The crypto market is ready to see $3.29 billion in Bitcoin and Ethereum choices expire at the moment, a growth that might set off short-term worth volatility and affect merchants’ profitability.

Of this whole, Bitcoin (BTC) choices account for $2.88 billion, whereas Ethereum (ETH) choices signify $417 million.

Bitcoin and Ethereum Holders Brace For Volatility

Based on information on Deribit, 35,176 Bitcoin choices will expire at the moment, barely greater than final week, the place 29,005 BTC contracts went bust. The choices contracts due for expiry at the moment have a put-to-call ratio of 0.74 and a most ache level of $86,000.

The put-to-call ratio signifies a typically bullish sentiment regardless of the pioneer crypto’s ongoing descent from the $90,000 mark.

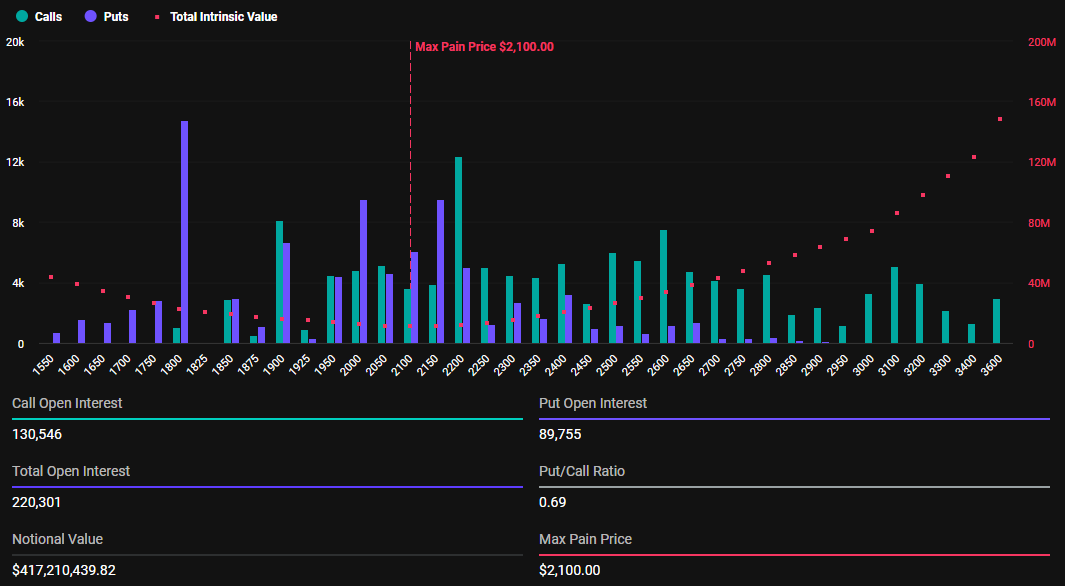

In the meantime, 220,301 Ethereum choices will expire at the moment, down from 223,395 final week. With a put-to-call ratio of 0.69 and a max ache level of $2,100, the expirations might affect ETH’s short-term worth motion.

Because the choices contracts close to expiration at 8:00 UTC at the moment, Bitcoin and Ethereum costs are anticipated to method their respective most ache factors. Based on BeInCrypto information, BTC was buying and selling for $81,992 as of this writing, whereas ETH was exchanging palms for $1,891.

This means a possible restoration for Bitcoin and Ethereum costs as good cash goals to maneuver them towards the “max pain” stage. Based on the Max Ache principle in choices buying and selling, costs are likely to gravitate towards strike costs the place the best variety of contracts, each calls and places, expire nugatory.

“Max pain has been ticking lower week after week. Do you see this continuing, or is a reversal coming?” Deribit analysts posed.

However, worth strain on BTC and ETH will possible ease after 08:00 UTC on Friday when Deribit settles the contracts. Nevertheless, the sheer scale of those expirations might nonetheless gasoline heightened volatility within the crypto markets.

Analysts Focus on Crypto Market Sentiment

Based on analysts at Greeks.stay, market sentiment is predominantly bearish within the short-term regardless of optimistic US CPI (Client Worth Index) information earlier this week.

“Traders are watching key potential support levels and discussing a potential bottom for BTC, with some suggesting $60,000 levels as a possible downside target,” the analysts wrote.

The analysts additionally be aware that some imagine President Trump’s tariffs and inflation are extra vital market drivers than geopolitical occasions like a Ukraine peace deal.

“Vladimir Putin says he agrees with proposals for ceasefire – but adds he has questions and Russia ‘now on the offensive in all areas’,” Sky Information reported.

Analysts be aware that peace and stability might gasoline market confidence, which might be bullish for shares and crypto. This aligns with a current JPMorgan survey, through which 51% of merchants recognized tariffs and inflation as the highest market movers for the 12 months.

Elsewhere, analyst Tony Stewart discusses choice flows within the crypto market, specializing in Bitcoin derivatives buying and selling on Deribit. He signifies shifts in market sentiment and buying and selling methods that noticed put patrons and name sellers revenue from the March 11 worth dip to 76,500 ranges, adopted by a much less supported bounce again resulting from heavy promoting of calls above $90,000.

Based on Stewart, this highlights a strategic rotation by merchants, shifting from overly optimistic March and June name positions to extra conservative April and Could calls. It additionally displays changes to market volatility.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.