Ethereum (ETH) derivatives merchants have reacted to the altcoin’s failure to maintain the $3,500 stage by rising their brief positions. This surge in bearish bets means that a majority of merchants anticipate additional worth declines for ETH.

Nonetheless, do different metrics align with this sentiment? This on-chain evaluation explores whether or not these merchants is likely to be making the proper name — or if the info hints at a possible rebound.

Ethereum Shorts Outpace Longs Amid Revenue-Taking

As of this writing, the liquidation map reveals that Ethereum derivatives merchants have opened brief positions totaling $918 million because the cryptocurrency’s worth drop yesterday.

In buying and selling, going lengthy or brief represents a dealer’s expectation of worth motion. Opening a protracted place suggests the dealer believes the value will rise. Going brief, alternatively, signifies that they anticipate a decline.

At the moment, ETH lengthy positions are valued at roughly $218 million, highlighting that shorts have considerably outpaced bullish publicity by $700 million. Nonetheless, you will need to notice that if Ethereum’s worth rallies towards $3,700, most of those positions with excessive leverage may face liquidation.

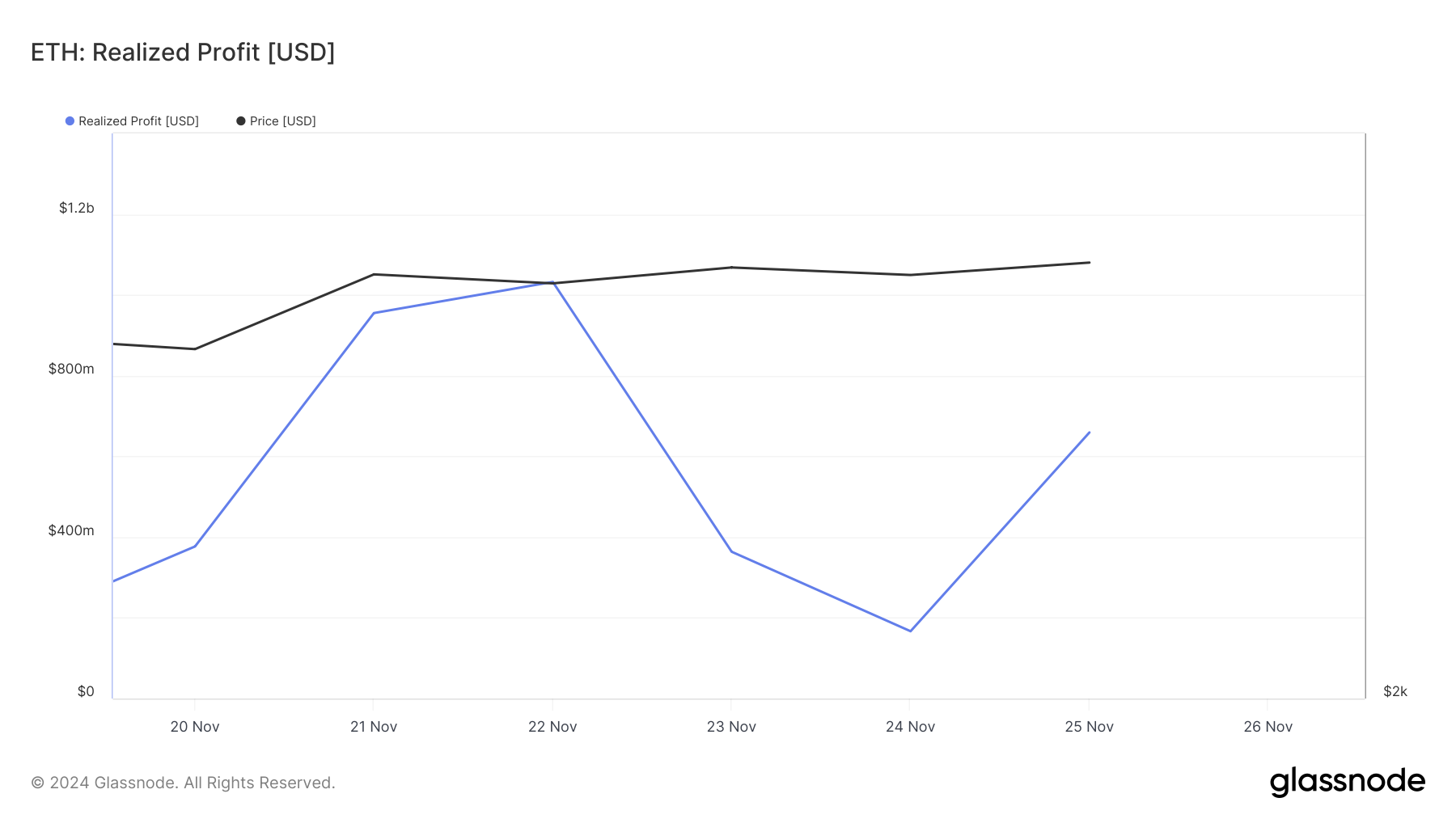

Nonetheless, knowledge from Glassnode means that these merchants might not face liquidation until a major rebound happens. That is primarily because of the rise in realized income, which signifies that merchants have locked in features by promoting or transferring belongings at the next worth.

As of press time, Ethereum’s realized income had surged to $659.22 million, suggesting that almost all shorts have capitalized on the value motion and could also be much less susceptible to liquidation within the brief time period.

ETH Value Prediction: Bearish

Since November 16, ETH’s worth has been buying and selling inside an ascending channel. An ascending channel is a chart sample shaped by two upward pattern traces, one drawn above the value (resistance) and the opposite under (help).

This sample signifies that the value is transferring larger inside an outlined vary. The help line exhibits the place the value tends to bounce larger, and the resistance line marks the place the value faces promoting stress.

As seen under, ETH, at $3,314, has dropped under the help line. If promoting stress intensifies, the cryptocurrency’s worth is prone to sink to $3,033.

Nonetheless, Ethereum derivatives merchants must be careful. Ought to the altcoin fail to drop under $3,220, this may not occur. As a substitute, the worth may rise to $3,547 and probably climb to $4,000.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.