The native cryptocurrency of the Avalanche blockchain is at the moment buying and selling at a crucial juncture amid dealer indecision, as downward forces threaten to set off a bearish near July.

Avalanche (AVAX) is at the moment buying and selling at a decisive juncture, altering fingers at $26.99, down greater than 6% over the previous 24-hours and over 11% this week.

AVAX has been experiencing important worth volatility over the previous 4 months, with notable traits evident in each the every day and weekly charts. On the every day chart, we will see a pronounced correction from the asset’s peak close to $65.39 in March 2024.

This peak was adopted by a steep decline, reaching a low of $21.8 in April. Earlier than the collapse to this mark, AVAX bulls mounted strong protection just a few days into the tip of March. This protection got here on the again of elevated adoption information for Avalanche after the challenge introduced participation in a partnership between a banking group and Chainlink Labs.

The drop beneath the $22 mark pushed AVAX beneath Toncoin (TON) on the record of largest property and created a crucial assist degree, as the worth discovered some stability and commenced a gentle restoration. Furthermore, the Bollinger Bands point out durations of consolidation, significantly between $29.24 and $41.80, suggesting a range-bound market throughout this part.

Notably, the latest motion has proven AVAX hovering across the $27 mark, with a slight rebound famous from the June low. Nonetheless, the worth stays beneath key Fibonacci retracement ranges, significantly the 0.236 degree at $32.03.

This resistance degree, mixed with the proximity to the decrease Bollinger Band, suggests cautious buying and selling sentiment. The Klinger Oscillator signifies blended indicators. A stronger optimistic divergence could be required to substantiate a extra sustained bullish reversal.

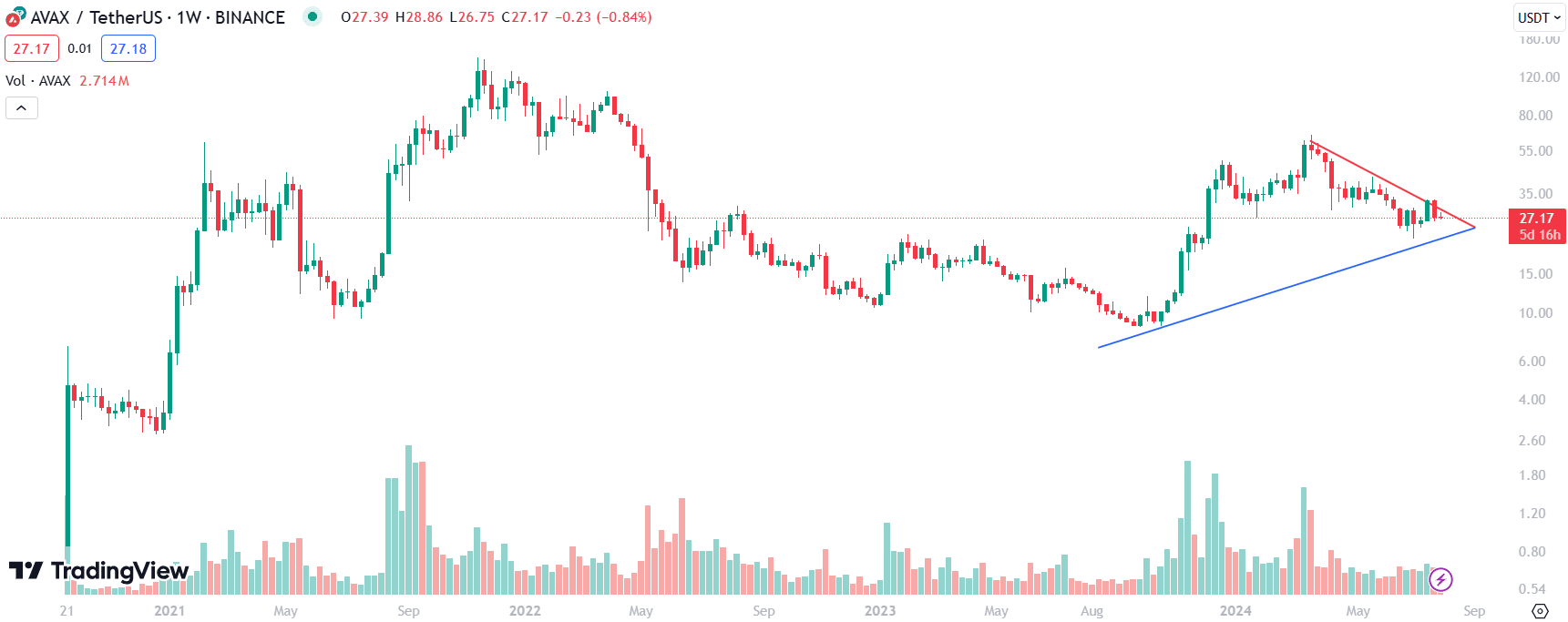

AVAX varieties symmetrical triangle on weekly chart

In the meantime, on the weekly chart, Avalanche has witnessed the formation of a long-term symmetrical triangle. This sample normally signifies a possible breakout route. The resistance line, sloping downward from the March excessive, intersects with a rising assist line from the historic lows of round $8.72 in September 2023.

The present worth place close to the apex of this triangle suggests an imminent breakout, although the route stays unsure. AVAX can also be witnessing reducing quantity, indicating a interval of market indecision. In the meantime, Avalanche’s native cyptocurrency is on the verge of closing July with a 7% drop.

Nonetheless, the discount in quantity usually precedes a big worth motion as merchants await affirmation of the breakout route. The crucial ranges to observe could be the native excessive of $41.8 for a bullish breakout and the assist zone close to $21.80 for a bearish breakdown.

Information from IntoTheBlock on the amount of huge buys and sells confirms the indecision available in the market. Notably, bulls have bought 25.82 million AVAX over the previous week, whereas bears have offered 25.64 million tokens throughout this era.

A break above the $40 mark might sign a bullish continuation, doubtlessly concentrating on $55.85, which aligns with the 78.6% Fibonacci degree. Conversely, a drop beneath the $21.80 assist might set off additional declines, presumably revisiting earlier lows.