The thrill surrounding Notcoin (NOT), a once-promising Telegram-based tap-to-earn undertaking, has considerably declined in current weeks. This dip in sentiment is probably going tied to the token’s disappointing value motion.

As soon as a prime performer among the many prime 100 cryptocurrencies, NOT’s worth has dropped by 30.76%. However as a substitute of shopping for the dip, the cryptocurrency holders seem like abandoning the ship.

Buyers Flee Notcoin Following Month-Lengthy Decline

On August 19, Notcoin’s value jumped to $0.011. This enhance sparked hypothesis that the token might maintain onto the hike. Nonetheless, BeInCrypto’s on-chain evaluation discovered what led to the short-lived upswing.

In keeping with IntoTheBlock, the common holding time of transacted cash on Notcoin’s community has dropped by almost 62% over the previous week. Moreover, the quantity of transacted cash during the last 30 days has declined.

The “Coins Holding Time” metric tracks how lengthy a cryptocurrency is held earlier than being offered or transacted. When this metric rises, it suggests holders are reluctant to promote, main to cost stability or development.

Learn extra: 5 Prime Notcoin Wallets in 2024

Nonetheless, the lower in NOT’s holding time displays rising promoting stress and diminished confidence in its short-term potential.

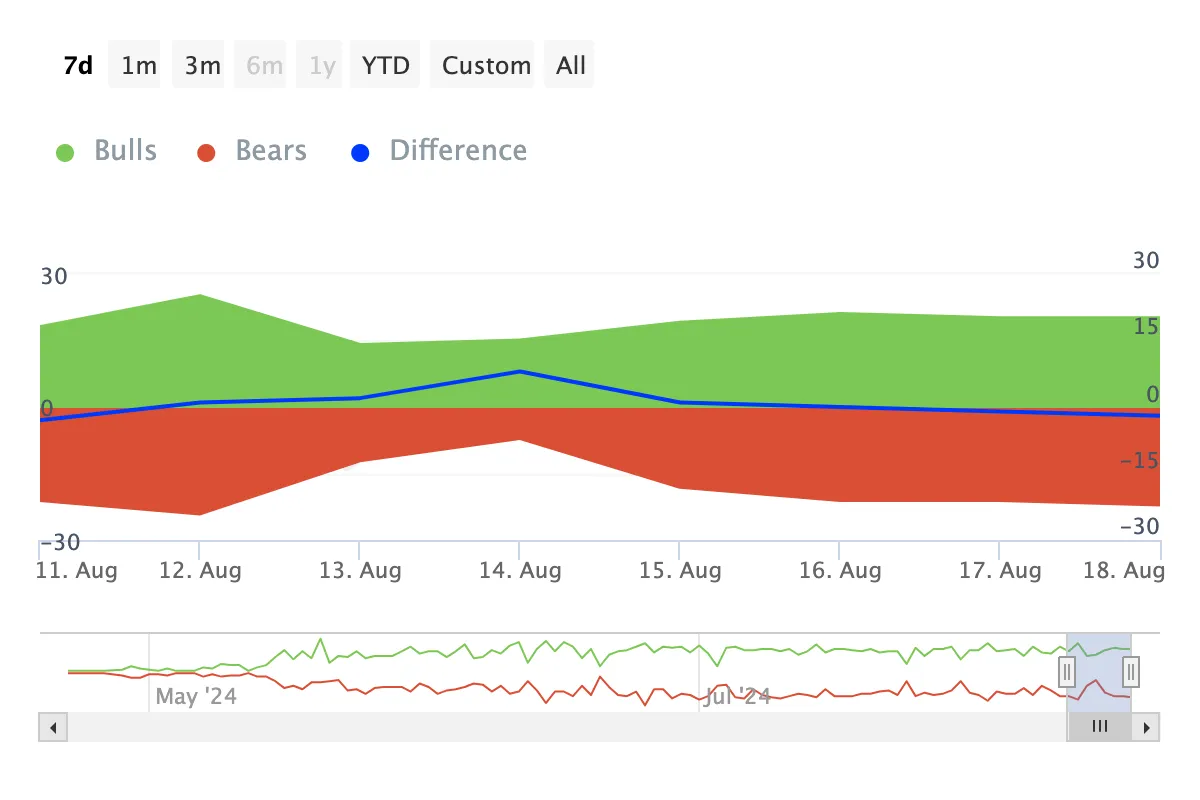

Moreover, blockchain analytics reveal that retail buyers aren’t the one ones promoting NOT. The Bulls and Bears indicator reveals extra bears than bulls, signaling elevated promoting exercise.

On this context, bulls symbolize addresses that purchased 1% of the full buying and selling quantity, whereas bears are these promoting 1% of the quantity. If this pattern persists, Notcoin might battle to recuperate from its 30% decline.

NOT Worth Prediction: One other Drop Imminent

Notcoin’s technical setup beneath highlights the failure to interrupt the bearish market construction. At press time, the cryptocurrency trades at $0.010.

Moreover, the value is trying to flip the 20-day EMA (blue) however stays clearly beneath the 50 EMA (yellow). EMA stands for Exponential Transferring Common and measures a cryptocurrency pattern course over a time period.

When the value is above the EMA, the pattern is bullish. However since NOT’s value is beneath the brief to mid-term indicators, the pattern is bearish. Aside from that, the formation of a loss of life cross, which is proven by the crossover of the longer EMA above the shorter one, provides credence to the bearish bias.

Learn extra: The place To Purchase Notcoin: Prime 5 Platforms In 2024

Moreover, the On Steadiness Quantity (OBV), an indicator that gauges shopping for and promoting stress, is flat. This suggests that NOT is starved of accumulation.

Until Notcoin’s market construction improves, the cryptocurrency’s value might drop to $0.0084. Nonetheless, if market members deem it match to purchase the dip and the value rises above the 20 EMA, the pattern might reverse. Ought to this be the case, NOT’s value might attain $0.012.

Disclaimer

In step with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.