This can be a joint weblog with Michael Weilandt.

It’s an undisputed undeniable fact that American pharmaceutical costs are the very best on the earth.

Extra on:

Economics

Worldwide Finance

Fiscal Coverage

Prescribed drugs and Vaccines

Huge pharmaceutical firms argue that that is important to sustaining pharmaceutical innovation (Novo Nordisk suggests in any other case, however that’s a distinct argument).

Funds hawks argue that there are simple financial savings available from becoming a member of the remainder of the world in utilizing the federal government’s buying energy to strike a greater deal.

However nobody doubts that U.S. costs are excessive.

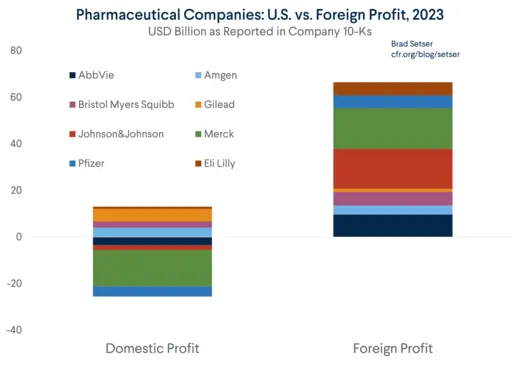

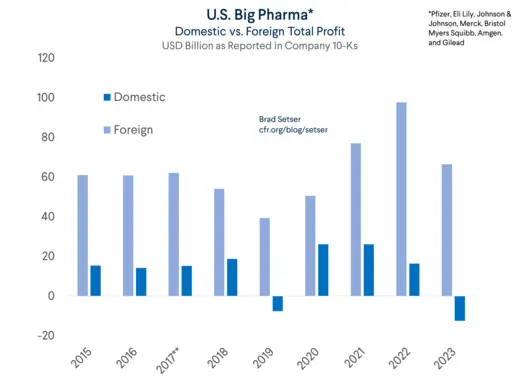

Nevertheless, these excessive costs don’t translate into excessive reported income in the USA. Slightly, the opposite: giant pharmaceutical firms usually report shedding cash within the U.S.

No must take our phrase for it.

Extra on:

Economics

Worldwide Finance

Fiscal Coverage

Prescribed drugs and Vaccines

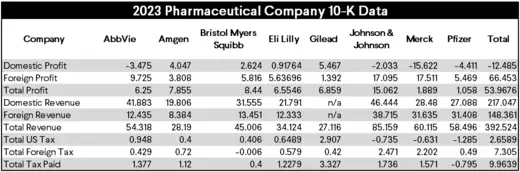

In 2023, Pfizer reported shedding $4.4 billion in the USA, AbbVie $3.5 billion, Merck $15.6 billion, and Johnson & Johnson $2.03 billion. Of the most important U.S. corporations, solely Eli Lilly seems to have eked out a small ($0.9 billion) revenue in the USA.*

This isn’t an aberration. Massive American pharmaceutical firms constantly report modest income within the U.S., and huge income overseas (although drug costs and income are a lot larger in the USA). 2023 is not any completely different than 2022 or, for that matter, 2021.

For a complete have a look at the 10-Okay knowledge, consult with the desk on the finish of this weblog.

So excessive costs surprisingly appear to correlate with giant losses. This, in fact, is a transparent signal that pharmaceutical firms stay in a world marked by switch pricing and tax arbitrage.

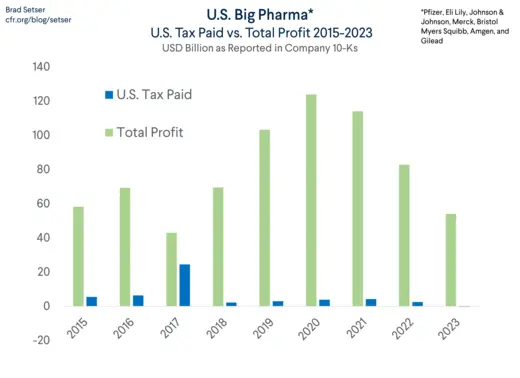

Losses within the U.S., in flip, translate into a really small U.S. revenue tax legal responsibility.

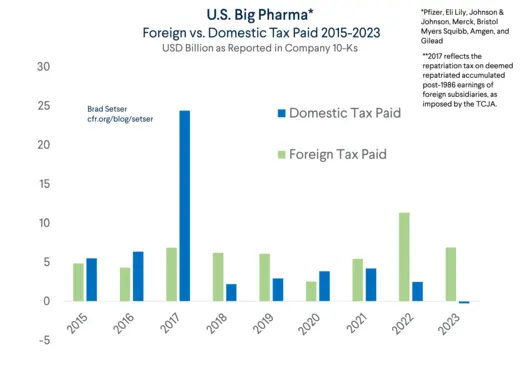

Most pharmaceutical firms do pay some tax globally. Most appear to pay efficient tax price of 10 to fifteen p.c absent tax losses tied to a serious buy or a big reorganization (2023 had lots of fees associated to the reorganization of corporations’ operations in Puerto Rico). However these firms sometimes don’t pay the majority of their revenue tax invoice in the USA.

Once more, no must take our phrase for it.

Pfizer, Johnson & Johnson, and Merck all had no U.S. tax legal responsibility in 2023 (they’ve some tax losses to hold ahead although).

AbbVie did pay a little bit of U.S. tax, although it books the entire income on its blockbuster drug Humira in Bermuda for one easy cause: Bermuda has no company revenue tax. AbbVie thus owed the USA a little bit of World Intangible Low-Taxed Earnings (GILTI) tax.**

Sum up the reported U.S. tax paid of the highest eight pharmaceutical firms (by income) and their mixed U.S. tax legal responsibility in 2023 was… zero. Adverse $1.3 billion to be exact.

One small disclaimer: Eli Lilly’s disclosure is much less complete, however we had been capable of estimate the foreign-domestic cut up by utilizing the reported share of home and Puerto Rican revenue relative to the whole.

2023 isn’t actually all that uncommon. Tax paid within the U.S. in 2022 was optimistic largely due to Pfizer’s extraordinary vaccine income (there’s cause to imagine that Pfizer wasn’t capable of shift these income out of the U.S., because the U.S. roughly financed the preliminary manufacturing, which was largely accomplished at residence).

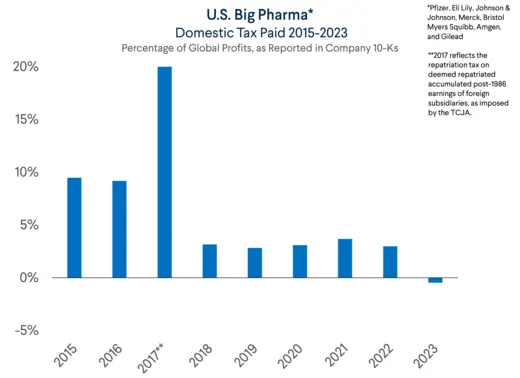

The broad development right here is obvious: pharmaceutical firms are making extra money than they did earlier than the Tax Cuts and Jobs Act (TCJA), however they’re paying much less tax within the U.S. than they did earlier than that laws.

The typical efficient tax price paid within the U.S. (so U.S. tax paid versus international revenue) was solely 3 p.c from 2018 to 2022, effectively beneath the standard efficient tax paid within the US earlier than the Tax Cuts and Jobs Act (see the work of Senator Wyden and his employees for extra particulars). The massive improve in tax paid in 2017 within the chart beneath was the one-off funds tied to the transition out of the previous regime of indefinite deferral of international income to the brand new regime of a 21 p.c headline price, semi-territorial taxation and a ten.5 p.c “GILTI” minimal.

I say this to not criticize the authors of the TCJA however reasonably as a result of there now must be a bipartisan consensus to reform the TCJA in order that American corporations that generate profits within the U.S. really pay tax within the U.S.

This can be a separable concern from the extent of company revenue tax.

Be it 15 p.c, 21 p.c, or 28 p.c—American firms should a minimum of pay that tax on their U.S. operations and gross sales.***

That is an achievable aim; there are literally methods to reform the tax code to power firms promoting medicine developed within the U.S. and offered to U.S. patrons to pay tax within the U.S.

Within the course of, pharmaceutical firms would really be incentivized to supply their most superior, patent-protected medicines within the U.S. reasonably than Eire, Belgium, Singapore, or Switzerland. Proper now, offshore manufacturing helps create the authorized foundation for reserving income on items offered within the U.S. by a U.S. firm offshore.

That is an “America first” proposal—it creates incentives to supply superior medicines within the U.S. and within the course of pay tax in the USA

Why are we so certain that this a sensible final result of a well-designed tax coverage?

Easy. We all know that Novo Nordisk, now Europe’s most beneficial firm—and a extremely revolutionary one—really pays tax in Denmark on the Danish company revenue tax price. That’s what it discloses in its annual report (see web page 9).

Swiss pharmaceutical firms additionally are inclined to pay the majority of their company revenue tax in Switzerland; French ones pay most of their tax in France.

Solely the U.S. has a tax code that permits American pharmaceutical firms to be a bigger a part of the tax base of Eire, Belgium, Bermuda, Malta, Hungary, Singapore, and Switzerland than the USA itself. Tax paid outdoors the USA now constantly exceeds tax paid inside the USA. It’s, as they are saying on the opposite aspect of the Atlantic, an “own goal.”

As an apart, Apple additionally now pays extra company revenue tax outdoors the U.S. (principally in Eire) than within the U.S. (see notice 7 in its 2023 10-Okay submitting). This isn’t only a “pharma” concern.

It’s, nonetheless, a difficulty that more and more requires an answer. The present tax code for pharma is a mixture of dangerous tax coverage, dangerous provide chain resilience coverage, and dangerous industrial coverage.

Now for the boring bits – how does large pharma shift revenue on U.S. gross sales abroad?

The reply is threefold:

a) The 2017 tax code created a a lot decrease tax on international income than U.S. income, encouraging corporations to search out methods to e book income overseas.

b) Producing prescribed drugs on the market within the U.S. outdoors the U.S. lets pharmaceutical firms faux that the income accrue to the placement of manufacturing (or the placement of the mental property rights), not the U.S.

c) Pharmaceutical firms are expert at shifting their mental property out of their U.S. headquarters to wholly owned subsidiaries positioned in low-tax jurisdictions.

To make this concrete, take into account AbbVie’s tax construction.

AbbVie isn’t distinctive, however its construction is very well-known because of the investigative work of the Senate Finance Committee, in addition to some previous tax litigation.

AbbVie produces Humira in Puerto Rico, a jurisdiction which for complicated causes is taken into account non-U.S. for revenue tax functions. It doesn’t, nonetheless, e book giant income in Puerto Rico. Slightly, AbbVie’s Puerto Rico subsidiary pays giant royalties to its Bermuda subsidiary.

AbbVie thus books the majority (99 p.c in 2022) of its revenue in Bermuda, which doesn’t accumulate any company revenue tax.

Earlier than the TCJA, AbbVie needed to transfer dividend funds from AbbVie Bermuda to AbbVie U.S. to cowl its U.S. working loss. It thus was not capable of indefinitely defer everything of its Bermuda revenue and paid some U.S. tax on the headline 35 p.c tax price.

After the TCJA, AbbVie has to pay a top-up tax to carry its general tax price on its worldwide revenue as much as 10.5 p.c. It could actually web any international tax it pays outdoors of Bermuda towards its U.S. GILTI tax legal responsibility. That is known as “blending,” and it must be ended. The GILTI tax must be imposed on a jurisdiction-by-jurisdiction foundation, reasonably than on the combination of an organization’s international revenue. The present construction permits corporations like AbbVie to mix revenue from low- or zero-tax jurisdictions with revenue from non-tax haven international operations (say, in Germany, France, or the UK), thereby decreasing their general tax legal responsibility.

AbbVie’s broad construction is commonplace: produce outdoors the (authorized) U.S. and e book revenue outdoors the U.S. Most firms have now moved away from Puerto Rico, however there’s nothing in any other case atypical about this tax construction.

It is usually all completely authorized. It simply shouldn’t be.

A easy precept is that U.S. firms ought to pay income on their U.S. gross sales within the U.S. Frankly, below source-based taxation, they really must be paying tax on all of the medicine developed within the U.S. within the U.S., not simply the income from their U.S. gross sales.

That, sadly, isn’t the noticed final result of the TCJA, six years in.***

* Eli Lilly doesn’t straight report its earnings by geographical location in its 10-Ks, however it does embrace language for a adequate estimate. Extra particularly, it discloses the annual percentages of “consolidated income before taxes” that was generated by Home and Puerto Rican firms.

** World Intangible Low Tax revenue (GILTI), the U.S. model of a worldwide minimal tax created within the TCJA. I’ve been recognized to name it the Pharma Tax Cuts and Irish Jobs Act, because it generated highly effective incentives to supply medicine for the U.S. market in low-tax jurisdictions like Eire and Singapore.

*** U.S. pharmaceutical firms are making between $70 and $100 billion a yr, so the ten-year income estimate from getting large pharma to pay tax within the U.S. is just not trivial.

**** Of us like Bob Lighthizer who care about bilateral commerce deficits must be pushing this, as prescribed drugs are an enormous cause for the usruns a big bilateral deficit with Eire and Switzerland. American pharmaceutical firms producing in Singapore reasonably than the U.S. for the Asian market additionally add to the U.S. bilateral commerce deficits in Asia, as US firms are producing exports for Singapore not the USA.