By some measures, bank cards have by no means been this costly. For cardholders who carry a steadiness with out paying it off in full every month, issuers typically cost curiosity primarily based on annual proportion charges (APRs). In 2022 alone, main bank card firms charged over $105 billion in curiosity, the first price of bank cards to customers. Whereas the results of will increase to the goal federal funds charge have obtained appreciable consideration, the typical APR margin (the distinction between the typical APR and the prime charge) has reached an all-time excessive.

On this evaluation, we present that greater APR margin drove about half of the rise in bank card charges during the last decade. In 2023, extra APR margin might have price the typical cardholder over $250. Main bank card firms earned an estimated $25 billion in extra curiosity income by elevating APR margin. Will increase to the typical APR margin – regardless of decrease charge-off charges and a comparatively secure share of subprime debtors – have fueled issuers’ profitability for the previous decade. Increased APR margins have allowed bank card firms to generate returns which might be considerably greater than different financial institution actions.

Bank card common APR margin is the best on document.

Over the past 10 years, common APR on bank cards assessed curiosity have nearly doubled from 12.9 p.c in late 2013 to 22.8 p.c in 2023 — the best degree recorded because the Federal Reserve started accumulating this information in 1994. The APR on most bank card accounts will be seen as being composed of the prime charge and the APR margin. The prime charge (a benchmark most banks use to set charges) represents an excellent proxy for banks’ funding prices, which have elevated in recent times. However bank card issuers have additionally sharply elevated common APRs past adjustments within the prime charge.

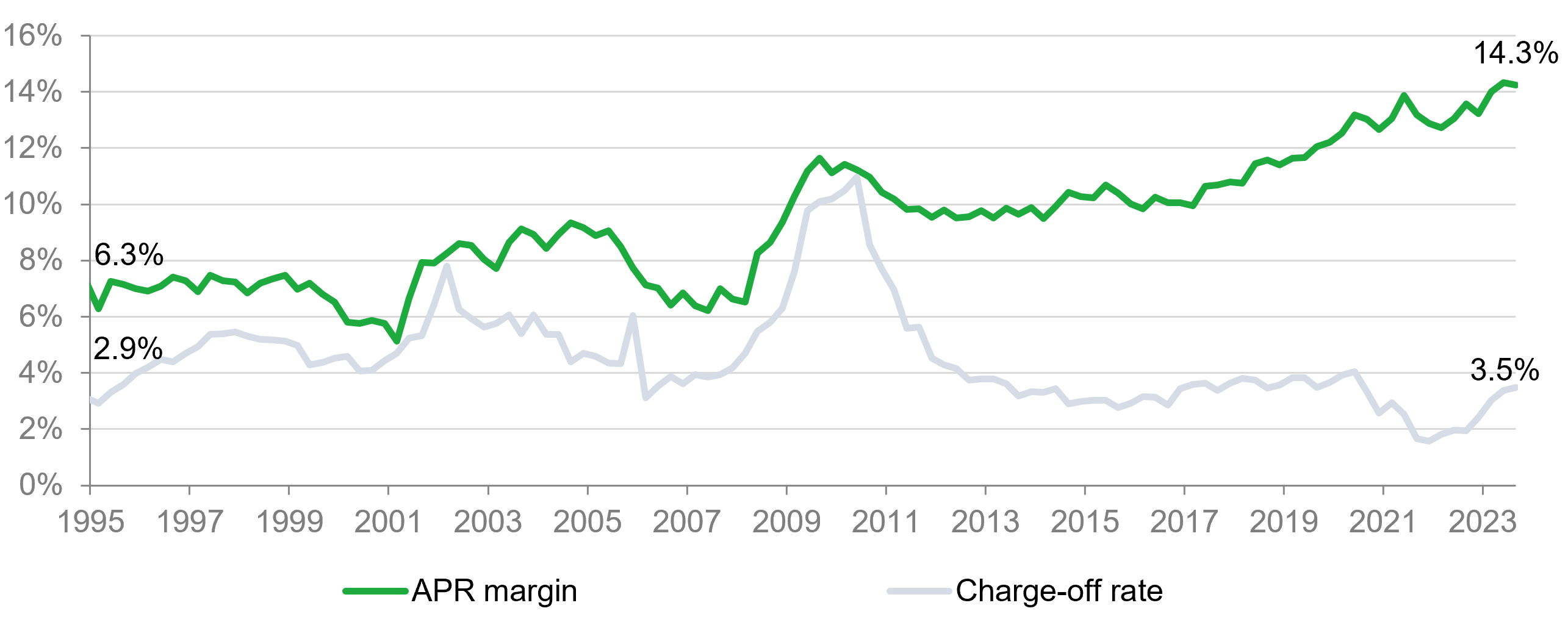

Almost half of the rise in common APR during the last 10 years has been pushed by issuers elevating their APR margin. APR margin for revolving accounts is now at 14.3 p.c, the best level in latest historical past. Greater than half of issuers despatched gives by unsolicited mail with the next APR margin within the third quarter of 2023 than on the identical product the 12 months earlier than, based on our evaluation of Competiscan information.

Determine 1: Common APRs on Accounts Assessed Curiosity and Common Prime Fee at Yr Finish

Supply: Federal Reserve

Increased APR margin has fueled the profitability of revolving balances.

Usually, card issuers set an APR margin to generate a revenue that’s no less than commensurate with the danger of lending cash to customers. Within the eight years after the Nice Recession, the typical APR margin stayed round 10 p.c, as issuers tailored to reforms within the Credit score Card Accountability Duty and Disclosure Act of 2009 (CARD Act) that restricted dangerous back-end and hidden pricing practices. However issuers started to step by step enhance APR margin in 2016. The pattern accelerated in 2018, and it continued via the pandemic.

Over the previous decade, card issuers elevated APR margin regardless of decrease charge-off charges and a comparatively secure share of cardholders with subprime credit score scores. The typical APR margin elevated 4.3 proportion factors from 2013 to 2023 (whereas the prime charge was almost 5 proportion factors greater). As such, the profitability of revolving balances excluding mortgage loss provisions (the cash that banks put aside for anticipated charge-offs) has been rising over this time interval.

Determine 2: Common APR Margin and Cost-Off Fee (Federal Reserve)

Supply: Federal Reserve

Extra APR margin prices customers billions of {dollars} a 12 months.

In 2023, main bank card issuers, with round $590 billion in revolving balances, charged an estimated $25 billion in extra curiosity charges by elevating the typical APR margin by 4.3 proportion factors during the last ten years. For a median client with a $5,300 steadiness throughout bank cards, the surplus APR margin price them over $250 in 2023. Since finance prices are usually a part of the minimal quantity due, this extra curiosity burden might push customers into persistent debt, accruing extra in curiosity and charges than they pay in the direction of the principal annually — and even delinquency.

The rise in APR margin has occurred throughout all credit score tiers. Even customers with the best credit score scores are incurring greater prices. The typical APR margin for accounts with credit score scores at 800 or above grew 1.6 proportion factors from 2015 to 2022 and not using a corresponding enhance in late funds.

Bank card rates of interest are a core driver of earnings.

Bank card issuers are reliant on income from curiosity charged to debtors who revolve on their balances to drive total earnings, as mirrored in rising APR margins. The return on property on normal goal playing cards, one measure of profitability, was greater in 2022 (at 5.9 p.c) than in 2019 (at 4.5 p.c), and much better than the returns banks obtained on different strains of enterprise. Even when excluding the affect of mortgage loss provisions, the profitability of bank cards has been rising.

CFPB analysis has discovered excessive ranges of focus within the client bank card market and proof of practices that inhibit customers’ capability to search out alternate options to costly bank card merchandise. These practices might assist clarify why bank card issuers have been capable of prop up excessive rates of interest to gas earnings. Our latest analysis has proven that whereas the highest bank card firms dominate the market, smaller issuers many instances supply bank cards with considerably decrease APRs. The CFPB will proceed to take steps to make sure that the buyer bank card market is truthful, aggressive, and clear and to assist customers keep away from debt spirals that may be tough to flee.