Ethereum Layer-2 community Arbitrum (ARB) noticed a big rise in its buying and selling quantity, pushed by anticipation of a serious occasion scheduled for August 16.

Because the occasion nears, traders will need to know the way ARB’s value will react. This on-chain evaluation examines the outlook.

Arbitrum’s Huge Day Drives Rising Market Curiosity

Information from Santiment revealed that Arbitrum’s buying and selling quantity was round $146 million on August 11. Within the early hours of August 13, the quantity had surpassed $260 million earlier than its current drop.

Buying and selling quantity represents the full worth of cryptocurrencies purchased and bought inside a selected interval. A rise in quantity signifies sturdy curiosity within the token, whereas a decline suggests fading investor curiosity.

Quantity additionally displays market power. Excessive buying and selling quantity reinforces the value pattern, whereas low quantity weakens it.

Learn extra: What Is Arbitrum?

At press time, ARB is buying and selling at $0.57. This displays a 14% enhance over the previous seven days however a 1.63% decline within the final 24 hours. Primarily based on the basics, if buying and selling quantity continues to lower, the downtrend might ease.

Arbitrum has just lately made headlines. The altcoin reached an all-time low in the course of the crypto market crash on August 5. Shortly after, international asset administration agency Franklin Templeton expanded its cash fund to Arbitrum.

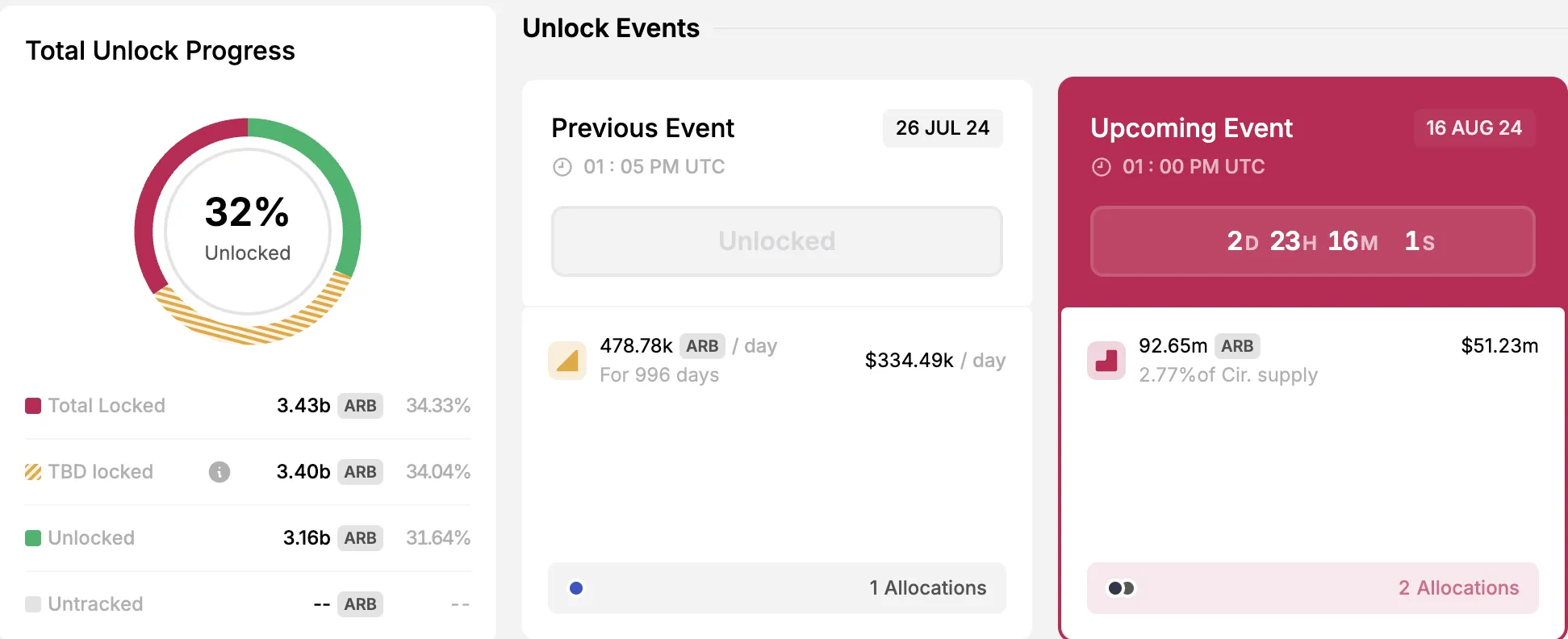

Whereas these are vital occasions, the upcoming token unlock is probably going driving the heightened market curiosity in ARB. In line with Token Unlocks, Arbitrum will launch one other 2.77% of its circulating provide on August 16. On the present value, these tokens are valued at roughly $51.2 million.

Typically, token unlocks trigger a giant market shakeup for altcoins. If demand doesn’t enhance in the course of the occasion, the unlock can set off a notable provide shock and a potential value lower. For ARB, the following two days will inform if the value will proceed to react negatively or recuperate.

ARB Value Prediction: The 1% in Earnings Might Quickly Be Zero

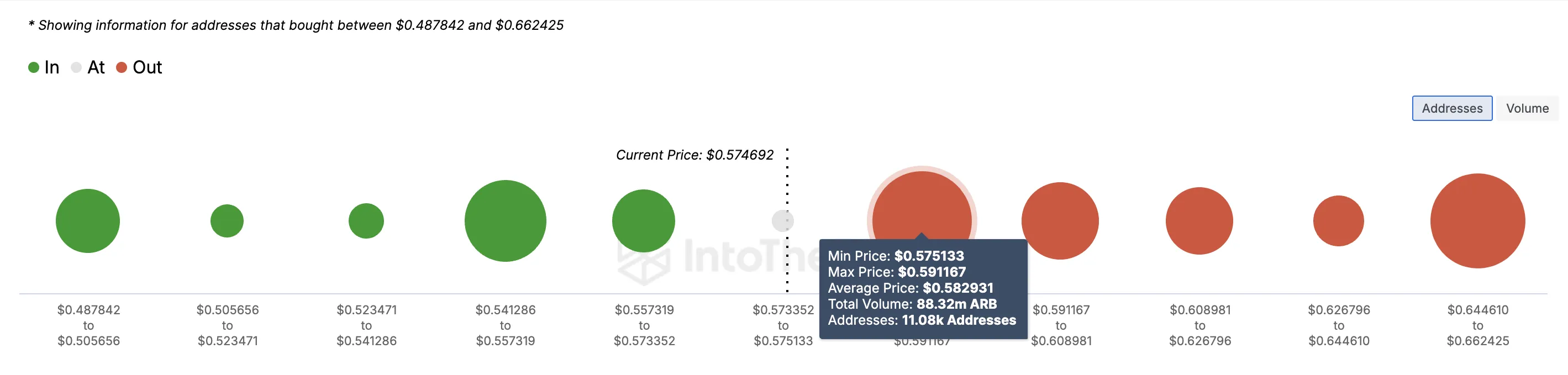

In the meantime, the In/Out of Cash Round Value (IOMAP) indicator gives priceless insights right into a cryptocurrency’s value potential. The IOMAP categorizes addresses based mostly on whether or not they’re being profitable on the present value, breaking even, or holding at a loss.

The indicator does this by figuring out the common value at which these tokens had been bought. Presently, only one% of ARB holders are in revenue, whereas 97% are holding the token at a loss.

Typically, the higher the variety of addresses at a selected value vary, the stronger the help or resistance. As of now, over 11,000 addresses maintain 88.32 million ARB tokens at a loss, with a median on-chain value foundation of $0.58.

In distinction, simply over 3,000 addresses maintain 16.78 million ARB tokens in revenue, having bought them at round $0.56. Due to this fact, if ARB’s value nears $0.58, lots of these holding at a loss might select to promote, creating potential resistance.

Learn extra: 5 Greatest Arbitrum (ARB) Wallets in 2024

If this occurs, Arbitrum’s market worth might drop to $0.55, the place the following help degree lies.

Nonetheless, Ethereum (ETH) is perhaps a saving grace for ARB. As a result of sturdy correlation between the 2 initiatives, an increase in ETH’s value might raise ARB as properly, doubtlessly invalidating the bearish outlook.

Disclaimer

In step with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.