Altcoins with robust fundamentals and rising ecosystems might see a rebound in February. Jupiter (JUP) has strengthened its place within the Solana ecosystem with key acquisitions, pushing its TVL previous Raydium.

Aerodrome Finance (AERO), the dominant DEX on Base, is buying and selling close to key psychological ranges after a pointy decline, making it probably the most fascinating altcoins to observe. In the meantime, Grass (GRASS) has struggled with the broader AI token correction however might get better if AI-related hype returns subsequent month.

Jupiter (JUP)

Jupiter (JUP) is increasing its presence within the Solana ecosystem via key acquisitions. It lately acquired Moonshot, a cash launchpad, and SonarWatch, a portfolio tracker. With these strikes, JUP has surpassed Raydium in Whole Worth Locked (TVL), reaching $2.87 billion.

Regardless of a 7% drop within the final 24 hours, JUP stays up 29% over the previous week. As considered one of Solana’s most used platforms, its rising ecosystem might drive additional positive aspects. Elevated adoption and integrations might proceed boosting its relevance.

If momentum continues, JUP might check $1.22 and $1.27 quickly. Nonetheless, if the pattern reverses, it could fall to $0.98, with additional draw back to $0.83 and even $0.76.

Aerodrome Finance (AERO)

AERO is the main utility on the Base chain, with $1 billion in TVL and $1.16 million in each day charges. As probably the most used DEX on Base, it holds a dominant place regardless of being 56% down from its all-time excessive on December 7, 2024, making it probably the most fascinating altcoins for February.

Over the previous month, AERO has dropped almost 31%, now buying and selling round $1 with a market cap of $765 million. The latest decline has pushed it nearer to key psychological ranges, making the subsequent strikes essential.

If AERO regains robust momentum, it might see a serious rally in February. Key targets embrace $1.4 and $1.6, with a possible transfer above $2 for the primary time since mid-December.

Grass (GRASS)

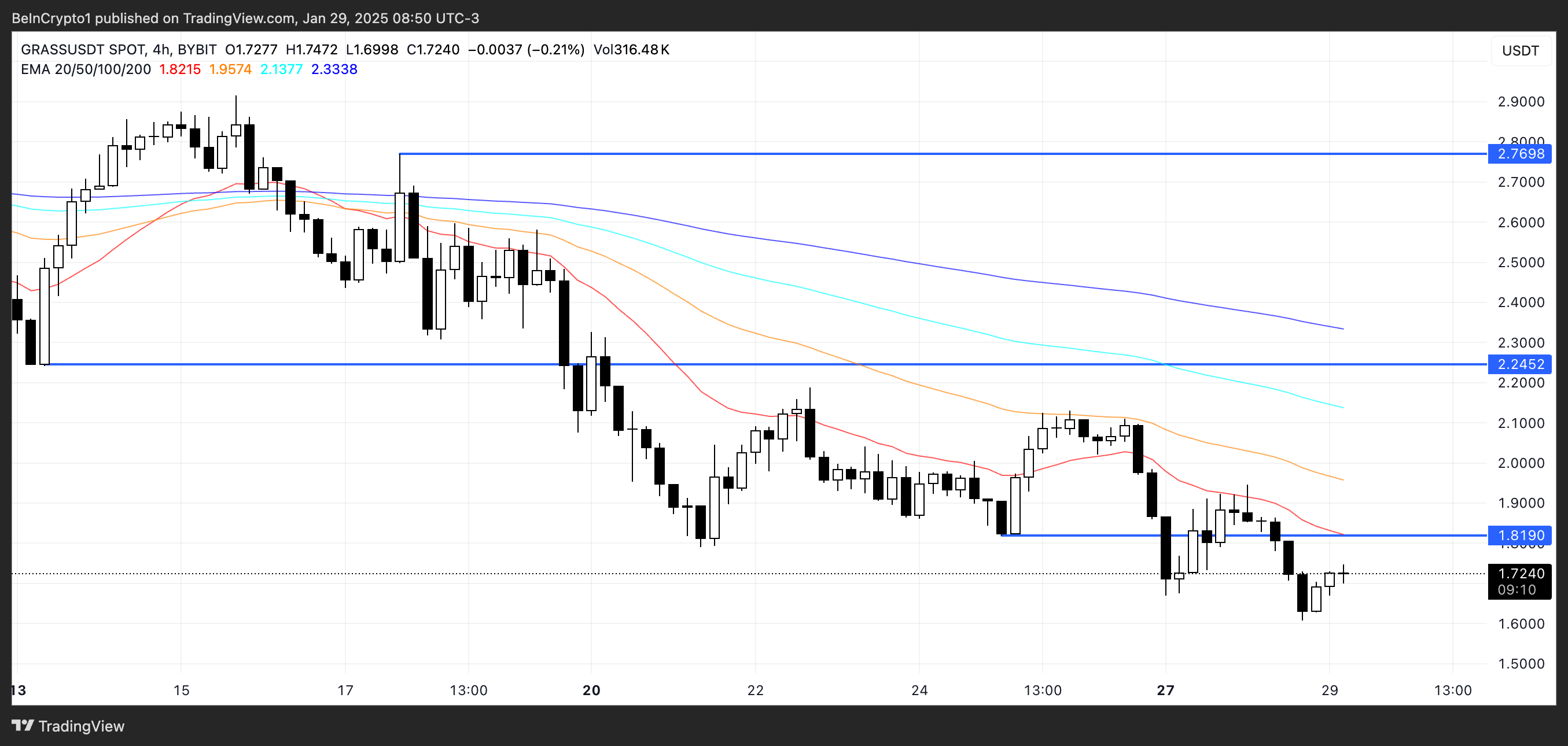

GRASS has been hit exhausting by the latest correction in synthetic intelligence cryptos, with its worth dropping over 27% previously 30 days. It’s now buying and selling at its lowest ranges since November 5, 2024, simply days after its airdrop.

The token tried to interrupt above $4 on three separate events in 2024 however failed every time. Since January 6, 2025, it has remained under $3, indicating a transparent downtrend.

If AI-related altcoins regain momentum in February, GRASS worth may gain advantage from the renewed curiosity. A rebound towards the $2 vary is feasible, and if the uptrend strengthens, the token might revisit the $3 degree as nicely.

Disclaimer

In step with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.