XRP is below heavy promoting strain, down greater than 5% within the final 24 hours and over 12% previously seven days. The latest downturn has been accompanied by more and more bearish technical indicators, together with a pointy spike in pattern power and a collapse in on-chain exercise.

With value momentum weakening and consumer engagement dropping, issues are mounting over XRP’s potential to carry key assist ranges. Except sentiment shifts shortly, the trail of least resistance seems to stay to the draw back.

DMI Chart Reveals The Present Downtrend Is Very Sturdy

XRP’s Directional Motion Index (DMI) is at present flashing robust bearish indicators, with the Common Directional Index (ADX) surging to 47.14 from 25.43 only a day in the past.

The ADX measures the power of a pattern, no matter its path, and values above 25 typically point out {that a} pattern is gaining momentum.

A studying above 40—like XRP’s present degree—suggests a really robust pattern is in play. Provided that XRP is at present in a downtrend, this rising ADX factors to intensifying bearish momentum and a market leaning closely towards additional declines.

Digging deeper into the DMI elements, the +DI, which tracks upward value strain, has dropped sharply from 20.13 to five.76. In the meantime, the -DI, which tracks downward value strain, has surged from 8.97 to 33.77.

This stark divergence reinforces the bearish pattern, indicating that sellers are aggressively taking management whereas purchaser power fades.

With ADX confirming the power of this transfer and directional indicators tilting closely to the draw back, XRP’s value might stay below strain within the brief time period until a major reversal in sentiment happens.

XRP Lively Addresses Are Closely Down

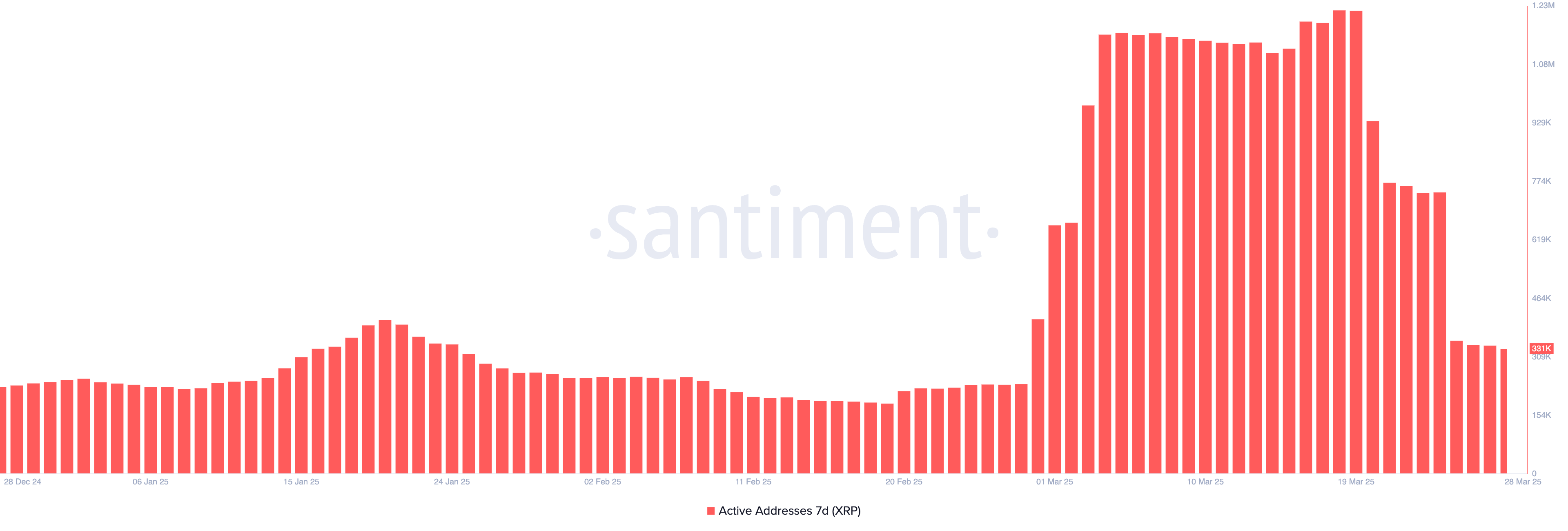

XRP’s 7-day energetic addresses have seen a pointy decline over the previous week, following a latest surge to new all-time highs. On March 19, the metric peaked at 1.22 million, signaling robust community exercise and consumer engagement.

Nonetheless, since then, it has plummeted to simply 331,000—a drop of over 70%. This sudden fall means that curiosity in transacting on the XRP has cooled off considerably in a brief span of time.

Monitoring energetic addresses is a key strategy to gauge on-chain exercise and general community well being. A rising variety of energetic addresses sometimes displays rising consumer participation, elevated demand, and potential investor curiosity—elements that may assist value power.

Conversely, a pointy decline just like the one XRP is at present experiencing can level to weakening momentum and fading curiosity, which might put extra strain on value.

Except consumer exercise begins to rebound, this drop in community engagement might proceed to weigh on XRP’s short-term outlook.

XRP Might Drop Beneath $2 Quickly

XRP’s Exponential Shifting Common (EMA) traces are at present signaling a robust downtrend, with the short-term EMAs positioned under the longer-term ones—a traditional bearish alignment.

This setup signifies that latest value momentum is weaker than the longer-term common, usually seen throughout sustained corrections. If this downtrend continues, XRP might retest the assist degree at $1.90.

A break under that would open the door to a deeper drop towards $1.77 in April.

Nonetheless, if market sentiment shifts and XRP value manages to reverse course, the primary key degree to look at is the resistance at $2.22.

A profitable breakout above this level might set off renewed bullish momentum, doubtlessly driving the worth as much as $2.47.

If that degree additionally will get breached, XRP might push additional to check the $2.59 mark.

Disclaimer

In keeping with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.