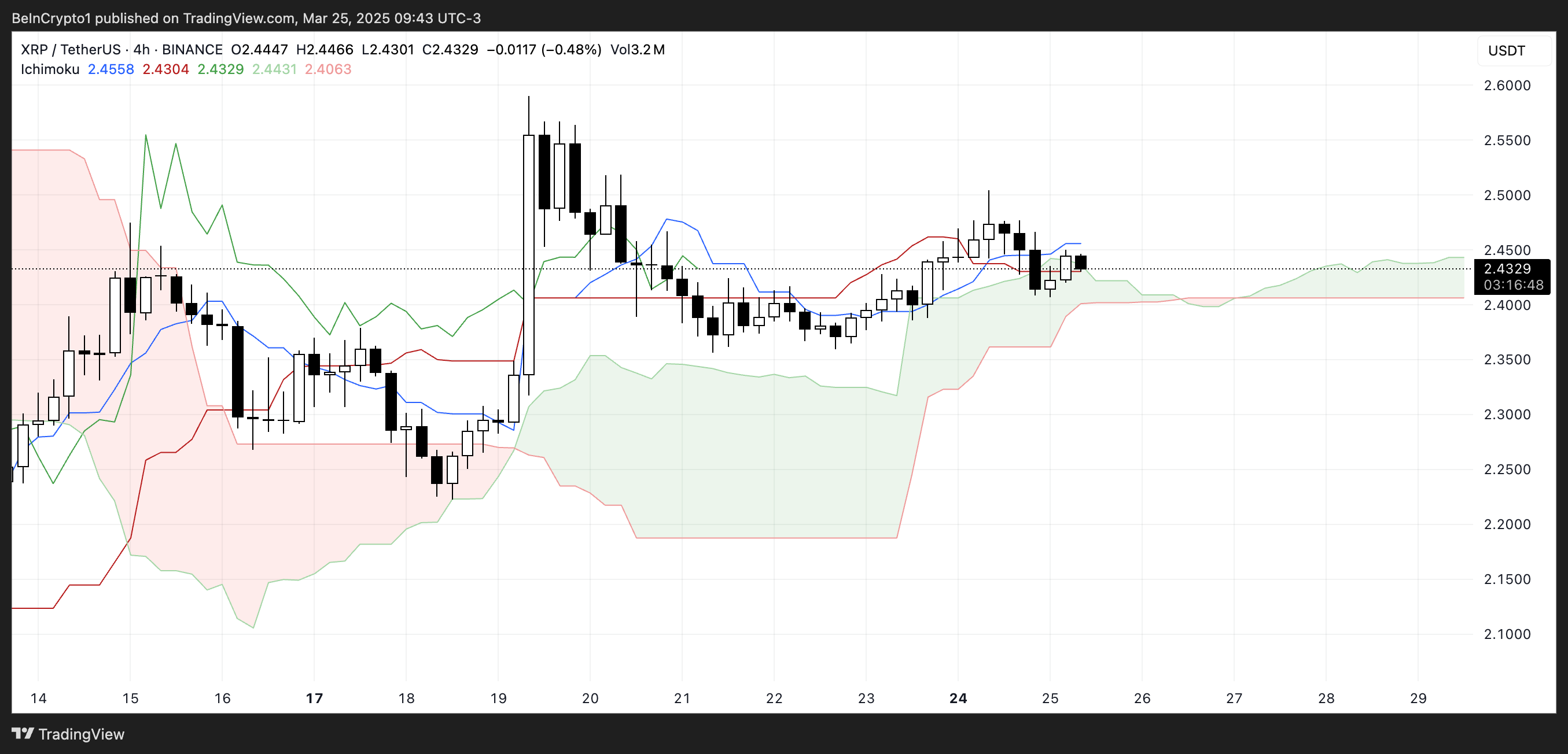

XRP’s Ichimoku Cloud chart reveals a market in consolidation, with value motion hovering simply above the cloud however missing robust momentum.

The Tenkan-sen and Kijun-sen traces are comparatively flat and shut collectively, indicating a pause in development power and a steadiness between patrons and sellers.

The shortage of a transparent Tenkan/Kijun crossover additionally helps the concept the market is in a impartial part relatively than trending decisively in both course.

The cloud forward is skinny and barely bullish. This means that whereas there’s some assist beneath the worth, it’s not notably robust.

A skinny cloud usually indicators potential vulnerability, as it might not maintain up properly towards elevated promoting strain. In the meantime, the Chikou Span (lagging line) is interacting intently with previous value motion, one other signal that momentum is weakening.

General, the Ichimoku setup displays uncertainty, with XRP needing a decisive push in both course to flee this range-bound construction.

Will XRP Breach $2.50 Resistance?

XRP skilled a powerful surge following the information that the SEC had dropped its case towards it. Nonetheless, that preliminary momentum has since cooled.

The value is now caught between a resistance zone at $2.47 and assist at $2.35. That highlights a part of consolidation and indecision.

If the present assist stage is retested and fails to carry, XRP may see elevated promoting strain. That will open the door for a transfer right down to $2.22. If bearish momentum intensifies, a deeper drop towards $1.90 is feasible.

On the flip aspect, if patrons can regain management and push XRP value above the $2.47 resistance.

The subsequent targets in that state of affairs can be $2.59 and $2.749, each of which align with earlier areas of rejection.

If the uptrend gathers power, XRP may climb as excessive as $2.99.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.