ApeCoin has seen its value surge 50% within the final 24 hours following the launch of its cross-network bridge and different ecosystem developments.

ApeCoin (APE), the governance token of the APE ecosystem, rose from $1.21 to $1.53 its six-month excessive over the previous day whereas its market cap surpassed the $1.1 billion mark.

The current value rally of ApeCoin can primarily be attributed to the launch of ApeChain, a brand new Layer-3 blockchain. The cross-chain bridge permits seamless transfers of APE, Wrapped Ethereum (WETH), USD Coin (USDC), Tether (USDT), and Dai (DAI) between ApeChain, Ethereum (ETH), and Arbitrum (ARB) networks.

Following its launch, APE’s utility has expanded inside the Yuga Labs ecosystem, the agency behind widespread NFT collections just like the Bored Ape Yacht Membership. With the brand new bridge, APE tokens can now be used for yield farming, enabling holders to robotically generate returns on APE, ETH, and stablecoins, thereby including to the token’s utility.

Because the native gasoline token of ApeChain, APE performs a central function in paying transaction charges, voting inside ApeCoin DAO, and serving as a fee methodology in Yuga Labs’ titles and real-world purchases.

Moreover, ApeCoin just lately launched a sensible contract replace, integrating the LayerZero Omnichain Fungible Token (OFT) commonplace, which permits APE to perform as a governance token for ApeCoin DAO and facilitates transaction charges throughout a number of chains.

A number of commentators on X famous that the current surge in APE got here as buyers more and more purchased the token amid the concern of lacking out on making vital positive aspects. Sometimes at any time when a meme coin crosses the $1 billion mark, buyers anticipate a parabolic rise in its value pushed by growing perception within the token because it turns into much less prone to be manipulated or be rug pulled.

The Relative Power Index and Stochastic RSI for APE have been each above overbought ranges at press time, which usually means a correction may very well be on the horizon. Nevertheless, within the case of meme cash sustained curiosity from merchants may help push costs larger as beforehand seen with a number of of ApeCoin’s contenders like POPCAT and WIF.

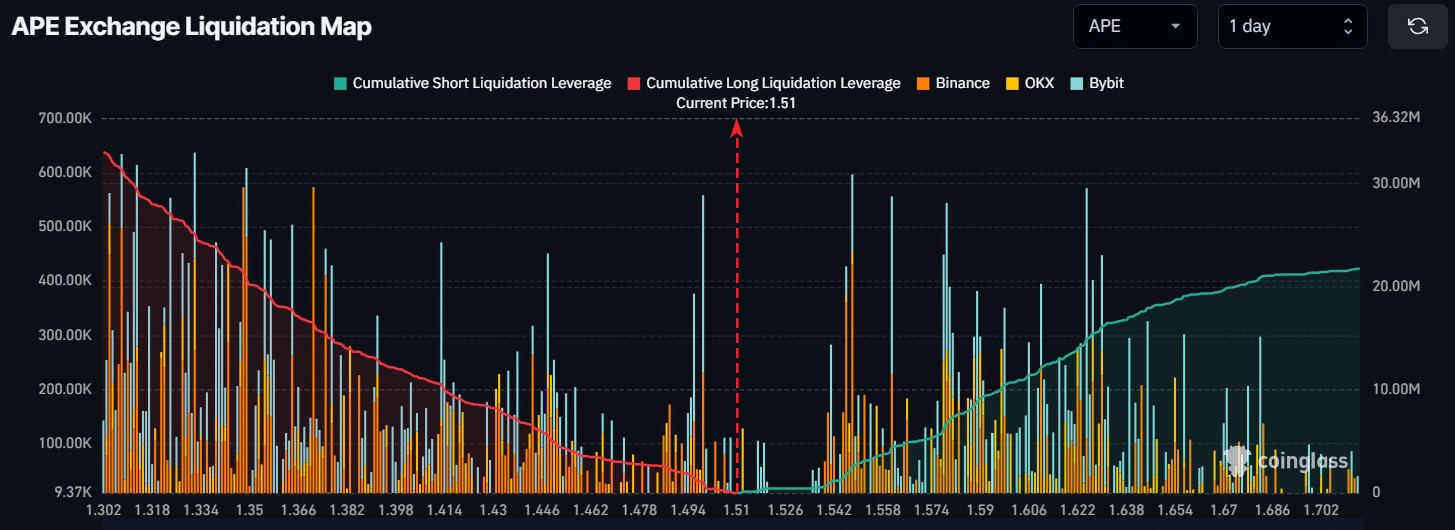

At the moment, the important thing liquidation ranges for APE are $1.548 on the upside, with most intraday merchants leveraging round this degree, per knowledge from CoinGlass. If APE rises to $1.548, this might result in the liquidation of about $2.59 million briefly positions.