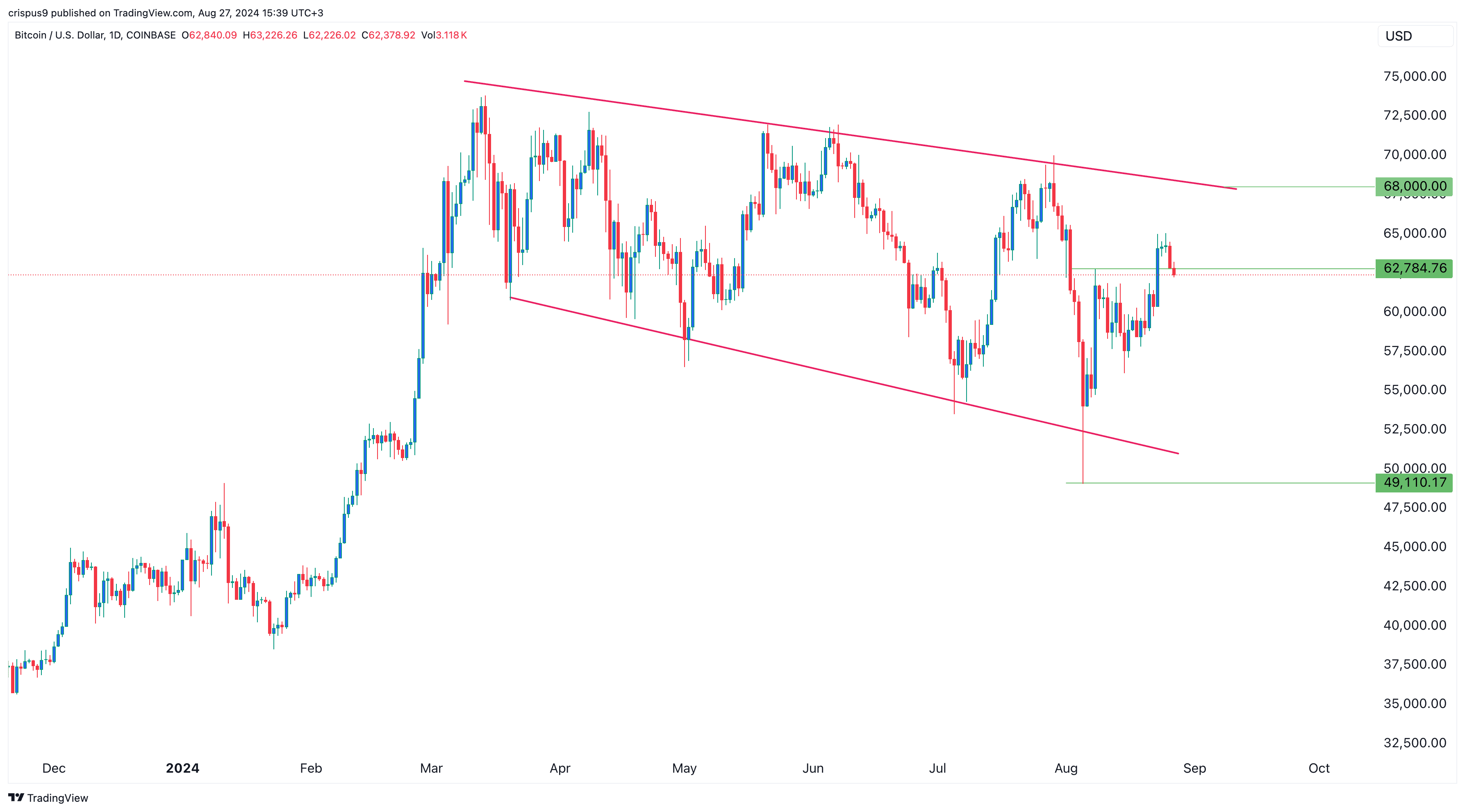

Bitcoin worth has retreated for 2 consecutive days as final week’s momentum within the crypto and inventory market pale.

Bitcoin (BTC) retreated from Sunday, Aug. 26 excessive of $64,960 to $62,300. Nonetheless, there are 4 primary explanation why the coin might stage a comeback and retest the vital resistance level at $68,000.

Futures open curiosity is rising

Third-party knowledge exhibits that demand for Bitcoin within the futures market is making a robust comeback. Information from SoSoValue counsel that curiosity jumped to $34.7 billion on Aug. 26, its highest level since Aug. 2 and far larger than this month’s low of $26.65 billion. It has additionally risen for 3 consecutive days.

Futures open curiosity is a crucial determine that exhibits the variety of contracts that haven’t been settled. A excessive determine is an indication that there are extra individuals available in the market, which signifies extra demand amongst market individuals.

Spot Bitcoin ETF inflows

Extra indicators of Bitcoin demand are within the exchange-traded funds market. Information exhibits that almost all ETFs recorded inflows on Monday, Aug. 26, for the eighth consecutive day. Whole inflows rose to over $202 million, a rise from Friday’s $252 million.

These funds added $506 million final week after gaining $32 million per week earlier, and this pattern might proceed. Altogether, spot Bitcoin ETFs have had over $18 billion in inflows, with the iShares Bitcoin Belief being probably the most lively.

The latest filings by hedge funds confirmed that companies like Millennium Administration, Citadel, Schonfeld, and Susquehanna had invested in Bitcoin ETFs. Wall Road banks like Goldman Sachs and Morgan Stanley had additionally invested in these ETFs.

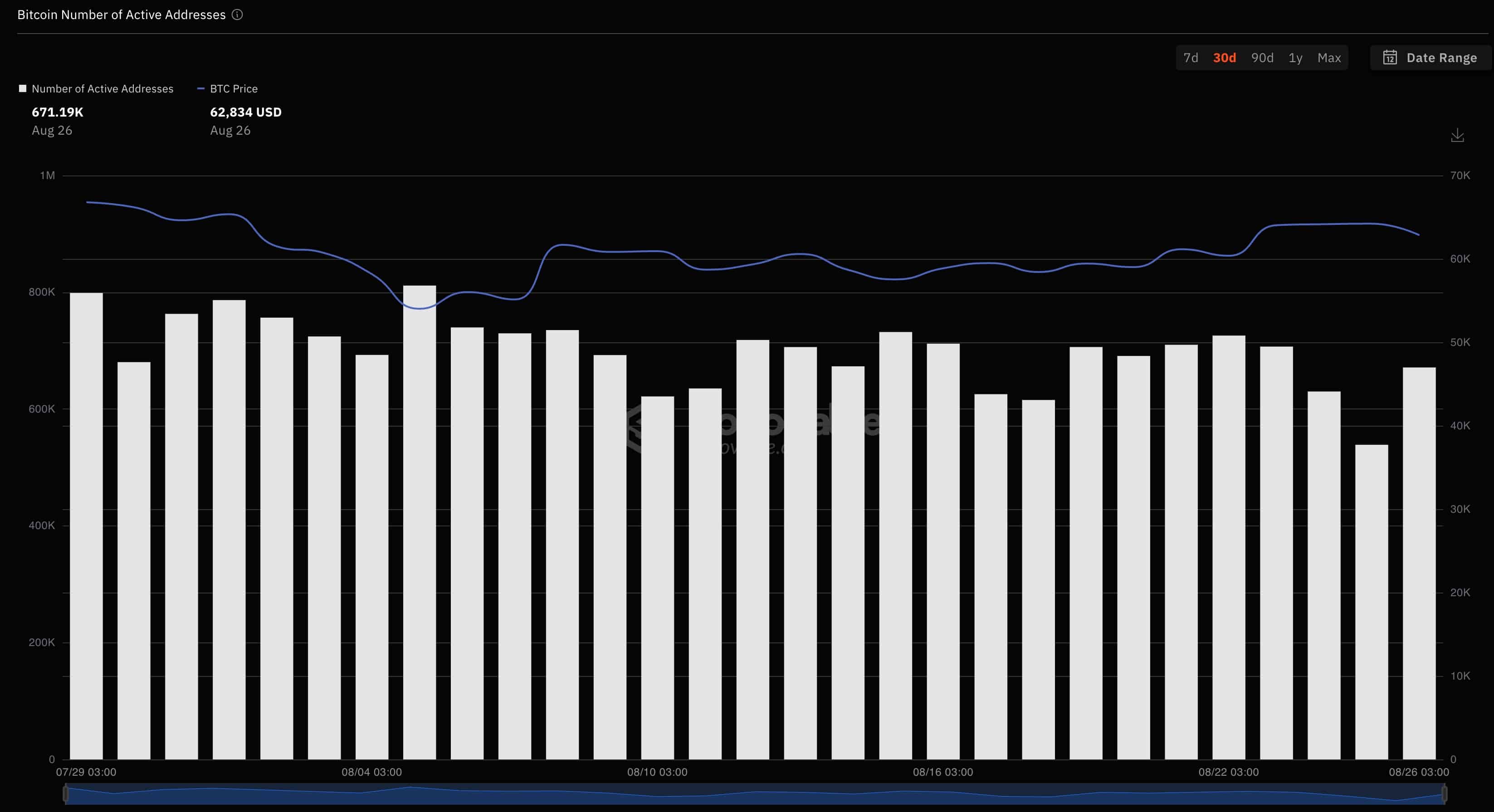

Bitcoin addresses are rising

In the meantime, on-chain knowledge exhibits that the variety of lively Bitcoin addresses is rising. In accordance with SoSoValue, lively Bitcoin addresses rose to 671,000 on Aug. 6, up from 538,000 on Sunday. The quantity is nearing the month-to-date excessive of 725,000.

Extra knowledge exhibits that new addresses in Bitcoin’s community are rising. New addresses rose to 264,000 on Monday, up from 253,000 a day earlier. These numbers imply that there’s nonetheless demand for Bitcoin within the crypto group.

Federal Reserve cuts

Moreover, Bitcoin might profit from rate of interest cuts because it has accomplished up to now. In a press release on Friday, Jerome Powell famous that the financial institution would seemingly begin slicing charges in September.

The scale of the reduce will rely upon the upcoming private consumption expenditure and non-farm payroll knowledge. A weak jobs report will elevate the chances of a jumbo 0.50% reduce.

Bitcoin does effectively when the Fed is slicing charges, because it did in 2020 when the Fed intervened due to the COVID-19 pandemic. It additionally rose in 2017 because the Fed slashed charges after which reversed in 2018 and 2022 when it hiked. It raised charges 4 occasions in 2028 and 6 in 2022 as inflation rose.

Moreover, $68,000 is a crucial stage since it’s alongside the collection of decrease highs that Bitcoin has been forming since March. The primary one was at $73,800, adopted by $72,000 in June, and $70,000 in July. A break above $68,000 will seemingly be an indication of a bullish breakout.