Crypto buyers suffered the most important liquidation in over every week as Bitcoin and most altcoins continued their downtrend.

Bitcoin and altcoins liquidations rise

Information compiled by CoinGlass exhibits that complete liquidations on Friday, Sep. 6, jumped to over $221 million, up from $72 million a day earlier. It was the most important leap since Aug. 27 when liquidations soared to $281 million.

- Bitcoin (BTC), the most important cryptocurrency, led the liquidations with over $114 million;

- Ethereum (ETH), $72 million value and

- Solana (SOL), $14 million.

Bitcoin and different cryptocurrencies dropped as buyers dumped dangerous property and moved to protected havens. The tech-heavy Nasdaq 100 index dropped by over 500 factors whereas the small-cap Russell 2000 index crashed by over 1.96%.

This decline occurred after the U.S. revealed blended jobs studies, signaling that the Federal Reserve will ship a 0.25% lower as a substitute of the anticipated 0.50%. The numbers confirmed that the unemployment fee fell barely to 4.2% whereas wage development bounced again.

There’s a danger that Bitcoin and different altcoins could proceed falling within the coming weeks. For one, a way of concern is spreading available in the market because the concern and greed index has fallen to the concern space of 30. In most durations, cryptocurrencies retreat when buyers are fearful.

Bitcoin and Ethereum are additionally seeing weak institutional demand as their ETFs have continued their outflows. Information exhibits that Bitcoin ETFs have shed property prior to now eight consecutive days whereas Ether funds have shed over $568 million since inception.

Extra knowledge exhibits that the futures open curiosity continued falling and is hovering at its lowest level in over a month. Bitcoin’s open curiosity dropped to $28.4 billion, down from the year-to-date excessive of over $37 billion.

Bitcoin worth has weak technicals

Bitcoin Loss of life Cross?

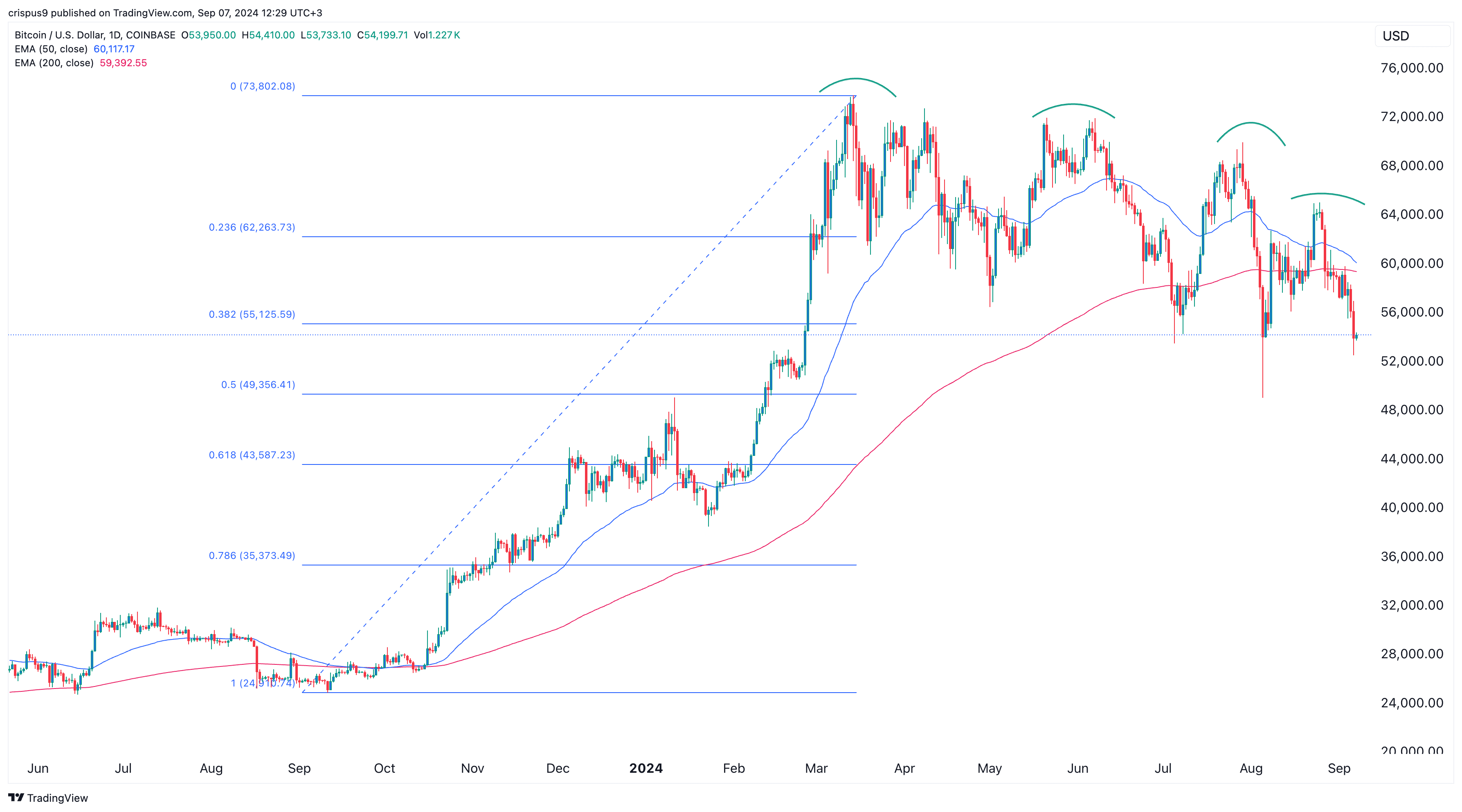

Technically, there’s a danger that Bitcoin is about to kind a loss of life cross sample because the unfold between the 200-day and 50-day Exponential Transferring Averages is narrowing.

The final time Bitcoin shaped a loss of life cross was in 2022. The occasion led to a 65% crash.

Bitcoin has additionally moved beneath the 38.2% Fibonacci Retracement level, that means that it may drop to the 50% degree of $49,000, its lowest degree final month. A drop beneath that time will result in extra draw back. Different altcoins are likely to crash when BTC isn’t doing effectively.