You may additionally like:

This report will study the highest 9 tendencies impacting the true property trade in 2024.

One of many key underlying drivers for these tendencies is a relocation from massive cities to the suburbs.

However there are a number of different necessary modifications in the true property area to regulate over the following 18-24 months.

With that, listed here are among the most necessary actual property tendencies to know:

1. Residence Costs Proceed To Climb

Because of the elevated demand for single-family houses and dwindling provide, costs for single-family houses have elevated by 43% over the past 4 years.

Common costs of single-family dwellings within the US have gone up by 7.6% simply since January 2024

This development is sweet for some however dangerous for others.

For present dwelling homeowners, they’re seeing the fairness of their houses improve considerably.

So, as market worth will increase, dwelling fairness does too.

In actual fact, the typical US dwelling proprietor noticed a 9.6% improve of their fairness final yr alone, with a collective $1.5 trillion added.

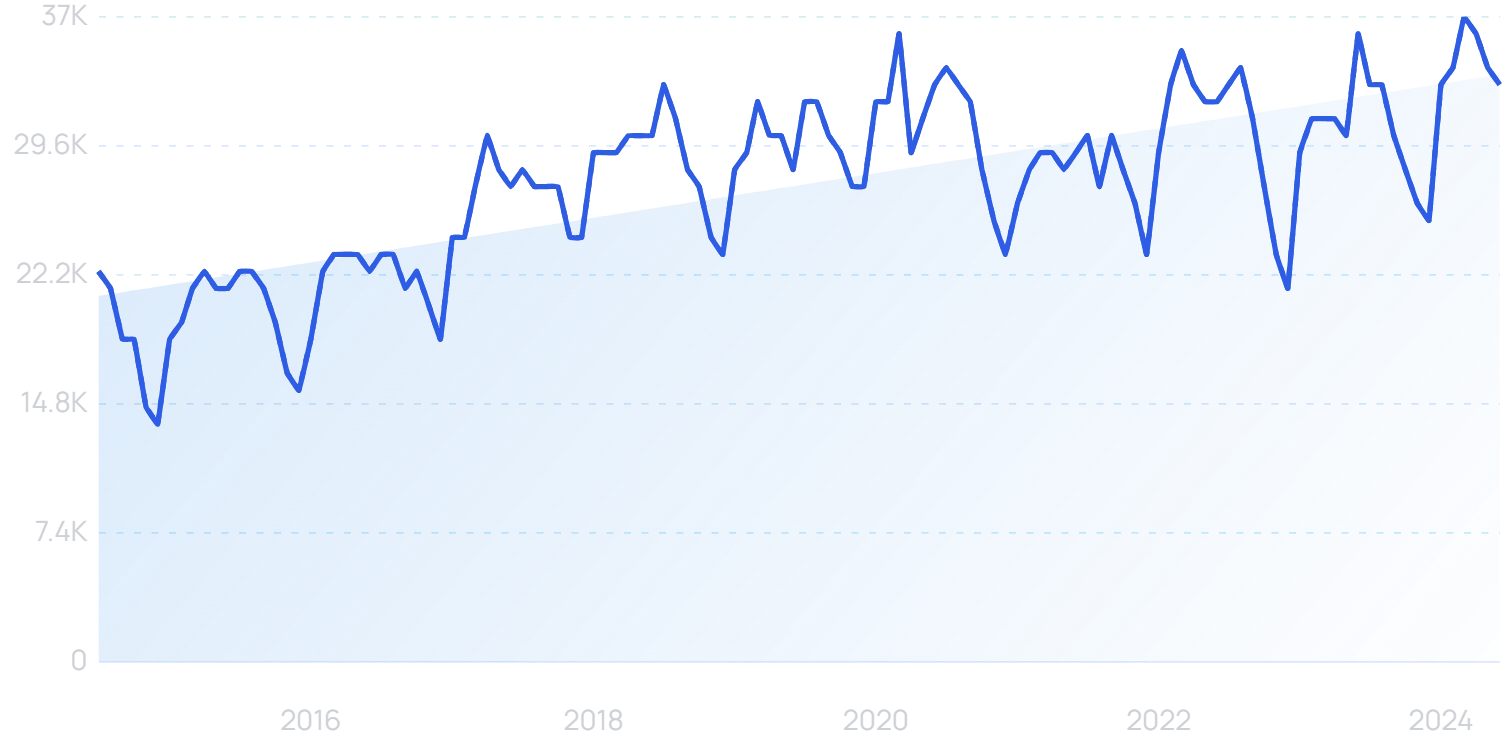

On-line searches for “home equity” have steadily elevated over the past decade.

However for first-time dwelling consumers, excessive costs have largely locked them out of the housing market completely.

Nevertheless, it is price noting that the housing market is displaying some indicators of cooling.

Median housing costs really declined within the first quarter of 2024. As those that beforehand locked into low-rate mortgages attain the tip of their phrases, extra property may come up on the market, doubtlessly extending that development.

That being stated, it’s predicted that costs will proceed to rise over the medium-term. Lawrence Yun, the chief economist on the Nationwide Affiliation of Realtors, forecasts that the typical sale value will rise by 15 to 25 per cent within the subsequent 5 years:

“A crash happens with oversupply. It will not happen, because there isn’t enough inventory.”

2. The Solar Belt’s Reputation Continues To Rise

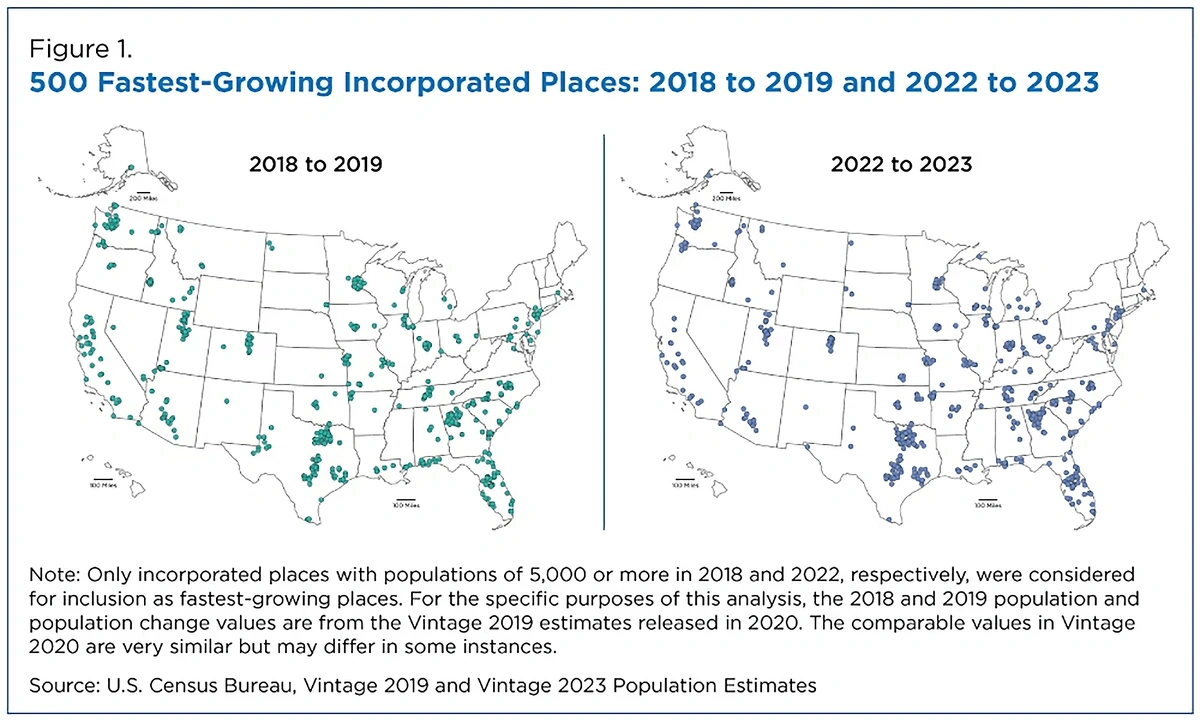

As People shift out of massive cities, one vacation spot they’re shifting to is the Solar Belt.

The pandemic strengthened the rising reputation of the Solar Belt, which is anticipated to persist for the foreseeable future.

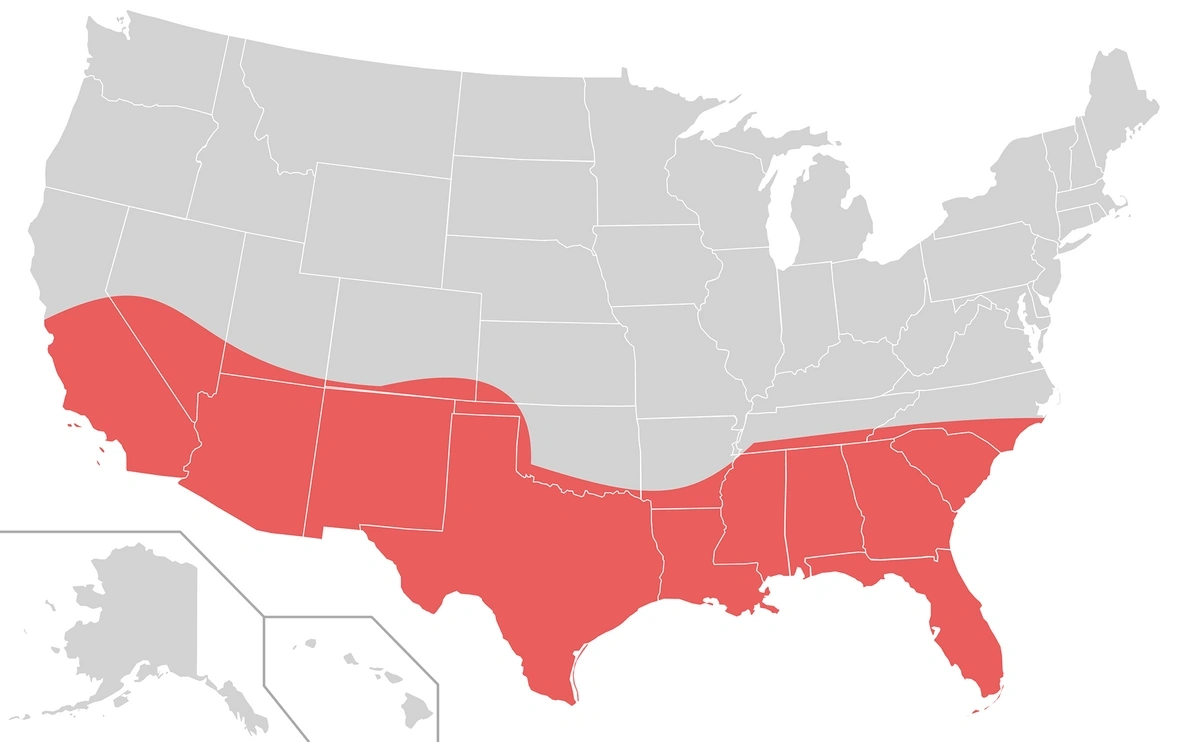

The Solar Belt is the swath of the US that stretches from California to North Carolina and encompasses 18 southern states in between.

Roughly 80% of the nation’s inhabitants development has been concentrated within the Solar Belt states.

And in keeping with one estimate, “The Sun Belt now holds about 50% of the national population (335 million), which is expected to rise to about 55% by 2040”.

The Solar Belt is trying to see elevated development over the following 10 years.

In addition to its enchantment to the retired set, the area can also be turning into more and more extra enticing to youthful professionals because of decrease taxes and extra reasonably priced housing costs and hire.

Moreover, even the largest Solar Belt cities provide more room in comparison with the highest US metro areas similar to New York.

The rising relocation and rising inhabitants within the Solar Belt have bolstered actual property markets within the area.

The expansion has not been restricted to single-family houses however has additionally translated to multifamily housing and business actual property.

Two main Solar Belt metro areas, Dallas and Tampa, are ranked within the high ten US cities with probably the most actual property potential.

Different fast-growing cities (Austin particularly) are positioned within the Solar Belt area too.

Then again, main metropolitan areas, like New York, Philadelphia, and San Francisco are seeing fluctuating actual property demand. Round one in 5 San Francisco dwelling homeowners are actually promoting their property for a loss.

3. Home Searching Goes Digital-First

The pandemic accelerated digitization throughout all sectors.

Searches for “digital transformation” are up 59% over the past 5 years.

And the true property market isn’t any exception.

Many consumers are actually capable of nearly tour property because of contemporary improvements and advances in expertise, similar to:

- 3D Excursions

- Drone movies

- Digital staging

* Replace chart *

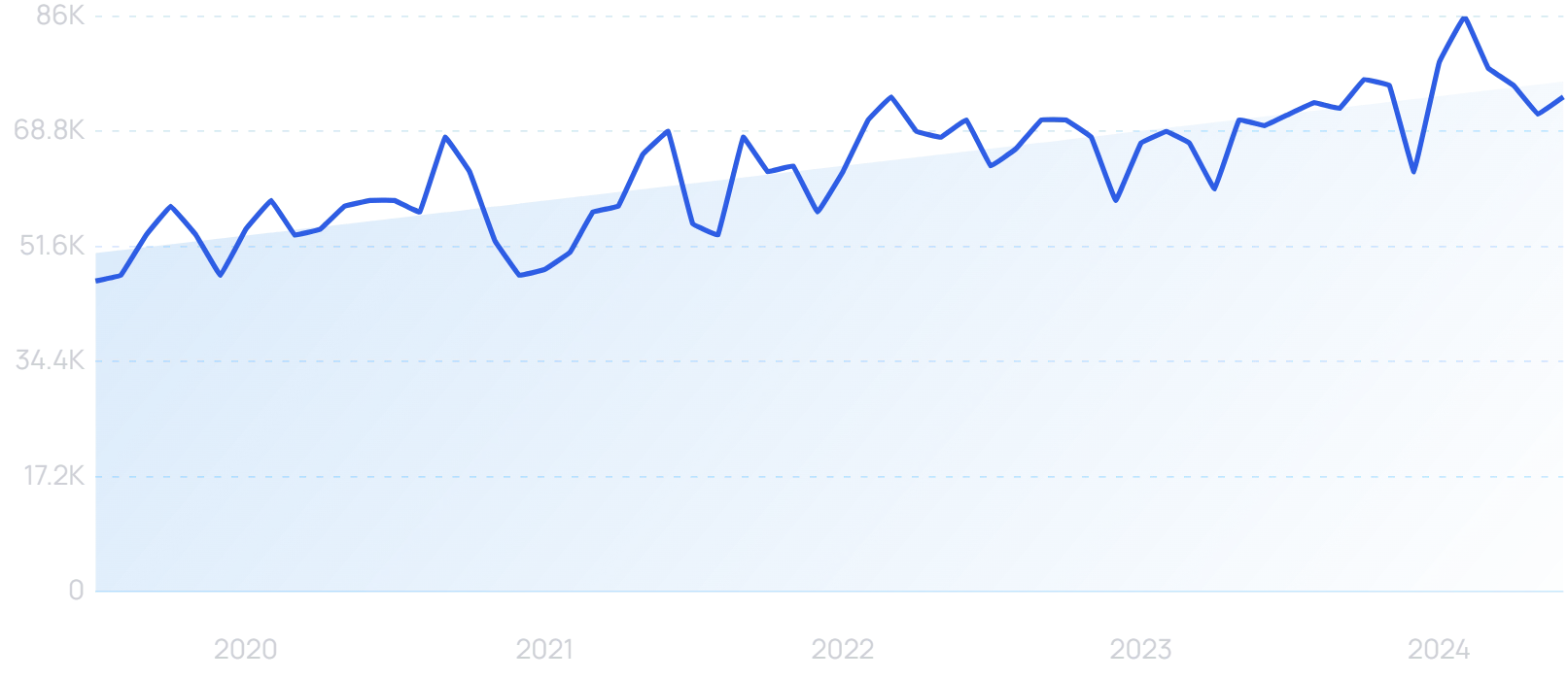

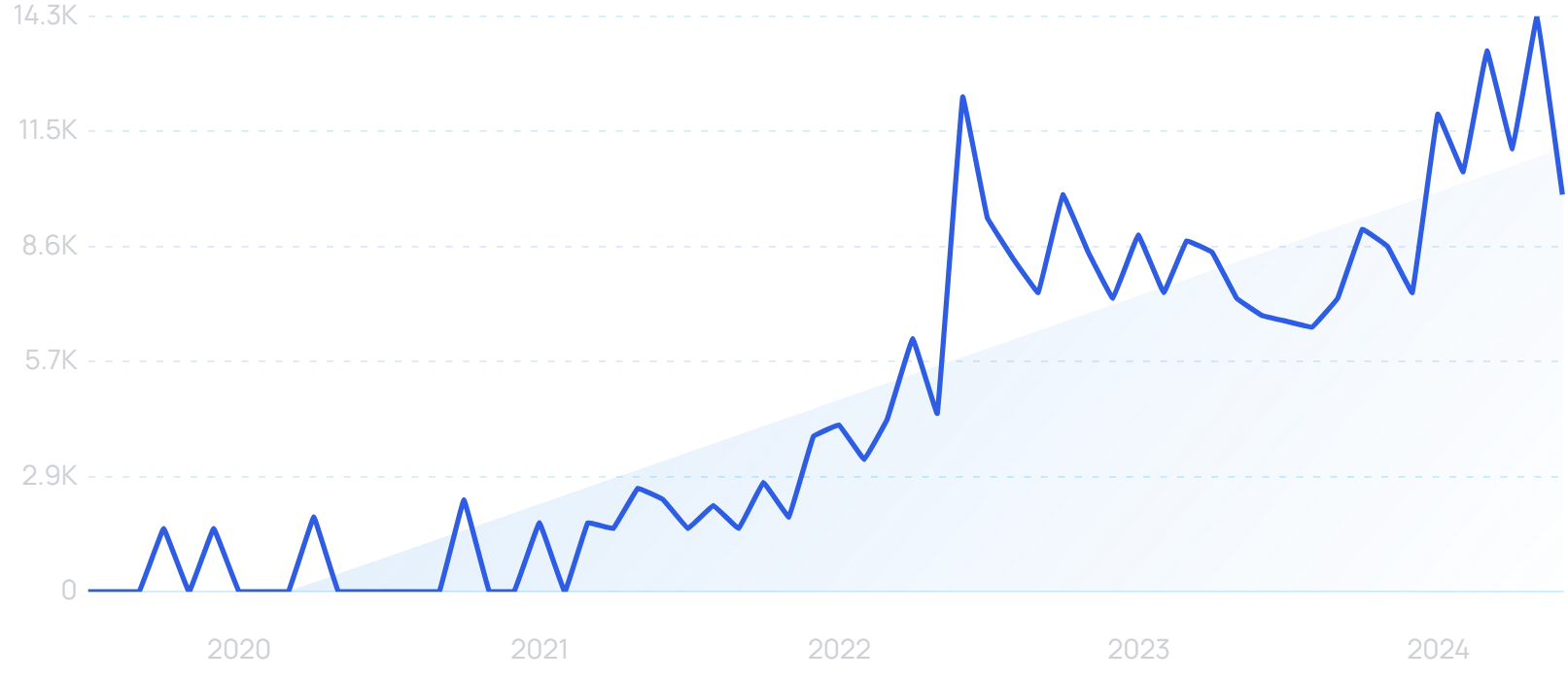

Searches for “virtual staging” are literally now increased than their pandemic peak.

On-line searches for “virtual staging”, which have been on the rise pre-pandemic, shot up in 2020.

Notably, searches for digital staging are literally considerably increased in 2024 (14,800 searches per 30 days) than they have been in 2020 (8,000 searches per 30 days).

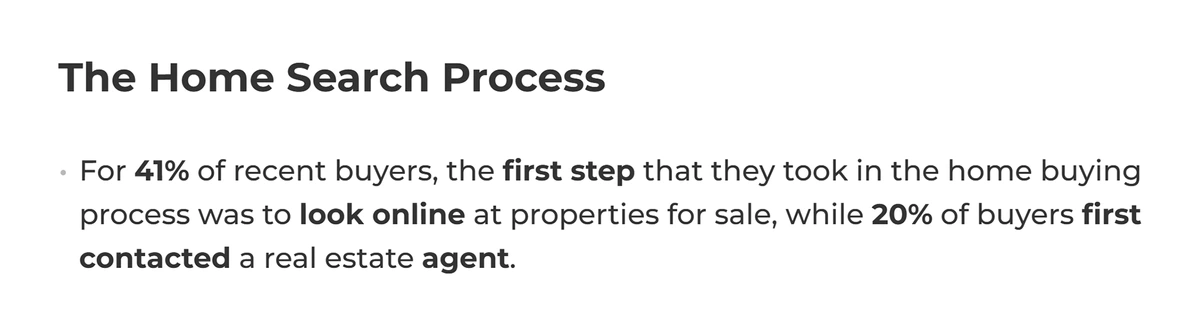

On-line instruments are actually ubiquitous in property looking. A Nationwide Affiliation of Realtors report discovered that each one consumers used the web within the search course of, with trying on-line step one for 41% of individuals.

On-line instruments are actually the go-to place to begin for greater than 4 in 10 individuals trying to purchase property.

Getting a mortgage could be completed on-line now too.

Huspy has initially centered on the UAE market. It permits customers to seek for a property and examine financing choices multi functional place, and has raised $37 million in Sequence A funding.

On-line searches for “Huspy” have climbed quickly because it was based.

Millennials, who’re infamous for his or her reliance on social media, are additionally turning to expertise to study extra about their new neighborhoods.

Web sites like Nextdoor enable residents of a specific space to remain in contact with different locals and sustain with neighborhood occasions.

4. People Transfer From Cities To The Suburbs

Whereas the shift has slowed because the peak of the pandemic, People are nonetheless shifting to the burbs in droves.

In actual fact, the US Census Bureau stories that People are persevering with to maneuver to smaller cities and the suburbs.

The US inhabitants is shifting away from city facilities and in direction of smaller cities and cities.

The 2 underlying causes for the shift are necessity and selection.

Those that can’t afford to remain are shifting out of necessity.

Whereas the rich are relocating by alternative.

Notably, the rise of distant work signifies that it is now not a requirement to stay and work in an enormous metropolis.

Final however not least, the suburbs are a horny vacation spot because of decrease taxes and cheaper housing and hire costs.

Some who’re shifting out of massive cities are in search of suburbs that retain among the massive metropolis really feel, areas that city planner Daniel Parolek refers to as “middle neighborhoods”.

Whereas the predominant characteristic of “middle neighborhoods” is the single-family dwelling, these areas additionally retain among the conveniences of an enormous metropolis, similar to multifamily housing choices, good public transportation, excessive walkability scores, buying, and eating places.

In keeping with Parolek, “middle neighborhoods” are tough to assemble from a rules perspective, however maybe this may begin to change sooner or later as demand for such areas will increase.

The shift from cities to suburbs can also be driving among the different actual property tendencies on this checklist.

Such because the rising reputation of the Solar Belt, rising median dwelling costs, and an total housing scarcity.

5. Single-Household Housing Demand Creates Shortages

The migration from cities to suburbs is leading to rising purchaser demand for single-family houses.

Nevertheless, provide does not look like catching up with demand.

Since 2012 there’s been a niche of over 7 million single-family houses.

New households outnumber new houses by greater than 7 million since 2012.

So as to meet demand, the present tempo of constructing would want to triple.

The demand for homes is compounded by one other coinciding development: Millennials coming into the house possession part of their lives.

Millennials trying to buy their first home or begin a household are additionally spurring suburban development.

In consequence, single-family housing stock stays at historic lows.

(The provision problem is exacerbated by the truth that institutional traders are shopping for roughly 8% of all houses available on the market).

Nevertheless, the market is projected to ultimately stabilize. And the tempo of recent building might meet up with the elevated demand. In Might 2024, privately-owned housing completions have been up 1% year-on-year.

The housing scarcity coupled with rising housing costs has been a boon for administration and building corporations.

6. Multi-Generational Residing Is On The Rise

Undoubtedly influenced by the squeeze on provide and rising costs, multi-generational dwelling has grow to be way more commonplace than it as soon as was.

Between 1971 and 2021, the variety of individuals dwelling in multi-generational households within the US quadrupled.

There’s an analogous development within the UK, the place the most recent census knowledge confirmed a 14.7% improve in grownup youngsters dwelling with their mother and father over the past 10 years.

But it surely’s not only a case of youngsters being unwilling or unable to maneuver out as a result of spiralling prices. Extra individuals are additionally dwelling with aged mother and father, in households that may span three or extra generations.

18% of individuals within the US aged 65 or over are in multi-generational households.

It’s a development additionally influenced by immigration, with 26% of Black and Hispanic People in a multi-generational dwelling setup, and solely 13% of White People.

7. Mortgage Charges See No Indicators Of Dropping

At first of January 2021, mortgage charges hit a file low of two.65%.

This prompted a spike in mortgage functions.

Nevertheless, in an effort to fight inflation, rates of interest have seen a number of will increase over the previous few years.

The typical 30-year fastened charge jumped to 7.08% in October 2022, and that determine has remained round 7% into 2024.

This sudden improve in rates of interest made shopping for a house costlier. And elevated month-to-month mortgage funds for these with variable mortgages.

Trying forward, the Fannie Mae Housing Forecast predicts that “We revised our mortgage rate forecast downward slightly month over month. We now forecast the 30-year fixed rate mortgage rate to average 6.6% in 2024, and to average 6.1% in 2025.”

Different specialists do predict charge drops over the following 12 months.

8. Rental Property Market Declines

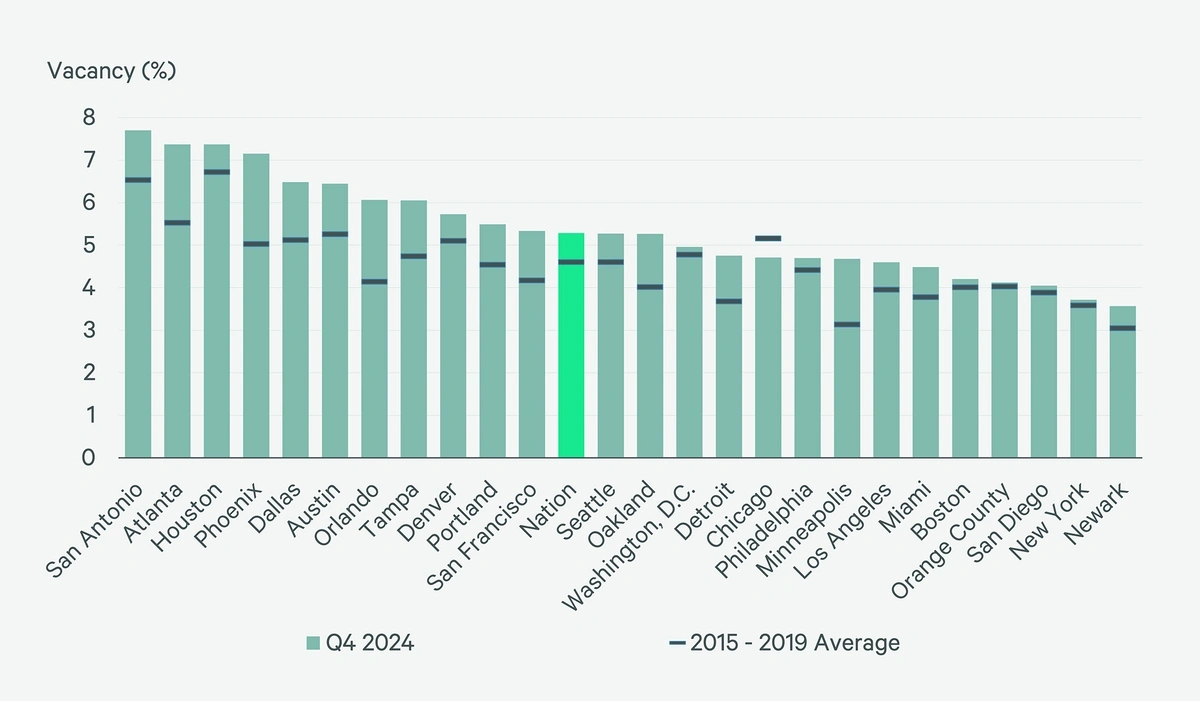

Partly as a result of shift of individuals from cities to suburbs, the rental marketplace for each residential and business properties in massive cities is on a slight decline.

In keeping with Zillow, total rental value development has settled right down to round 0.4% month-over-month. That peaked at 0.79% from August to September 2022.

Demand for rental properties will seemingly proceed to say no within the greatest cities. Individuals who can afford it look to purchase a home. Those that can’t achieve this search for different alternate options (like staying with their mother and father) to save cash.

Rental vacancies are duly rising in main metropolitan areas. Charleston, Memphis, Houston and Oklahoma Metropolis all have emptiness charges above 10%, putting them within the nationwide high 10.

Nevertheless, demand for rental properties is definitely going up in mid-size and smaller cities across the nation because the demand for houses in these areas outpaces the availability. Specialists have famous this development in secondary markets.

The downturn within the rental market is creating actual property funding alternatives.

Buyers may also benefit from business properties, similar to accommodations and retail buildings, and repurpose them into housing items.

9. Business Real Estate Panorama Stays In Flux

Workplace vacancies rose to 19.6% in This autumn 2023, the best on file and the most important quarterly surge because the begin of 2021.

Business actual property has been basically impacted by altering working patterns.

It’s necessary to not overstate the shift to distant work in relation to the business actual property market.

70% of People nonetheless choose a working association absolutely or largely in individual, a determine that truly rises amongst these aged 18-34, whose early working experiences have been formed by the pandemic.

However nor can the lasting results of Covid be ignored. Business actual property alternatives trending in a extra constructive path come within the type of retail and multi-family properties.

Tom LaSalvia, Head of Business Real Estate Economics at Moody’s Analytics CRE, says “Year over year, national level effective rent for neighborhood and community shopping centers is the highest it has been since before the onset of the pandemic in early 2020.”

And whereas supply of an estimated 440,000 new multi-family items in 2024 is anticipated to gradual development on this sector, building begins have already dropped by greater than 50% from their Q1 2022 peak.

Building of recent multi-family items is declining steeply

Conclusion

That wraps up our checklist of necessary actual property tendencies taking place proper now.

As extra individuals transfer to the suburbs and look to buy a house, single-family housing costs are anticipated to remain excessive and provide low.

Excessive mortgage charges might harm demand for houses, with inter-generational dwelling among the many alternate options being sought.

Within the meantime, the rental property market in massive cities will stay in decline, which can present alternatives for actual property traders planning for a post-pandemic restoration of metropolis life.

Properly-placed retail institutions are already benefiting from the inexperienced shoots of this restoration, though results on business workplace area are proving extra long-lasting.