On December 4, the Altcoin Season Index hit 88, suggesting that non-Bitcoin cryptocurrencies would possibly carry out higher than the primary coin. Nevertheless, the altcoin season probabilities may need been dealt an enormous blow.

Regardless of that, it seems that the much-anticipated season would possibly nonetheless come again. Listed below are three indicators suggesting that most of the high 50 cryptos would possibly quickly see notable hikes.

Alts Will get Pushed Down Once more

Altcoin season refers to a interval when altcoins outperform Bitcoin by way of market cap progress. The Altcoin Season Index measures this development, figuring out whether or not 75% of the highest 50 cryptocurrencies are outperforming Bitcoin.

Sometimes, an index worth above 75 indicators the onset of altcoin season, whereas a worth at 25 displays Bitcoin dominance. Nevertheless, as of now, the index has dropped to 49, highlighting a setback for altcoins as Bitcoin regains a stronger foothold out there.

However regardless of the drawdown, it doesn’t seem that the alt season is over. One indicator suggesting that is Bitcoin dominance.

A rise in Bitcoin dominance typically signifies a rising choice for Bitcoin over altcoins, significantly in periods of market uncertainty. This development means that traders see Bitcoin as a safer possibility, given its relative stability and established market place.

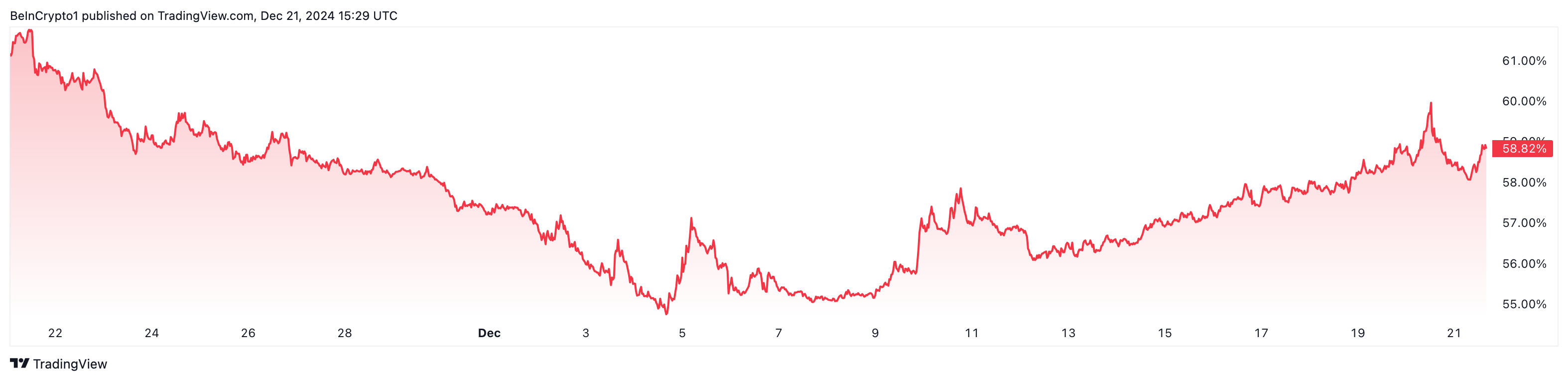

As dominance rises, curiosity in smaller cryptocurrencies could decline, probably resulting in lowered capital inflows for altcoins. Some weeks again, Bitcoin’s dominance climbed to 62%, suggesting that altcoins won’t proceed to play second-fiddle

However on the time of writing, it has dropped to 58.82%, indicating that altcoins have taken some share of management. Ought to the decline proceed, then BTC costs would possibly drop whereas altcoin costs would possibly soar.

The Altcoin Market Cap Nonetheless in Line to Rally

The TOTAL2 market capitalization, which tracks the highest 125 altcoins, has not too long ago dropped to $1.35 trillion, suggesting that non-Bitcoin belongings are underperforming. This decline typically indicators that altcoin season could also be delayed, with Bitcoin dominating the market.

Nevertheless, there’s a silver lining: the TOTAL2 has damaged above a descending triangle, signaling a possible development reversal. Whereas the altcoin season could face setbacks for now, this breakout implies that altcoins would possibly achieve momentum if quantity begins to rise.

Ought to this quantity decide up, TOTAL2’s market cap may climb to $1.65 trillion, signaling the revival of altcoin season probabilities and probably driving costs increased.

Disclaimer

Consistent with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.