Binance’s spot buying and selling quantity surpasses all different exchanges mixed and has reached a formidable market share of 41.87%—the very best up to now 10 months.

Binance has solidified its place because the main crypto trade. Nonetheless, this dominance raises issues about market focus and its broader influence on the crypto business.

Binance Continues to Lead the Crypto Market

Binance has bolstered its standing as the highest crypto trade, with its spot buying and selling quantity outpacing all opponents mixed. A put up on X by analyst Joao Wedson on March 30, 2025, highlighted that Binance’s spot buying and selling quantity is now eight instances bigger than that of Coinbase, the most important trade within the US.

Though this determine has declined in comparison with early 2024, it nonetheless reveals Binance’s international dominance. Regardless of the decline in general spot buying and selling quantity throughout the market, Binance’s management stays unshaken.

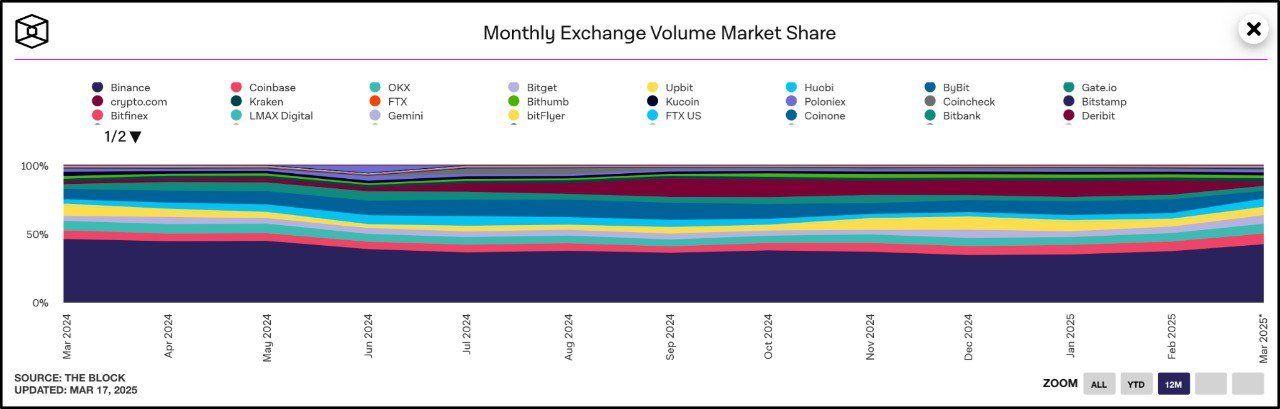

Extra information from a CryptoVerse put up on X signifies that Binance’s market share has climbed to 41.87%, marking a 10-month excessive. This determine is 5 instances bigger than Coinbase and almost six instances greater than OKX, one other main participant.

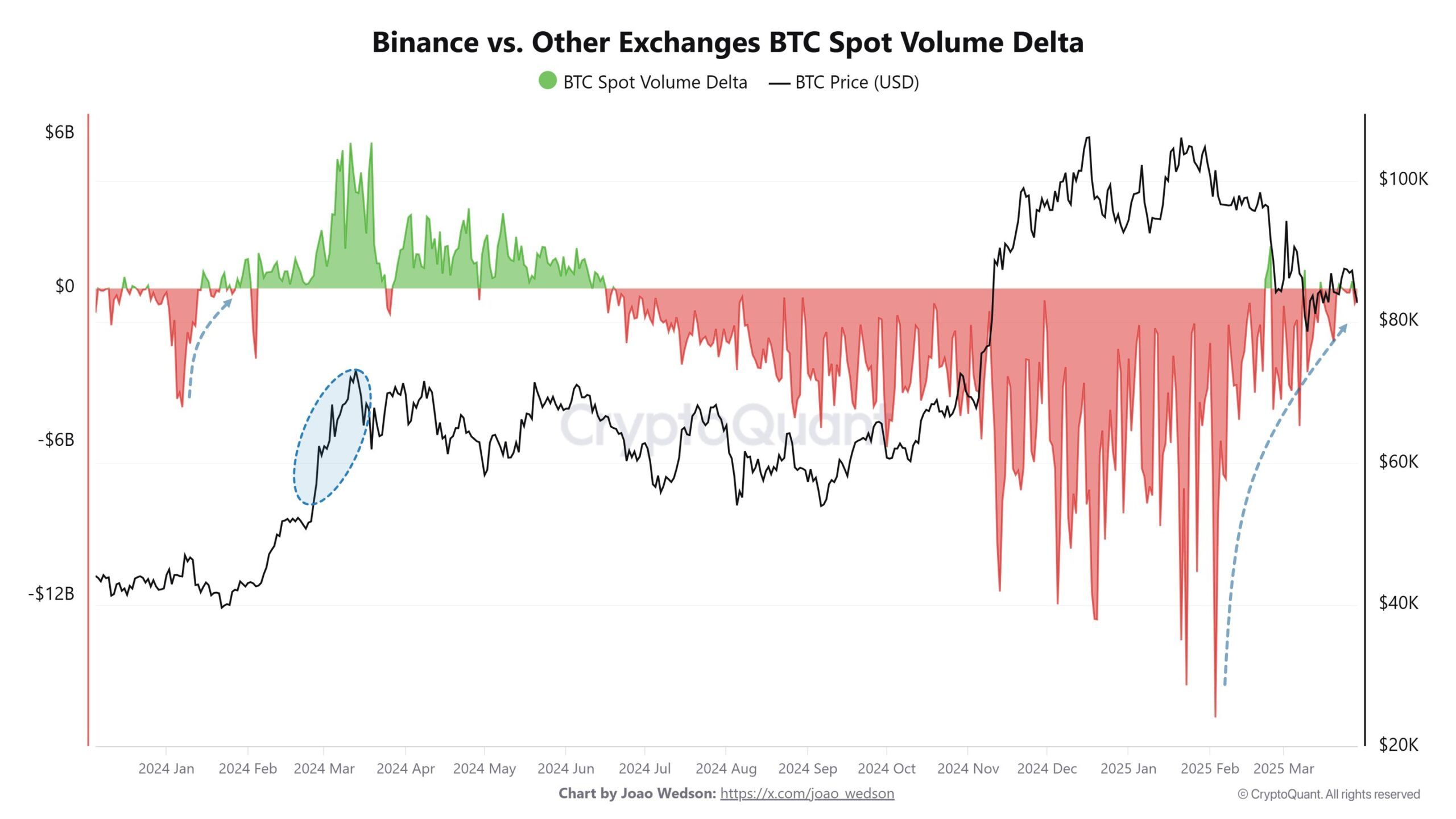

One of the vital intriguing facets of Binance’s dominance is its historic correlation with Bitcoin worth actions. In keeping with Joao Wedson, in January 2024, when Binance’s spot buying and selling quantity first exceeded all different exchanges mixed, Bitcoin’s worth surged from $42,000 to $73,000 within the following weeks.

This sample will probably be repeated in 2025. The Binance vs. Different Exchanges BTC Spot Quantity Delta index, which measures the distinction in Bitcoin spot buying and selling quantity between Binance and its opponents, has as soon as once more turned constructive. In keeping with the evaluation, this might sign a bullish pattern for Bitcoin within the coming months, at the same time as general spot buying and selling quantity declines.

The correlation means that Binance’s dominance may very well be a number one indicator for Bitcoin bull runs. The trade’s means to draw important buying and selling exercise usually displays heightened market curiosity and liquidity. This will drive worth momentum.

A number of components contribute to Binance’s sustained dominance within the cryptocurrency market. First, its in depth international attain. In keeping with a Binance report, the trade has served over 250 million customers worldwide and persistently studies each day buying and selling volumes exceeding $30 billion. In the meantime, information from The Block signifies that Coinbase, with 110 million customers, handles solely round $15–$20 billion each day.

On the constructive facet, Binance’s excessive buying and selling quantity enhances market liquidity, making it simpler for merchants to execute giant orders with out inflicting important worth swings.

Nonetheless, Binance’s overwhelming market share raises issues about centralization. This might make Binance susceptible to hacks or information leaks. Binance has additionally been caught up in lots of accusations associated to token itemizing, inflicting combined reactions in the neighborhood.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.